Did you predict 2020 would turn out this way?

If you had a crystal ball, or at least were prepared for this sort of uncertainty, you probably are in a good position to emerge from this year strong and well-positioned for 2021.

As you plan for the coming year, realize that 2020 has much to teach us. Our goal should be to learn from this past year and create a structure to thrive, regardless of prevailing conditions.

At DLP Lending, we’ve continued working with real estate investors through the COVID-19 pandemic, with virtually no impact on our funding commitments. Through our experiences this year, we have some insights to share about how to better prepare oneself as a real estate investor. After all, the future is uncertain, but you have to be ready to navigate through it.

So, in this article, let’s review the past year and see what lessons we can take from it. This will help ensure we head into 2021 with the right strategy and a winning mindset.

Lesson #1: Survey the landscape and prepare accordingly

It’s helpful to review how the real estate investment landscape has changed this year, especially with lending.

A late summer survey of bankers displayed the fears many lenders have. According to the industry survey, nearly half of presidents, CEOs, and CFOs believe commercial real estate lending faces the toughest road ahead. Nearly a quarter said industrial and commercial lending was the top concern for their bank.

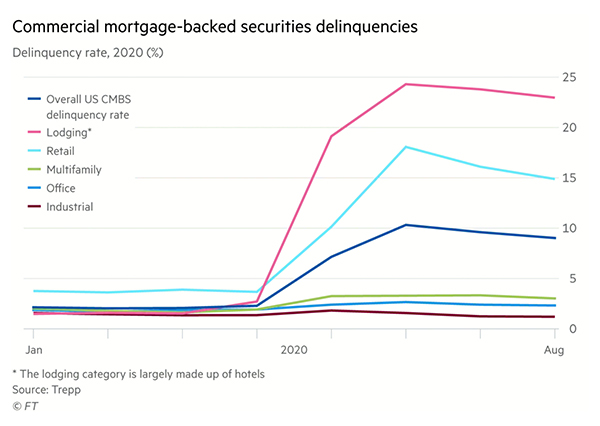

It appears these concerns are justified. In the multifamily space, big lenders have encountered a difficult road. M&T Bank, New York Community Bank, and Signature Bank have all seen shares decline by 30%+ since the start of the pandemic. Research published by the Financial Times notes Wall Street investors in the $1.4 trillion commercial-backed mortgage securities market are bracing for losses.

Investors across all real estate sectors must exercise more caution than ever before.

Fewer funding sources and tighter lending requirements

Such developments have created a problem: funding gaps. With Wall Street taking losses, lending requirements have become more strict.

This means more is required from investors in order to obtain capital. You must embrace the new norm lenders have taken to mitigate risks themselves. As a borrower, you should expect:

- Lower leverage and the need for more cash out of pocket

- Higher rates and a higher cost of capital

- A need for more cash reserves

- Tighter borrower requirements

The fact is, many lenders have become much more conservative in their underwriting. If you don’t come ready to meet these new norms in lending, you can miss out on potentially lucrative deals.

Therefore, you should prepare accordingly. Only consider deals after careful analysis and when you have adequate cash on hand and reliable access to capital.

Lesson #2: Take greater control of your access to capital

With all this said, lucrative opportunities still exist in the real estate space. For instance, single-family homes saw incredible rises in 2020, defying the pandemic. At the end of August 2020, the median home sale price had reached nearly $330,000. Such rises in home prices present opportunities to fix-and-flip investors with capital on hand.

Opportunities have popped up in places you may not have considered as well. Given changes to the food supply chain during the pandemic, demand for cold-storage facilities to keep food chilled has skyrocketed.

So, you can have tons of success if you know where the opportunities are. However, you can’t close a good deal if you don’t have consistent access to capital.

Access to capital is a problem many real estate entrepreneurs have encountered during the pandemic. It’s also probably why many investors had issues with disposition at the onset of COVID-19, as potential buyers couldn’t access capital. According to CoStar, a commercial real estate data analytics firm, second-quarter transaction volumes declined by around 65%.

So, if you needed to liquidate an asset, you may have had trouble. Or, if you discovered a great deal, you may have not had the capital to close.

We’ve seen such experiences firsthand. One homebuilder in Florida, hoping to capitalize on the housing inventory shortage, had a lender back out last minute on funding for the building of single-family homes. That’s because the lender’s funding sources, which were likely tethered to Wall Street or institutional capital, had begun drying up. The homebuilder already had pre-sales, so this put his entire business at risk.

Here’s what the home builder said about the importance of having access to capital:

“It saved my business while most of my competitors had to cease operations.”

Imagine if you had similar access to capital that was virtually impervious to the market shifts? You could ensure virtually no good deal passes you by.

This is why you must evaluate your sources of capital so that you can manage future fluctuations.

Where you should get your capital

What works for you may vary, but it is important to create certainty during uncertainty. Take steps while you can to:

- Analyze where your current capital partner gets their funds. If that money is tied to sources they can’t control, such as a Wall Street fund, know you may have fewer options during a market downturn.

- Find a lending partner that is solely reliant on their ability to garner investments. These private money lenders have a structure that allows them to continue lending, even during hard times.

- Identify a stable, scalable source of capital, i.e. a line of credit. This gives you consistent access to funds. When getting a traditional loan becomes tough, that means you’ll have backup sources of cash. We’ve seen many investors open lines of credit during the pandemic for this very reason.

Lesson #3: Culture is everything

When Coronavirus hit, it immediately became clear: Only the elite organizations would survive and thrive. You can have a good strategy, but you also need a good culture to win in real estate.

This begins with committing to a conservative approach, always doing your due diligence, and having more cash reserves on hand. This will not only ensure you go after the right deals, but also that you’re in a position to have success.

You also have to execute. It sounds easy, but many investors get lackadaisical with their strategy. For instance, they may neglect to do good due diligence and enter into a bad deal.

Additionally, you need the right culture. If you have a resilient, thriving culture, you’re more likely to endure and even accelerate growth during tough times, according to a Gallup study. That means you should focus on having a team with disciplined thought, disciplined people, and disciplined action. Moreover, everyone must be united and working towards a common goal.

With the right strategy, right execution, and right culture, you’ll be in a position to thrive in 2021.

On to 2021 and beyond

It’s easy to say let’s just be done with 2020. But thoughtful reflection can uplift us. We can learn a lot from this past year.

2020 has shown us the resiliency of the human spirit. Real estate is no easy game, yet here you are. You’re reading this and preparing for the road ahead.

Take these lessons from 2020 into 2021 and beyond, and you’ll be in a position to not only endure good times and bad, but also excel in any environment.

As it turns out, you don’t even need a crystal ball.

0 Comments