It may be tempting to think the post-COVID world will look much like the pre-COVID one. The reality is the landscape has changed.

That’s why experts list COVID-19 as the top issue affecting real estate going forward. Uncertainty remains, and the aftermath of the pandemic will test our priorities, resilience, and ability to execute.

Most of all, the Coronavirus pandemic has helped us realize that, when volatility and turbulence hit, only the strongest survive and thrive. Yes, the best real estate investors have cash on hand and own properties that deliver cash flow. But there’s more to it.

Businesses were profitable before the pandemic because they executed very well and operated efficiently. In a post-COVID world, they’ll be successful for the same reasons. If you built your company with a focus on having great people and consistent execution, you can weather this storm.

So, as much as success in the post-COVID world is about a smart investment strategy, it’s also about having a strong company culture. In this article, we’ll look at why that is and how having the right operations and right people can enable you to fight through challenges and emerge prosperous.

Have the right strategy, the right people, and the right operations

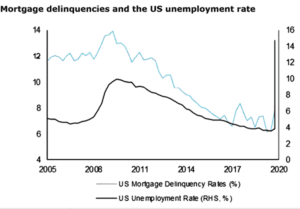

COVID-19 has created uncertainty in ways we’ve never seen before. When the number of mortgage delinquencies hit 4.3 million in May 2020, many began to worry about another housing crash. Meanwhile, concerns about future waves of Coronavirus cases have led hospitals to stock up on supplies.

It’s hard to predict what the future holds. Real estate investors should take a conservative approach, one that will help mitigate the risk of uncertainty. Because in the post-COVID world, additional precautions are essential.

Given how lenders have changed their lending strategies to mitigate risk, real estate investors should:

- Prepare more cash out-of-pocket so that they’re less leveraged

- Calculate a higher cost of capital and higher interest rates into their deals

- Have more reserves, enough to cover at least six months of payments (principal, interest, taxes, and insurance)

- Focus on building relationships with lenders who have control of capital and you are confident will still be standing if we have another government shutdown.

Having a more conservative approach is key to successfully navigating uncertainty, but it’s only half the battle. You have to execute. It sounds easy, but this is where many real estate entrepreneurs fail. They take their eye off their discipline and their lack of consistency leads to pitfalls, such as insufficient capital and not doing due diligence properly.

This is why I stress having disciplined thought, disciplined people, and disciplined action. It’s more important than ever in the post-COVID world. When you have a strong, united team, you’re more prepared to overcome issues and challenges together.

According to a Harvard Business Review report, strong company culture boosts team engagement, resulting in an average earnings growth of 28%. Similarly, a University of Warwick study found that engaged, happy employees are 12% more productive.

Without discipline, your operations and therefore your strategy will falter—even during boom times. In the post-COVID world, it’s even more important to have the best possible operations and personnel in place.

Establish a sustainable business model of success in the post-COVID world

Just as we should employ a more conservative investment approach, real estate investors should take additional precautions with how they manage personnel and operations. You have to adjust resources to focus on long-term sustainability. If you don’t, the market could swallow you.

As Paul Moore, a commercial real estate investor, attests, a primary reason real estate entrepreneurs fail is because they fail to understand and act according to cycles. During the end of cycles, they fail to see the warning signs, take on too much risk, and end up paying for it when the market drops.

Nobody could’ve predicted COVID-19 back in late 2019. But you still should’ve been preparing to protect yourself from a downturn. Seeing that the market is in flux now, you should take steps to manage the continuing uncertainty.

You may be thinking that you’ll just white-knuckle it until things stabilize. But nobody can predict with 100% accuracy how the post-COVID world will turn. As a survey of real estate experts from Attom Data, First American Financial Corporation, Redfin, and others, shows, there isn’t a consensus on whether a V-shaped or W-shaped recovery will happen, nor agreement on how long that recovery will take.

So, what can you do to ensure your survival? Well, you can take steps to seize opportunities. Because they do exist.

In the months ahead, you may see less inventory and fewer flips. However, good investors won’t have problems finding deals because there’s more volatility, more distress, and less competition.

Remember: As investors, we buy deals, not markets. There are always deals, especially in volatile markets.

For instance, look at how mortgage delinquencies shot up along with the unemployment in the early days of the pandemic. Certainly, this could result in distressed inventory hitting the market. That means good deals will be available to those investors who are prepared.

Now, the question is: How do you get yourself ready to get these deals?

It centers on having these four quadrants:

- Disciplined people

- Disciplined operations

- Disciplined strategy

- Disciplined acceleration

These four quadrants are known as the Elite Execution System (EES). Let’s get into detail about what this business model of success looks like

- Have a clear strategy

At DLP Real Estate Capital, we use what we call the DLP Elite Compass. The Elite Compass directs our path. It’s a tool for mapping out our growth, building our strategy, and ultimately getting on the right path to achieving our vision.

The Compass sets the path to where we are going. It ensures the whole company is aligned and we’re all working towards the same goals. These aren’t ‘pie-in-the-sky’ goals, but realistic plans that can be executed and achieved.

Simply put, having a clear strategy, like the Compass, allows you to consistently execute and stay on track. It’s a tool that can enable you to reach and exceed your goals.

- Set clear goals

Your goals must be S.M.A.R.T (specific, measurable, achievable, realistic, and timely).

- Know your Key Numbers

Know your numbers so you can analyze successes and failures. Track those metrics, such as your break-even number, conversion rates, and return on investment. And hold yourself accountable.

- Stay consistent

Test and implement the best practices for your business. This includes all internal processes, from how you ensure people are in the right positions to how your research deals. This also involves doing your due diligence and thoroughly planning for all phases of the investment, from acquisition to repositioning to disposition. Now more than ever, you need proper due diligence to ensure you don’t enter bad deals.

This takes discipline and hard work, so don’t cut corners. Consistency in operations is vital to succeeding in the post-COVID world.

At DLP Real Estate Capital, we adhere to the 20-Mile March philosophy. This comes from Jim Collins’ book, Great by Choice. The idea is that you march 20 miles every day towards your destination, regardless of outside conditions. You don’t march 60 miles one day, then zero the next because of bad weather. That’s how you perish.

- Have a good capital plan

One reason there’s less competition for deals is because of financing hurdles. Many real estate investors simply don’t have access to debt funding. This tightening of credit has created great opportunities for those operators who’ve built deep relationships with lenders, as they’re in a position to buy. Conversely, those without lender relationships have experienced trouble finding funding.

The lesson here is to work on building relationships with lenders. It will help you access debt and win deals.

- Mitigate internal risks

To win in the post-COVID world, you have to focus your resources on long-term sustainability. That doesn’t necessarily entail cutting costs and laying off people, though downsizing could be a part of it. Real estate investors should prioritize:

- Getting the most out of everyone on their team: This requires you to get the right people in the right seat. Make sure team members are where they can be doing the most for the company. Engagement should be a key focus here too, as companies with high employee engagement are 21% more profitable. Keep team members engaged by clearly setting responsibilities and defining expectations, and giving them the autonomy and resources to reach their goals.

- Having the right management system: Set responsibilities, define expectations, and establish methods to review work. Also, eliminate waste wherever possible

- Being data-driven: Don’t let emotions drive decisions! Let the data lead you to opportunities.

- Knowing when and how to downsize assets: When it comes to properties, have a laser focus on profitability. It makes sense to sell assets that your research predicts won’t perform well in the post-COVID world. Having that cash on hand will put you in a position to capitalize on opportunities that arise.

- Knowing when and how to downsize personnel: Human capital is your biggest asset, but also one of your biggest expenses. When it comes to personnel, downsizing gets complicated. University of Colorado-Denver research shows that proactive downsizing, or cutting people before revenue suffers, doesn’t necessarily work. Companies that conserve resources through pay cuts, furloughs, and other methods perform better during the recovery and are more profitable over the long run.

Now is the time to build an elite organization

Too many real estate investment firms weren’t prepared for COVID. When the pandemic put stress on the market, we saw many competitors stop acquiring properties. They got into defense mode. They shed properties, laid off key employees, and some even went out of business.

If you’re still standing, know the fundamentals you need to succeed remain the same. And you still possess the power to grow and scale your real estate business—even in this volatile landscape.

Ultimately, your success depends on much more than having an intelligent, cautious strategy. You need to do everything possible to get the right people in the right seat, implement operational best practices, and establish a proven system for winning deals. That’s how you build an elite organization.

Now’s the time to get your real estate business to be the best you can be. Because if not now, what happens the next time the market takes an unexpected turn?

Don Wenner is Founder and CEO of DLP Real Estate Capital.

0 Comments