Prior to Covid-19, median household incomes in the United States were rising sharply, according to US Census data. From 2016 to 2019, median household incomes jumped from $59,039 to $68,703, a 16 percent gain.

That was good news for American families anyway you spin it.

On the surface, it should be good news to the housing industry as well. Over the same period, the median home price only jumped by about five percent from Q4 2016 to Q4 2019 ($310,900 to $327,100).

Consumers have definitely made some gains in housing affordability in the past four years.

But, go back a full generation, and the numbers tell a different story. Thirty-one years ago in 1989, the median home price was $124,000, while the median household income was $28,000. Household income was 22.5 percent of the median home price, compared to 20.7 percent in 2019.

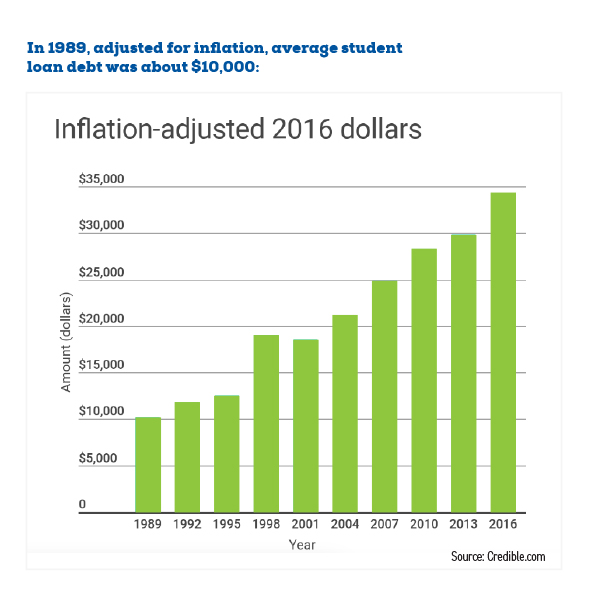

Admittedly, a 1.8 percentage-point difference doesn’t seem like a lot. Factor in the rise in student loan debt, though, and you can see why housing affordability continues to be a significant challenge, even as incomes have been rising. There is a record-high $1.6 trillion in outstanding student debt today. Here are some key stats, according to finance website Credible.com:

- Average student loan debt → $33,654

- Average monthly student loan payment → $393

- Total student loan debt → $1.598 trillion

- Number student loan borrowers → 43 million

- Number of borrowers who owe $100,000 or more → 2.8 million

The additional debt makes purchasing a home much more difficult today.

Home values seem to have held up well, despite the Covid-19-induced economic slide earlier this year. As the economy improves and incomes are likely to rise again, there is pent-up demand for single-family housing. But, builders continually aim for high-end customers leaving the working-class, middle-class and entry-level buyers with few options.

Even rental properties tend to cater to the high-end customer. In Atlanta, for example, 91 percent of multifamily housing projects were aimed at high-end customers in 2015.

Millennials, the generation between the ages of 24 and 39, should be in peak home-buying mode. But, they carry the largest share of student debt and it’s often pricing too many people out of the American Dream.

What are the implications for builders and developers? We must continue to look for ways to provide more affordable-housing options that meet the needs of cash-strapped Millennials and working professionals such as teachers, fire fighters, and police officers.

Build-to-Rent subdivisions give people a high-quality, single-family rental home option. Millennials are in family-building mode and even if they can’t afford to own a home, they can still rent something with four sides and a yard for the kids to play. Five years ago, I was a partner in a condo development called Solo East in Nashville, Tenn. This was high-quality housing in an up-and-coming area of one of the hottest real estate markets in the country. It was moderately priced and included high-end amenities such as granite countertops. This type of development, either as a rental or as purchase, is needed to fill current and future demand. Solo East sold out quickly and we need to see more developers come up with similar options for cash-strapped customers.

Working Americans and young families need their housing requirements met, and it is up to the entire real estate investment industry to come up with new and innovative ways to meet this market demand. Builders and developers that can fill this space will succeed in the years to come.

0 Comments