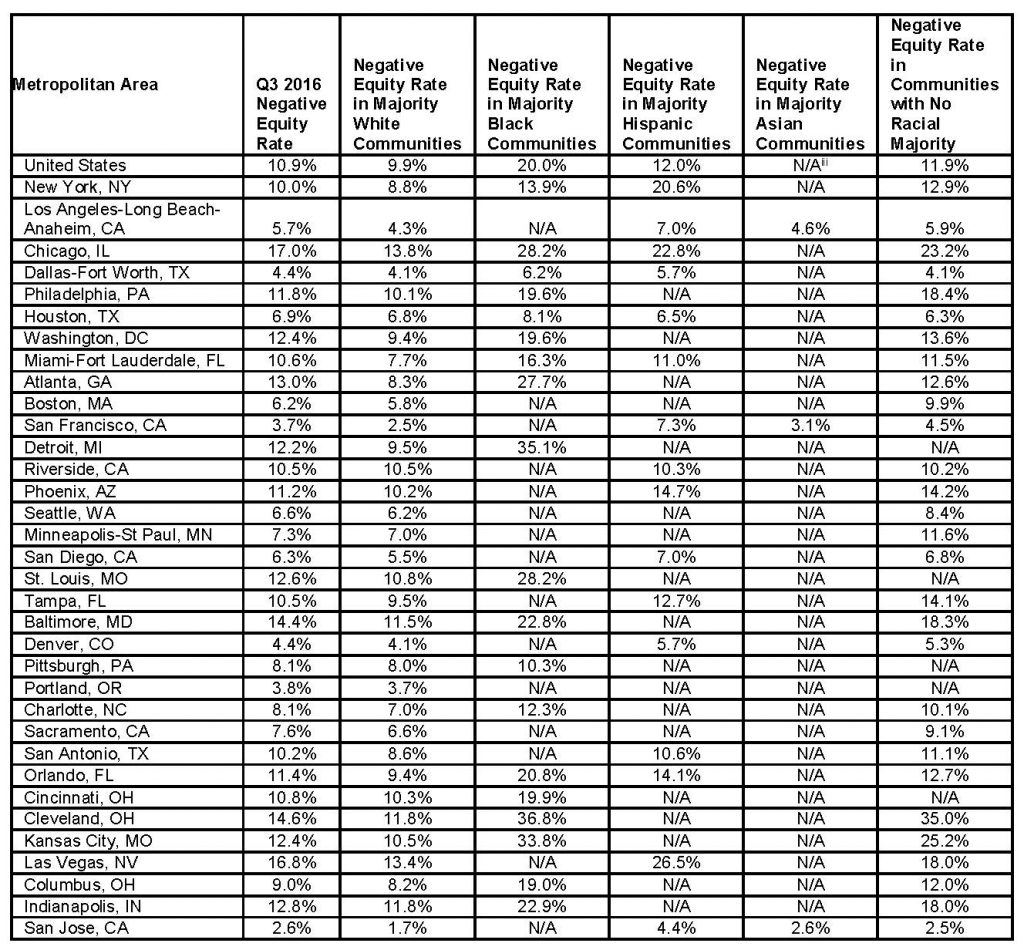

A new analysis shows different effects of negative equity on racial groups in the United States. The Zillow analysis shows 20 percent of homeowners in predominately African American communities were underwater in Q3 2016, nearly double the national rate of 10.9 percent. In half of the largest U.S. metros, homeowners in mostly African American neighborhoods are more likely to be underwater than homeowners in other neighborhoods. The negative equity rate in communities where the majority of residents are of Latino decent was 12 percent in Q3 1016.

Nationally, the negative equity rate in the third quarter of 2016 was 10.9 percent. In Census tracts where the majority of residents are African American, the negative equity rate was 20 percent, while in tracts where most residents are Caucasian, the rate was 9.9 percent. In Census tracts where the majority of people are Hispanic, 12 percent of homeowners were underwater. In places where there was no racial majority, 11.9 percent of homeowners were in negative equity.

Negative equity is a persistent reminder of the housing crash. After the housing bubble burst in 2007, homes in predominantly African American and Latino communities lost more value than those in Asian or Caucasian neighborhoods. While strong home value appreciation during the recovery has helped many homeowners resurface on their mortgage debt, African American and Latino communities have not had as strong a recovery.

Underwater homeowners are stuck in their homes, unable to sell except by a short sale or by paying the remaining balance on their mortgage. The paralysis has far-reaching effects. When a large share of homeowners can’t sell their homes, it limits the inventory of homes for the entire market, leaving fewer options for potential homebuyers.

“Negative equity is not an equal opportunity offender, with certain markets still being more affected than others,” said Zillow Chief Economist Dr. Svenja Gudell. “Our previous research has shown that negative equity is more concentrated among less expensive homes and now we know that it is also more prevalent in minority neighborhoods than in white communities, which are also trailing in the overall housing recovery. These gaps can and will have long-lasting implications for growth and equality.”

Negative equity is not evenly distributed among homeowners – homeowners in African American neighborhoods are more likely to be underwater than any other race in half of the largest U.S. metros.

In Detroit, 12.2 percent of all homeowners were underwater in Q3 2016. However, 35.1 percent of homeowners in predominantly African American communities were underwater, compared to 9.5 percent of homeowners in mainly white neighborhoods.

About Zillow

Zillow® is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with the best local professionals who can help. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Zillow also sponsors the bi-annual Zillow Housing Confidence Index (ZHCI) which measures consumer confidence in local housing markets, both currently and over time. Launched in 2006, Zillow is owned and operated by Zillow Group (NASDAQ:Z and ZG), and headquartered in Seattle.

0 Comments