Happy New Year and welcome to 2019!

We hope you made it to the New Year unscathed. Traditionally, many take a little time around the end of the year to reflect on the past 12 months and review what goals were achieved and those that weren’t met so that the next 12 months can be even more successful.

From a loss prevention perspective, our company concentrates on proactive tools and practices you can implement around your investment properties and your own home to protect yourself, your family, tenants and visitors from harm.

These proactive steps can enable you to protect your property from suffering a loss as well. For example, if we practice fire safety, the chances of a fire at your properties are likely to go down.

In 2018, however, we once again saw some serious weather events that no one had control over. You can properly prepare for those events to minimize potential losses, but it takes preparation and action.

Hurricanes

The 2018 hurricane season was milder than expected, but we still had two big storms hit the Gulf and East Coast of the U.S. later in the year that did some extreme damage.

Hurricane Florence hit the shores of the Carolinas on September 14th as a Category 1 storm. While there were certainly areas that suffered from the high winds of a Category 1 storm, which generate wind speeds between 74 – 95 miles per hour, most of the damage came from the heavy rains that caused widespread flooding in North and South Carolina. Fifty-five deaths were attributed to the storm while property damage and economic loss is estimated to be greater than $16.9 billion.

Less than a month later, Hurricane Michael made landfall along the Florida panhandle as a Category 4 storm. With wind speeds of 130 – 156 miles per hour, Hurricane Michael was more than capable of causing catastrophic damage. Michael sustained hurricane force winds well into the state of Georgia before losing its strength over the land.

Many older homes that were built before stricter building codes were passed were destroyed in Mexico Beach, FL. Michael caused 60 deaths, while property and economic loss is estimated to be greater than $14 billion. Articles about Michael pointed to a “silver lining” in that the storm made landfall in the most sparsely populated areas along the Florida coast. We’re sure that came as little consolation to the people who suffered the impact of this storm and are still trying to put their homes and lives back together.

Besides avoiding the purchase of investment properties or homes along the coast, what can you really do to protect yourselves against the devastation of hurricanes? The answer is a lot.

Make sure you have a risk mitigation plan, carefully review it and implement it when necessary. Here are three steps to crafting a plan.

Step 1: Check your property.

Make sure coastal properties are built to code and retrofitted wherever possible.

Step 2: Plan ahead.

Don’t wait for the announcement of a hurricane by the National Weather Service to buy supplies or come up with an evacuation plan. Have your supplies ready to board-up and seal the house against the storm and be ready to put your evacuation plan into practice.

Step 3: Check your insurance coverage.

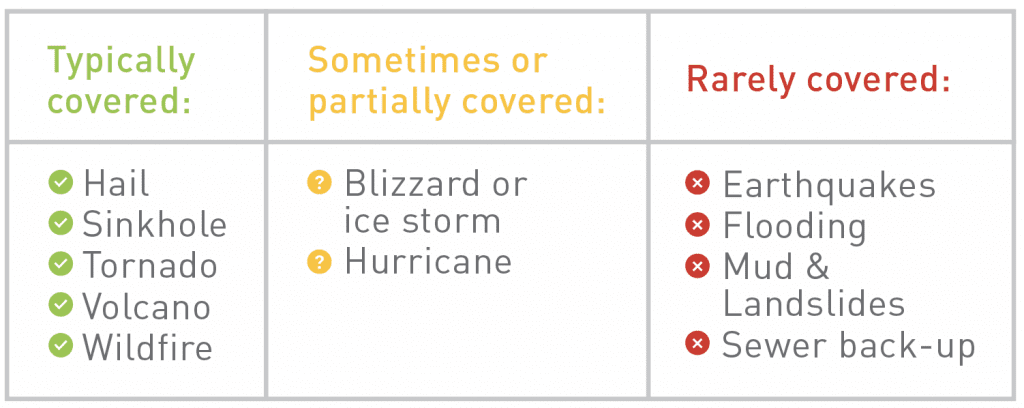

Though not the only part, insurance is an important part of your risk mitigation plan. Insurance is designed to return your property to the condition it was in before a loss happened, but it’s essential that you have the right coverage. Don’t assume that everything is covered by your policy. Talk to your insurance advisor and confirm you have the coverage you want. In the middle of filing a claim is not the time you want to discover that you aren’t covered.

- Named Storm Coverage: A homeowners or dwelling policy may not include Named Storm coverage, so you may need to purchase this coverage separately. Named Storm coverage is more expensive and usually has a higher deductible, but those who decided not to purchase the coverage prior to Florence or Michael now have very little upon which to fall back. FEMA grants are there to help, however, they aren’t designed to make you whole.

- Flood Coverage: Most of the damage done by Florence was due to flooding. Flood coverage, however, is not a part of your homeowners or dwelling policy. Flood coverage is commonly written through the National Flood Insurance Program (NFIP). There are limits on the amount of coverage you can buy and there is a 30-day waiting period before your coverage goes into effect. So, if a storm is approaching and you haven’t already purchased this coverage ahead of time, you’re going to be out of luck! According to North Carolina Insurance Commissioner Mike Causey, only 134,000 homes in his state had a NFIP flood policy when Florence hit. According to the U.S. Census Bureau’s 2000 Census there were 3,132,013 households (this includes apartments) in North Carolina, so only about 4 percent had flood coverage.

For a more secure 2019, check with your insurance agent to make sure you are properly covered for all the perils listed below!

0 Comments