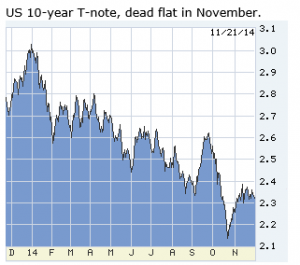

Mortgage rates have been stable near 4.00%, held there by the 10-year T-note moving hardly at all in the last month, 2.31%-2.38% since Halloween. Such stability is most unusual, best understood as a market gathering tension for a significant snap.

Mortgage rates have been stable near 4.00%, held there by the 10-year T-note moving hardly at all in the last month, 2.31%-2.38% since Halloween. Such stability is most unusual, best understood as a market gathering tension for a significant snap.

The dominant news is central banks trying to cope with extreme deflationary pressures, and this week the Fed released the minutes of its October 28/29 meeting.

Reading the Fed minutes

Reading Fed minutes is a black art. This set is “only” 15 pages, but unspeakably dense, jargon-ridden, in the unique code of Fed politics, most of it irrelevant to the big questions or intentionally masking answers, if any: RATES UP, OR DOWN, WHEN?

For the brave and foolhardy willing to give it a try, here follows a guide, and re-interpretation of this set in plain site on their website here. I say “re-interpret” because I couldn’t get to the real thing until yesterday, after reading earlier reviews by media Fedologists. As I read I flashed back to the media analysis, wondering if they had read the same minutes. I don’t recall a wider gap between the analysts and what’s in the actual words. The consensus was ho-hum, Fed stands pat. Not so.

These minutes begin with an incomprehensible discussion of the mechanics of rate hikes. Ignore all of that. When they need to hike, they will.

At the bottom of page three, a big hint: “Staff Review of the Economic Situation.” The bulk of all meeting minutes is anonymous commentary by Fed governors and regional Fed presidents, at each point adding “one member said”, or a few, or several, or many, or most, as the Secretary tries to describe weight of opinion. When the Fed first began to publish minutes only three weeks after the fact (ten years ago, Bernanke invention), these modifiers were so confusing that it published a guide.

In general, all the time, ignore the governors and regional presidents (in the minutes described as “members”) until you learn which have good sense and which don’t. Since the minutes’ commentary is anonymous, we can’t tell if an apparent consensus is among the bright lights (Dudley, Fischer, Rosengren, Williams, Lacker, Evans, and Lockhart), or the dim and argumentative (Fisher, George, Bullard, Plosser, Mester, Kocherlakota — all regional presidents). One serious study by economists outside the Fed (Romer, et al) backwalked the opinions of the regional Fed presidents for predictive accuracy and concluded: “They need not offer forecasts.”

Page three: Staff said that market indications of inflation had declined, but inflation surveys were stable. Since the meeting surveys have fallen, too. That’s a big deal: in three weeks the Fed’s primary assumption about inflation has been cast in doubt.

Page four, Staff: “Foreign economies appeared to have continued to expand at a moderate rate in the third quarter… In Japan, consumption staged a mild rebound…. euro area pointed only to continued sluggish growth.” Events have proved this commentary absurdly optimistic. Strangely, profoundly out of touch.

Page 5, in puzzled tone, Staff observed that market pricing had pushed back the date for a Fed rate hike. My margin note is “duh.” Markets see US wages and global deflation. Later on that page: “Credit flows to nonfinancial business picked up in September.” The Fed’s own H.8 shows a deep slowdown in total bank credit.

Page 6: “Staff revised down its projection for real GDP growth….” What?! You see that in any media analysis? Staff: “The risks to the forecast for real GDP growth and inflation were seen as tilted to the downside.”

The labor market has improved faster than the Fed thought possible only a year ago, and has positioned to intercept the inflation pressure from wages inevitably rising as the labor market tightens. Yet wages are not rising, and may not even if unemployment falls another percent or more. Staff seems aware that things are not going according to plan. The Fed historically underweights events overseas because the US is the least export-dependent of any major economy, but these minutes are at the edge of oblivious to foreign pressures which will undercut US wages and prices.

Stick out my turkey neck: when rates snap, it will be down.

—————————————————-

US 10-year T-note, dead flat in November.

Oil. After a drop so deep and fast, you’d expect a rebound. Uh-uh.

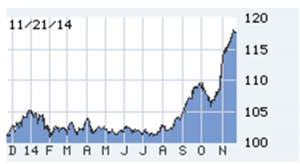

Yen. After 3Q 1.6% negative GDP, no telling how extreme this move will be. It is already huge; Goldman today forecast 140/$ soon.

Euro. Heavily influenced by Draghi jawbone. His words do not match his actions or ECB authority, and he risks little-boy-and-wolf. ECB QE would weaken the euro; until then it retains strength as a safe-haven currency. However, the euro-zone economies are so weak that the euro will weaken, QE or not.

UK pound. This one is stunning. The best economy in Europe, but last month’s wage measurement found no gain at all for the first time since data began (1997). Exit, BOE tightening. No wage gain, no inflation threat, deflation in the Channel.

How widespread is this devaluation versus the dollar? Here is the Israeli shekel in the last year (shekels/dollar):

[hs_form id=”4″]

0 Comments