Here in the U.S. we enjoy the sturdiest economic situation in the world, no matter how creaky it may feel. But, to look outside… eyes wider and wider all the time.

Here in the U.S. we enjoy the sturdiest economic situation in the world, no matter how creaky it may feel. But, to look outside… eyes wider and wider all the time.

It’s especially hard to handicap a new load of information as pre-holiday markets never really opened Friday and there is no reaction to watch. And upcoming after the holiday is breath-catching, with an European Central Bank (ECB) meeting on Thursday and U.S. job data on Friday for real estate investors to watch.

So, start big and then study components. Begin in the U.S. and move outward. Always, always, stick with Clinton’s Law (“It’s the economy....”).

Above all, the Great Misconception, that the global economy is still suffering from the financial crisis. Not so. That ended years ago.

The world economy is wrestling with three things

No. 1 — The deflationary “trade shock” from the opening of China 25 years ago.

No. 2 — The West’s struggle to control its borrowing in a slow-growth era

No. 3 — The folly of the euro.

New U.S. data confirm an unprecedented pattern: at least two-thirds of the country feels no recovery at all, and the other third wonders what the fuss is about. Manufacturing data is strong, orders for durable goods in a solid up-trend, bank lending growing at a 9% annual pace, the best in seven years, and the stock market… hoo-EEE! Yet today we learned that consumer spending fell .1% in July, incomes rose .2%, and real consumer prices (Personal Consumption Expenditure deflator) fell .2% in the month and have risen year-over-year only 1.5%. Housing data managed no more than an up-wobble.

Rates in the U.S. continue to slide, but mostly Treasurys bought for safety, not yet mortgages. The most profound decline has been in 30-year Treasurys, now barely above 3.00% — a modestly astounding verdict on the long-term future.

Overseas, economics first. The deepening slowdown is widespread. Brazil’s GDP contracted in the first half of 2014, its first recession in five years. Argentina’s unique kelptocracy (stealing from itself) may have reached a 20-year endgame, its standard of living on the edge of a Grecian manhole.

But Europe is the big deal, one-quarter of global GDP. This morning’s inflation news there is deflation: in the aggregate prices rose .3% annualized last month, down from .4% in the prior, but half of Europe is now in outright deflation. French President Francois Hollande, he of the 17% approval rating (perhaps his family and several mistresses?) canned all of the far-Left ministers (of his own party) and will now attempt reform of the French economy and bloated government spending, austerity simultaneous with begging the Germans to allow a bigger budget deficit.

The German 10-year yield has fallen to 0.89% while the euro has fallen to $1.31 — a theoretically impossible combination. If global cash is leaving the euro, it should be leaving euro bonds as well. (The flip side of that trade: Fed tightening is theoretically imminent, but U.S. bonds are falling in yield). Everyone in markets is prepared for Very Dramatic Action by the ECB, some form of QE. Most in markets also think, unkindly, that the ECB will be too late, with too little, and that Draghi has become a German lapdog willing to do anything but admit that German trade and budget policies are the cause of the disaster, and the euro itself.

Three military crises grind on, but only one matters. Gaza turns out to be a wildly perverse gain in regional stability, Arab nations throwing in with Israel. ISIS will be difficult, and Iraq beyond all the king’s men and horses to repair, but there is nothing viral in play. ISIS is a reconstituted Sunni/Baathist/Saddam goon squad, accustomed for a few hundred years to running much of Syria and Iraq and annoyed to have been run out, now refilling a void. But its Islamism is a sham, and nihilism seldom has legs.

Ukraine is dangerous in two ways. The West will use only economic weapons, but their deployment will worsen the European economy. The larger risk: Vladimir (and others) believe the West can be rolled, and in particular the American President, who yesterday said of ISIS, “We don’t have a strategy yet.”

In the whole furball above, the most important strands: next week’s U.S. jobs and the ECB meeting.

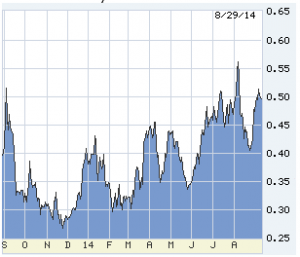

US 10-year T-note. Some downward force from a questionable domestic economy, but arguably the whole move since spring has been due to the ex-US slowdown: Click on the charts to enlarge.

The US 2-year T-note is always the best Fed-predictor. It is nervous, but pricing no more than a .25% hike in the next couple of years, if that. 2s like this are a very strong warning to the Fed: You may want to come off zero to prevent distortions in markets, but the economy can’t take it:

US 30-year T-bond. You won’t find a stronger indicator for future economic activity than this cascade, joined by long German bonds:

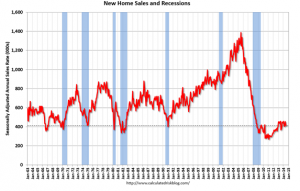

Sames of new homes… ouch:

The following is another splendid chart from calculatedriskblog.com. A two-part story: the nearly 10% price appreciation last year was the statistical artifact of the last big-volume sales of distressed homes; however, the month-after-month decline in 2014 says not all is well with housing and the economy supporting it. Forget the traditional support of the economy by housing:

|

Month |

YoY House |

|

Jan-13 |

6.7% |

|

Feb-13 |

7.3% |

|

Mar-13 |

7.6% |

|

Apr-13 |

8.1% |

|

May-13 |

7.9% |

|

Jun-13 |

8.4% |

|

Jul-13 |

8.7% |

|

Aug-13 |

9.0% |

|

Sep-13 |

9.0% |

|

Oct-13 |

8.8% |

|

Nov-13 |

8.5% |

|

Dec-13 |

8.4% |

|

Jan-14 |

8.0% |

|

Feb-14 |

7.6% |

|

Mar-14 |

7.0% |

|

Apr-14 |

6.4% |

|

May-14 |

5.9% |

|

June-14 |

5.5% |

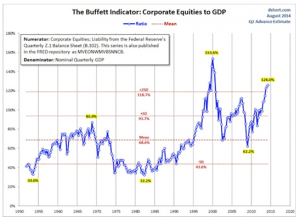

The next three charts all appear to show the stock market entering bubble territory, especially odd as the global economy is slowing. Most observers chalk up the steady rise to a too-easy Fed. Not here. The “trade shock” since 1990 has done violence to incomes and consumers, but the business world has arguably never before seen such favorable conditions. Stocks are far more vulnerable to an interruption in trade (that’s the deepest risk in Vladimir’s excursions) than to policy change at the Fed. BTW: the three indicators below are probably the best measurements of the stock market.

[hs_form id=”4″]

0 Comments