Financial markets have stopped their hysterics for now, so let’s get some other things straight. Things about mortgages and other credit. Simple things.

Financial markets have stopped their hysterics for now, so let’s get some other things straight. Things about mortgages and other credit. Simple things.

FDR’s first fireside chat in 1933 was devoted to simple explanations of banking. The next day Will Rogers said the president’s words were so simple that, “Even the bankers understood.”

Mel Watt, the new head of the Federal Housing Finance Agency (FHFA), conservator of Fannie and Freddie, has announced a preliminary effort to restore 97% loans, and to ease Fannie/Freddie demands for buy-back of defaulted loans. That same day of Watt’s announcement, six federal agencies (Fed, Housing and Urban Development (HUD), Federal Deposit Insurance Corporation (FDIC), FHFA, Office of the Comptroller of the Currency (OCC), and Securities and Exchange Commission (SEC) relaxed Dodd-Frank mortgage skin-in-game 5% retention, and dropped mandatory 20% down payments for some loans.

Did something big happen with mortgages?

Given headlines, you’d have thought something big happened with mortgages. The National Association of Realtors (NAR) yelled, “Dramatic Easing of Mortgage Standards.” The Economist snarled back, “Structurally Unsound,” joined by WSJ and NYT “Here-we-go-Bubble-again.”

I will not attempt to describe the details. Fear not! Few consumers will ever know that any of these events took place. Properly underwritten 97% loans would help, but we survived the last four years without them. The FHA is the outfit that needs help, its target consumers suffering under last year’s nearly tripled mortgage insurance. We in the trade will enjoy some clarified underwriting from reduced buybacks, but we are so unreasonable on other grounds that borrowers won’t feel a thing.

The new Dodd-Frank rules? 689 tortured and opaque pages. Might as well be blank. Civilization would move on unimpeded with them or without them.

Why the shrill commentary from the press? The political right hates government, and hates government mortgages more than anything except taxes, and thinks anyone without 20% to put down is lazy. The left has rediscovered its ancient hatred of banks and bankers — but vaults should open wide for constituents of Elizabeth Warren.

All perfectly natural after a disaster like the Bubble. Everyone used to be pals with housing and Fannie. Hell hath no fury like a lover scorned. The media post-Bubble has set new standards for willful ignorance and unprofessional torch-and-pitchforking. The Bubble blew in 2007… seven years, and you still won’t get the story straight?

Good news

Then good news, very good news.

NY Fed Prez Bill Dudley told assembled bankers that unless they stopped gaming the system their banks would be “dramatically downsized and simplified.” Thank you. Way past time. Generating bales of oppressive rules which paralyze the honest, while the crooked enjoy being chased by Keystone Cops, no personal consequences if caught… stupid.

More good news. The Fed has unloaded on two specific credit products early, before damage. Junk bonds have their place: corporate access to credit via well-regulated securities. However, recovering banks have fallen into old booze: creatively underwritten corporate loans unlikely to perform as advertised, flipped out of the bank in collateralized loan obligations ( CLOs). Maybe $130 billion this year in goofy paper known as “leveraged loans” and “covenant light,” as in the Bubble finding yield-hungry (and blind) buyers. The Fed has also made clear its displeasure with subprime loans for autos.

Then, possibly more good news, although so poorly and wrongly covered that few will know. Two-bit pick-pocket Maurice Greenberg, ex-CEO of AIG, the world’s largest insurance company upon its collapse in 2008, filed suit for $40 billion in damages, alleging improper government taking. AIG required $185 billion in Fed cash to firebreak a systemic meltdown. Greenberg hired David Boies, one of the great litigators of our time, who hauled Ben Bernanke into court to testify over two days. One observer described Bernanke’s responses as either “annoyed, or very annoyed.”

Greenberg should be in compact accommodations at Leavenworth, and Bernanke undisturbed. Greenberg as plaintiff demonstrates Wall Street’s completely backwards attitude to the world, and the foolishness of society chasing and fining institutions instead of holding individuals accountable. I have hope for the verdict in this case.

——————————————–

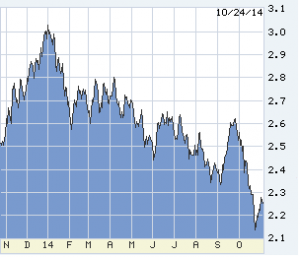

S&P 500 in the last year. Maybe it will resume choppy decline, maybe go to new highs. Mortgage rates do follow the silly thing from time to time, but nobody ever knows in advance. Stocks in a time-out for the moment. Click on the charts to enlarge.

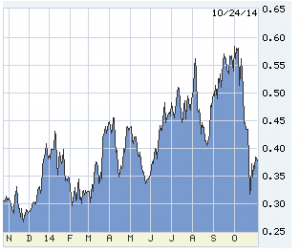

10-year T-note in the last year. Decline trend intact, driven NOT by the stock market, but by deteriorating conditions and deflation pressure in Europe, China, and Japan.

2-year T-note in the last year. Ascending on Fed-tightening expectations. Cancel those.

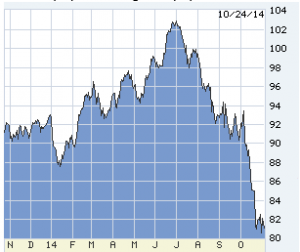

Nymex oil in the last year. Decline probably done. Most important thought: falling oil and gasoline prices usually stimulate the economy. I suspect not now — households will save any spare change, or pay down debt.

Euro in the last year. The dollar rise has stopped cold with the evaporation of imminent Fed tightening.

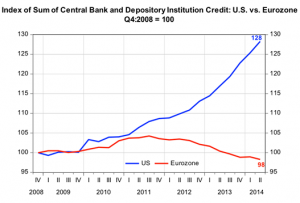

Those who think QE didn’t do anything? We had it, Europe did not. Study these two charts (thanks to Paul Kasriel).

[hs_form id=”4″]

0 Comments