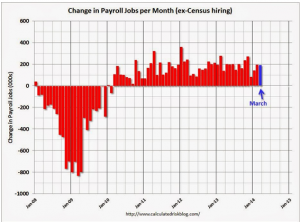

To the silent consternation of the markets, the March payrolls report arrived exactly as expected, a gain of 192,000. Zounds. Since this report has never before come in as forecast, no one knows what to make of it.

To the silent consternation of the markets, the March payrolls report arrived exactly as expected, a gain of 192,000. Zounds. Since this report has never before come in as forecast, no one knows what to make of it.

On our son’s third birthday, the young man held court in his highchair while fiddling with his spaghetti and simultaneously kicking one foot up and down, over and over. Suddenly that shoe flew off, did perfect somersaults above his head and landed flat on his tray beside his plate. He remained deadpan, eyes in steady contact with the video camera, as though “Oh, happens all the time.”

Thus bonds and stocks sit in stunned paralysis pretending all of this makes sense. The twin Institute for Supply Management (ISM) surveys for March: manufacturing from 53.2 to 53.7, and service sector from 51.6 to 53.1. So much for the better-weather surge. Wages are still stuck on a 0% annual slope after inflation. Auto sales are up 7.3% year-over-year, more than triple nominal wage growth, indicating our fondness for cars and the massive return of subprime lending. Want a car, you get a car.

Overseas… the European Central Bank (ECB) is jawboning a massive stimulus which will not be; reforms are slowing China more than it can officially report; and Japan increased its consumption tax from 5% to 8%, the next step in its inventive disaster. No wonder money continues to flow to US bonds.

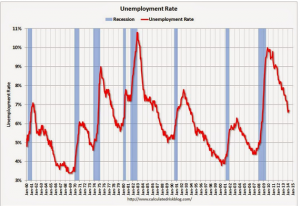

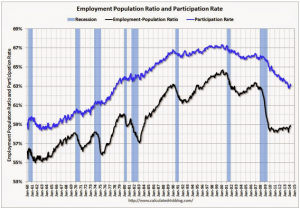

The monthly payroll and unemployment reports, together with weekly news of new claims for unemployment insurance have defined Fed policy and turns in long-term rates since I was the age of my son’s shoe trick (1952). Absolutely axiomatic: when unemployment falls far enough, employers will begin to compete for workers by paying higher wages. Since the Fed is always behind the information curve, its mission has been to snug-up policy as soon as the labor market tightens, thus pre-empting inflation pressure. That way the Fed can prolong an expansion phase by preventing premature overheating (and despite jackdaws of both left and right wing, the Fed has done well by any comparison to pre-Fed days).

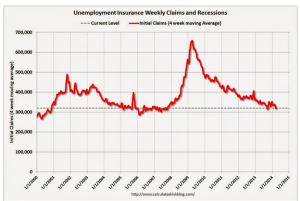

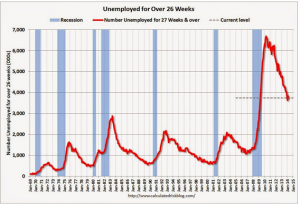

Today that axiom is in doubt. Everybody gets the concept that the unemployment rate no longer reflects conditions in the labor market. It is painfully clear that too many people have left and are still leaving the labor force, and that even a decline to the mid-6s in rate has done nothing for wages. Weekly claims for unemployment insurance have been normalized for almost two years at or below 350,000.

One large and surly group still blames the victim: the job market is poor because of obsolete or missing skills in the U.S. workforce. However, the longer we go without acceleration in the overall economy, the harder to defend dogma.

If it is different this time — if electronically greased global commerce is leveling wages — then the current pattern makes perfect sense. No matter how scarce U.S. labor becomes, global employment will flow elsewhere, not to higher wages here. Old dogmatics point to unfilled jobs requiring specialized skills. It is different this time: even if employers bid up the wages for the super-productive, there are too few of these positions to move the inflation needle. Only so may cardiac surgeons, robot programmers and mechanics, and dreamer-uppers of new apps….

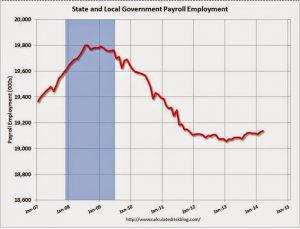

A different economy should mean different public-policy response. Fed Chair Janet Yellen gets it, but neither party has a clue, both re-fighting old wars. We have spent and borrowed our way into a fiscal box, and have already shrunken a lot of government spending.

State the problem: we must help Americans of all ages to acquire global-competitive skills and attitude, and without make-work, and without ruinous student debt. One government-shrinking opportunity: relax the over-reaction to the credit bubble. New evidence of Japan-style wounds: in the last six years ownership of homes among those aged 35-44 has fallen 6.3 points to 60.9%, and among those under 35 down 4.2 points to 36.8%. Meanwhile, of those 45-54, 71.3%, and 55-64 77%. Sacrifice youth on the altar of panic, and pay a very high price. ———————————————————-

10-year T-note. Stuck in loooong range, but ascending bottoms more troublesome. Click on charts to enlarge.

0 Comments