Mortgage and long-term rates are still near their lows — reassuring, considering everything else has lost its marbles.

Mortgage and long-term rates are still near their lows — reassuring, considering everything else has lost its marbles.

Or perhaps bonds are doing well because everything else is nuts… a fair proposition to which we’ll return.

Aged about 12 I got to see the Ringling Brothers and Barnum & Bailey “Greatest Show in Earth” at Madison Square Garden in NYC. Three rings and then some, acts and animals all over that giant auditorium floor, but each one in confined space. Watching the economy today is like that circus, but each act interactive with the others.

A lion tamer trying to get in the little car with the clowns while lions chase them round and round… An elephant knocks down half the trapeze, Wallendas landing in the crowd… The ringmaster trying to restore order while a troop of escaped monkeys strips him of top hat, red coat, and megaphone.

A hawkish Fed statement

From order to chaos and back to order…. The Fed, doing its level best to maintain dignity, issued a hawkish statement post-meeting Wednesday. Very hawkish, and as ignored as the ringmaster above.

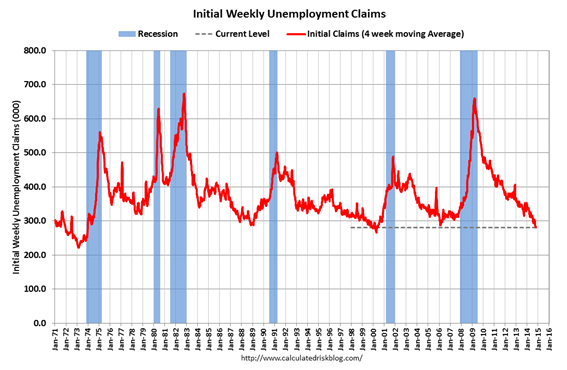

“Substantial improvement in the outlook for the labor market… underlying strength in the broader economy.” Chair Yellen has made her call: unemployment as traditionally measured now below 6%, and new claims for unemployment insurance at a super-cycle low, the threat is sudden gains in wages and inflation. She left in “considerable period of time” for 0%-.25% Fed funds, but we know from Fed vice-chair Stanley Fischer that “considerable” is weeks to six months.

This was a hair-trigger statement, a profound bet that those traditional measures of the labor market will again be predictive. I suppose the Chair has to make that call. Although not tightening yet, the threat itself is a form of tightening, and the market response leads us straight to the chaos.

Only currencies moved on the Fed’s words, the euro and yen resuming free-fall versus the dollar. The mechanism of falling is investors of all kinds selling zero-paying euro- and yen-denominated securities and buying dollar ones, anticipating Fed-hiked yield.

Fed quandaries

Back to Fed quandaries: one of the best inflation indicators is long-term Treasurys. Treasury 10s have fallen all year, consistent with a forecast for a weak economy and falling inflation, and silly for the Fed to think of raising its rate. But, Eric Rosengren, Boston-Fed-Prez and the smartest one of the lot, pointed to this Fed problem: if the dollar is rocketing, a lot of money is buying UST-10s and artificially cutting its yield, masking an inflation threat. But the dollar is up because the Fed threatens to tighten, maybe prematurely.

You want circular rings in your circus?

How about data? US GDP gained 3.5% in Q3, but hollow: consumption a thin 1.8% pace, the rest suspect. In today’s release, personal spending fell .2% in September, and incomes rose only .2%, both far below estimate. Personal consumption expenditures ( PCE) core inflation held at 1.5% year-over-year but is certain to fall if only because the rocketing dollar will cut the cost of all imports. Might falling oil goose the economy? Very little, negligible compared to historical drops. Prior drops cut the cost of all energy, but today natural gas and oil are already down. This one is gasoline-only, not bad, but not big.

What is happening overseas?

Stock market marbles are pouring out of heads on the news that the Bank of Japan will increase annual QE from $650 billion to $725 billion. And — incredible — Japan’s government pension fund will dump an additional one-quarter of its $1.4 trillion assets into global stocks, the BoJ effectively buying Japanese bonds that the fund holds to free up the cash. Meanwhile the European Central Bank (ECB) has begun a pathetic QE, roughly four years too late and a piddling $2 billion per month, but even that excites marbleless stock yahoos.

The BoJ and ECB are hosing funny money into bubbled markets, mostly so that at future trial they can say the collapse wasn’t their fault, while the Fed wants to tighten into imaginary inflation. Could I make that up?

Can long-term interest rates fall even more?

Stick with the basics. If US wages begin to rise, the Fed will tighten quickly. The bond market, dollar-distorted or not, will then vote on the Fed’s move: appropriate, overdue, or premature? Hunch here: long-term rates might even fall on the move.

———————————————

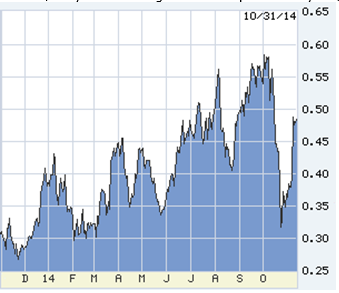

The euro in the last year. The brief rise in October was caused by poor global economic data, and the presumption that the Fed would hold off open-ended — you’ll see that formation in every currency and bond chart, and the obverse in US stocks. Yellen a hawk… here we go again.

Yen in the last year — remember, upside down, number of yen to the dollar, up is weak. The yen movement is more extreme because the BoJ has entered a Weimar experiment. Most market people think the printed cash will wash right out of Japan, having little or no impact on its disaster in progess. Perhaps more likely to hasten a funeral than to prolong the hospice decades.

10-year T-note one year back. Downtrend still in place. September-October volatility all about economy and Fed go/no-go.

The 2-year T-note is the arch-predictor of Fed action. (BTW: never pay attention to Fed funds futures, wrong far more often than right). The October data/Fed whipsaw plain as day, but even 2s disbelieve true grounds for Fed tightening — if the 2s market did believe, they’d be trading north of September’s yield, right now.

Claims are running below 300,000 weekly. US population today is 315,000,000 — one hundred million more people than 1974, when this level of claims was an inflation threat, and every time since.

Oil, five years back. This one is likely to be more durable than the previous down-spikes.

Natural gas five years back. Stimulus has been in place for three years, and prices won’t go lower.

Coal five years back. We still use a lot of the stuff, and it’s not following oil.

[hs_form id=”4″]

0 Comments