Whither long-term interest rates? Everyone building a new home, or thinking of buying anything wants to know. What is the up-side risk, Fed on the warpath?

Whither long-term interest rates? Everyone building a new home, or thinking of buying anything wants to know. What is the up-side risk, Fed on the warpath?

Long-term rates rose in anticipation of the Fed meeting concluding on Wednesday.

Markets got the hawkish post-meeting statement they expected, but since mid-morning Thursday long-term rates… fell.

What’s up with down?

The Fed’s statement changed only one word which mattered, adding “some” as noted: “The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market….”

The Fed never adds words without purpose. Bond market cynics feel the Fed is so determined to liftoff that it might as well have inserted “any.” Unless the economy flat stalls between now and fall, the Fed will invent theory as necessary to justify a rate hike. As of Wednesday. Then the ground shifted.

On Thursday 2nd quarter GDP arrived a thin 2.3% annualized, and Q1 was revised to a 0.6% annual gain, initially reported as a similar contraction. Optimists’ claims of a strong rebound after a bad winter — absurd, although they are still in shameless denial.

However, with the quarterly figure came a benchmark revision: from 2011-2014 GDP did not grow at 2.3% annually, only 2.0% — optimists and the Fed itself throughout the period predicting acceleration above 3.0%.

Then Friday morning, the sleepy last-Friday in July, everyone of importance in the Hamptons, the Employment Cost Index (ECI) for Q2: up a negligible 0.2%. The ECI is the best indicator of labor compensation, inclusive of benefits. This Q2 figure is the lowest since 1982 (then in the pit of previously the worst recession since the Depression).

Long-term rates are going to stay down

Now back away from this week’s micro detail. And please do not read the following as negative — the conclusion is the good news that long-term rates are going to stay down, and recession risk is minor.

Back away as far as it’s possible to go: the Fed’s job is to encourage the most rapid economic growth possible while keeping inflation under control. Thus the first question before the Fed every day: How fast is that? Economists speak of “potential” and “capacity.” The most over-complicated terminology: the non-accelerating inflation rate of unemployment, “NAIRU.” In English: How low can unemployment go before employers pay too much, and inflation? The current 5.3% is already at NAIRU low.

The speed limit of the U.S. economy is at 2 percent

Back to “too fast,” the most basic calculation: add the rate of productivity increase to population growth. If GDP rises faster than that, inflation results. U.S. population is growing about 1% per year, and productivity is poor, only about 1%, way off long-term trends. Add ‘em up, get 2%, and you have the speed limit of the U.S, economy.

Ouch.

Last week the Fed fat-fingered a release of the Fed staff’s study of the same issue. Historically the Fed staff does fairly well, better than private economists and the regional-Fed presidents. Best of all, they reflect the intentions of the Fed Chair (a slightly cooked book, circular). The staff’s estimate of annual GDP potential in the next five years: 1.80%. That means our economy is growing too fast now. 🙂

This line of thought has cascaded into the bond market in slow motion. Until the last two weeks, the working assumption was a Fed that wanted to lift off for fear of financial market bubbles inflated by zero-cost money, to begin a long process gently so as not harshly later, and to take out insurance against age-old NAIRU fear that a too-tight labor market would beget too-fast wage growth, even though no such thing is evident.

Now it seems the Fed intends to put on brakes, enforce a 2% limit late in 2016. The stock market bozos and other optimists don’t get it, but old-time bond-market people drool happily at the prospect of a Fed more likely to err on the tight side.

Mark me down with the droolers. The Fed is stuck, using measures of a bygone U.S. economy, and underestimating external effects on us.

Today the outside world is in a dangerous trade war, competitively devaluing currencies, labor, and materials. The world needs more stimulus, not less; and Lord knows, better public policy everywhere.

————————————————————

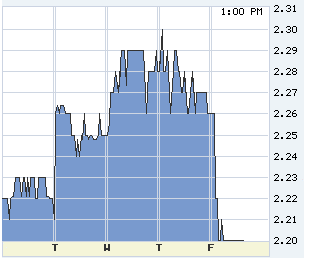

10-year T-note this last week. The ECI changed the game Friday, but long rates had already begun to slide.

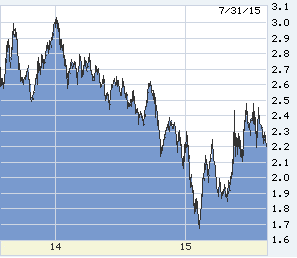

10-year T-note in the last two years. Break below 2.20% and mortgages will likely fall back into the threes. Historically, long-term rates refusing to rise in the face of Fed warnings is a warning to the Fed.

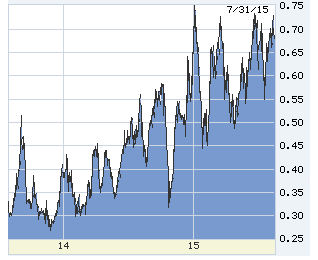

The best Fed forecast always is the 2-year T-note, below. During 2015 a consistent top at 0.70% anticipates one Fed hike in the next year, but no more. But, note the ascending bottoms of trading in 2015. This is a chart of disbelief: the Fed says it’s coming, but they can’t be serious about sustained hikes — can they?

The accidental Fed release. Top line: forecast of actual result says the economy right now is as hot as it’s going to get, and in 18 months will cool to 1.75% annual. Fifth line down, potential GDP confirms. The Fed intends to make GDP cool to potential.

The underlying weakness in labor and incomes shows in this chart of American youth. This is the cohort which must do well enough — soon — to pay taxes to pay for entitlement spending predicated on 3%-plus GDP growth. Are those still living at home doing so because they like it? Or because the economy is too constrained to provide opportunity? (Chart thanks to Washington Post)

[hs_form id=”4″]

0 Comments