The world is a better-looking place than one week ago, and Fed Chair Yellen whispered “bang” but did not shoot. Thus the great barometer, the 10-year U.S. Treasury-note, rose a bit in yield, from 2.33% last week to 2.40% today, mortgages following.

The world is a better-looking place than one week ago, and Fed Chair Yellen whispered “bang” but did not shoot. Thus the great barometer, the 10-year U.S. Treasury-note, rose a bit in yield, from 2.33% last week to 2.40% today, mortgages following.

At the end of each August the KC Fed hosts a meeting of the world’s central bankers in Jackson Hole, together with economist and media hangers-on. In theory a casual affair, so let your visual imagination run.

We used to think of Alan Greenspan sitting by the campfire in his three-piece pinstripes, leading the singing of sad cowboy songs with new lyrics about the need to wreck economies in order to save them. Janet Yellen has a wonderful Brooklyn sense of humor… consider her barely five-foot frame in waders headed out into the Snake river.

Her speech was a detailed rundown on a labor market “…yet to fully recover.” The soft little banglet was in this line: “But if progress in the labor market continues to be more rapid than anticipated by the Committee….” We saw that sentence from her once earlier this summer, and wondered then if the word “continues” was intentional — that the labor market was doing better than the Fed expected. Fed Chairs very rarely misspeak; to see “continues” again we should assume means just what it says, and the Fed is closer to a rate hike than many in the market assume.

U.S. economic data this week was just as positive as it was negative last week, especially housing data. Better, but not breakthrough. Poor data continued to come in from Europe, Japan, and China. However, the ISIS threat has crested, and Czar Vladimir is getting nowhere in Ukraine. There will be more market-moving events from both places, and rates will tend to fall on Fridays as money flows to safe bonds for protection over weekends.

The Fed wants very badly to get off zero

For the time being it wants even more badly not to abort this non-recovery economy. As soon as Yellen can look the country in the eye and say the job market is as good as it can get with her help, then the Fed funds rate will rise to .25%-.50%, and everyone at the Fed and a lot of other places will get under their desks, cover their ears, and hope not to get hit by any of the big pieces after the explosion.

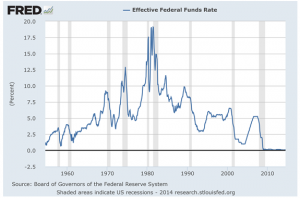

So it was in 1993. From 1989 to 1992 the Fed cut its overnight rate from 9.625% (gulp) to 3.00%, holding there all through 1993. Then by complete surprise (in the style of the old Fed and Greenspan) in February 1994 hiked to 3.25%. Bond and mortgage markets immediately blew up. Part of the detonation was the market’s understanding that the Fed would go much farther — CPI was still above 4%, and previous recession damage was repaired. The Fed did not stop its hikes until early 1995 at 6% (double-gulp), and nearly caused another recession.

Different times then, very much so, but the mechanism then was the same as now: credit markets quickly become accustomed to low costs of short-term money, and the Fed has this time been at zero for almost six years. Nobody knows or can know the extent of unwise risks taken in markets. The most important single source of gas for the late bubble was Greenspan’s belief that markets would work in their own interests.

Meanwhile markets were manufacturing vast quantities of securitized IOUs which could not possibly perform. Greenspan’s belief may have been the worst single thought in the history of central banking. He did not understand the single, dominant counter-thought at every trading desk on Wall Street: “I’ll get out first.”

As plain as it is that the Fed will soon day attempt “liftoff” (the Fed’s in-house term), you and the Fed can be absolutely certain that surprisingly large and invisible trading positions today exist on faith in “I’ll get out first.”

However, today unlike 1994, there is no latent inflation pressure anywhere in the world, deflation remains the threat, much of the global economy is damaged and not healing, and the Fed will not have far to go with rate hikes. Just enough to scare the pants off the overconfident, and maybe not hurting mortgage rates.

10-year T-note this last week

The world did not fall apart over last weekend, rates up on Monday; then up some more on good housing news on Wednesday; Yellen’s speech a non-event this morning; sliding lower now because another scary weekend ahead. Click on charts to enlarge.

This gorgeous six-month decline is contingent on a continuing flow of lousy news. One flicker of rising wages and it will end. Three flickers… end badly.

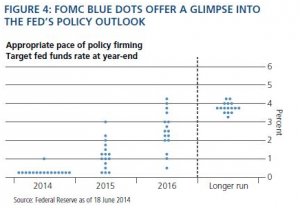

Fed funds forecast at its last meeting. To 1% by the end of 2015 is a fair bet. To be north of 2% by the end of 2016 will require a very different economy. To normalize near a historical 4.00% will require a different world.

Nice chart of existing home sales, but it’s each month as an annualized number, and seasonal adjustments distort every winter and summer:

A much better chart from fabulous www.calculatedriskblog.com: stabilized sales, but thin considering we’re at the same level of sales as an America with 46,000,000 fewer people.

[hs_form id=”4″]

0 Comments