While it might feel like we’re in a similar housing market bubble circa 2006, it’s not the same. In order for there to be a bubble in the first place, there has to be a catalyst that causes the housing market to crash. Historically, there are a variety of factors that can lead to a bubble and burst. For example, banks’ use of risky financial products, a larger supply of homes than demand, or enough speculative activity from investors to drive prices up very high.

Right now, there’s no bubble to pop. All economic indicators point to a continuation of the torrid housing market. In this article, Sundae’s Chief Economist Polina Ryshakov shares why a bubble hasn’t formed—yet.

The current pool of mortgages

As a whole, the mortgage pool gives insight into the types of buyers purchasing homes in the current market. The mortgage data loan origination cohorts reflect record credit scores and relatively low loan-to-value ratios. Additionally, new mortgages are mostly extended to credit-worthy borrowers. Due to competition, only buyers with the strongest track records and largest down payments can win bidding wars. This is in stark contrast to the Great Recession, where there were less qualified buyers with higher risk profiles buying homes.

Source: Sundae.com

The current imbalance between supply and demand

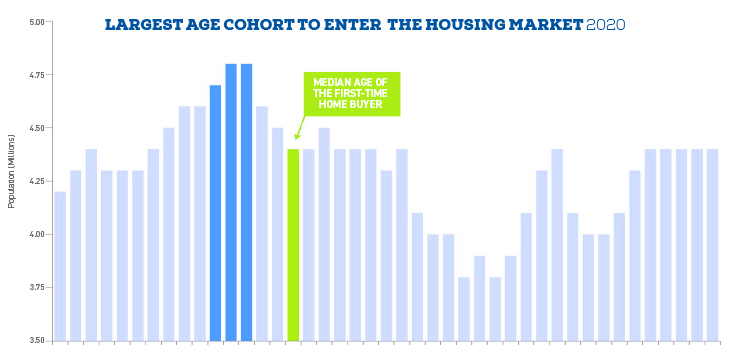

Almost 15 million millennials will age into their prime home-buying age of 32 over the next 3 years. With this influx of new buyers, FreddieMac estimates the housing shortage has increased even more. As a result, demand continues to rise as these millennials search and compete for homes which are in low supply.

Source: Sundae.com

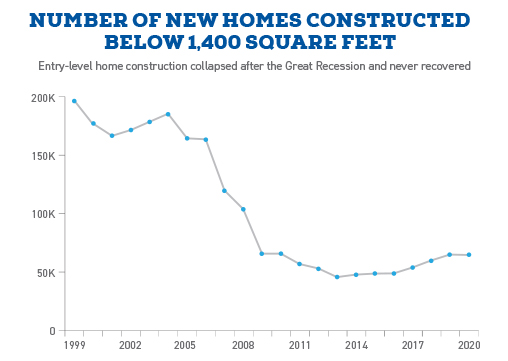

What’s even worse, the number of new homes constructed below 1,400 square feet (entry-level homes) collapsed after the Great Recessions and hasn’t recovered. Meanwhile, the stimulus put money in people’s savings accounts and COVID-19 forced them to save on going out and vacations in the past year. The personal savings rate skyrocketed, meaning that the percentage of people’s income remaining each month after taxes and spending grew dramatically. According to the U.S. Bureau of Economic Analysis, it spiked from 12.7% in March to a record 32.3% in April.

With forced savings and stimulus help, more renters entered the buyer pool or could save up to buy a house sooner than expected. Before the pandemic, buyers cited down payment as being the most difficult part of the home-buying process. In the post-pandemic world, it might be a combination of down payment and fierce competition.

Source: U.S. Census Bureau, Freddie Mac, Sundae

Investor activity at present

Another indicator of the housing market is investor behavior. Investor activity has definitely picked up. More and more investors are likely to enter the real estate space. Along with the local investors, we’re seeing iBuyers and institutional investors flood the space. That’s because the risk of perceived inflation is high and real estate is a good inflation hedge option.

Two tips to succeed in the current market

You layer these factors into a housing landscape where inventory hasn’t kept up with demand for a decade, and you have a hot market that will only get hotter. Here are our tips for the current real estate landscape:

1. Get in now

There is a 3- to 4-year lag on new construction so the inventory scarcity isn’t going anywhere. Although new permit filings have increased, it doesn’t guarantee that new homes will materialize. Not every permit filed translates into a construction start and not every start will become a completion. In other words, it will still take a long time for new construction to catch up.

Furthermore, it will take some time to make up for the supply gap between single-family home constructions and household formations. Between the beginning of 2019 and June of 2021, the gap increased from 3.84 million to 5.24 million homes. Builders are playing catch-up, so it will take years to sort out the lack of inventory.

2. Lock in these mortgage rates while they are still low

It’s about the cost of owning and your monthly payments—not the value of the house. Home prices over the past 50 years have steadily increased. This is irrespective of interest rates, which have gone up and down during the same time period. There are talks of the Federal Reserve increasing interest rates as soon as next year to combat inflation. Securing a mortgage at the current rate offers a chance at a lower monthly mortgage payment than if you wait.

There’s still reason to be optimistic about real estate

Bubbles will always be around. Every generation has its own bubble-forming behavior around a new trend. Does this mean there won’t be another housing bubble?

Probably not. It’s always a possibility that with a combination of low mortgage rates, a housing supply crunch and Millennials coming of age, things will get out of control. However, it takes a long time for demographics to work their way through.Millennials are going to remain a strong force in the housing market for the next 3 to 4 years. It also takes a long time for builders to ramp up supply. With continued demand along with other factors, there’s plenty of reason to remain bullish on real estate.

Polina Ryshakov is Sundae’s Sr. Director of Research and Lead Economist. She has more than 15 years of valuation experience across commercial and residential real estate.

0 Comments