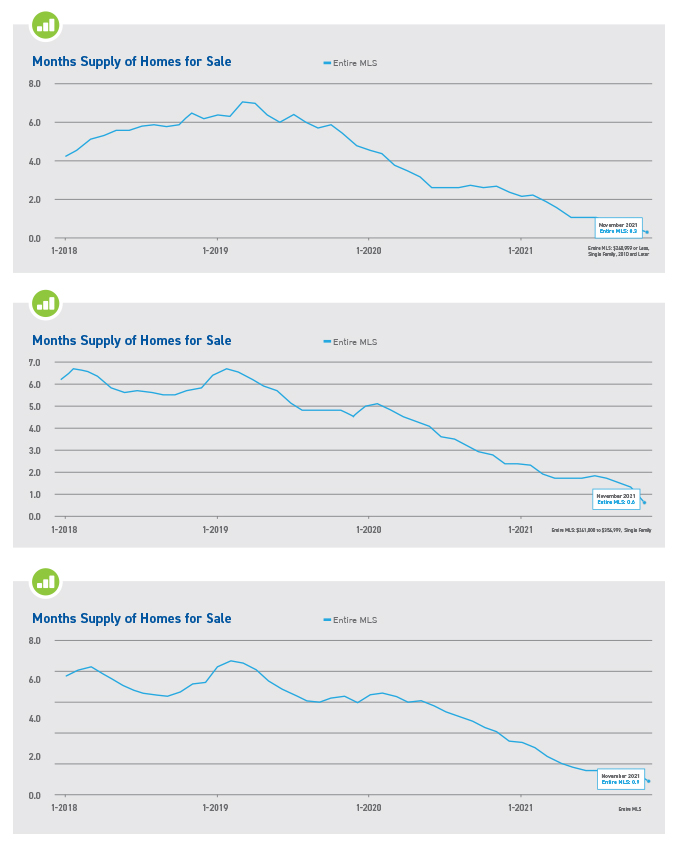

The real estate market nationwide is seeing unprecedented surges. One of the hottest markets in the US is Southwest Florida. As of November 2021, Southwest Florida is showing 0.3 months of inventory in Collier, Lee and Charlotte counties, which is down 80% of where we should be for a balanced market. This is mostly a result of strong buyer demand, high competition from deep-pocketed institutional investors, builders’ inability to provide new inventory, and a dash of seller reluctance as replacement properties are not as easy to find, thus limiting new resale inventory.

Enormous Demand & Desirability

Whether it’s golfing, boating, fishing, kayaking, or the many other activities to enjoy in the beautiful outdoors of Southwest Florida, we are home to those seeking an enhanced quality of everyday life. This past year has only accelerated that trend as Florida, to many, has been deemed the closest resemblance to “normal” during very uncertain times. As a result, the desirability for people to be here is higher than ever before, consistently strong, and not going away anytime soon. It’s estimated that 850 people will move to Florida per day over the next 5 years. While the markets feeding this growth continue to be Midwest and Northeast cities, Southwest Florida is now seeing residential and business relocations from California, Texas and the Pacific Northwest. The accessibility to Southwest Florida via new non-stop routes from San Francisco, San Diego and Seattle to the Southwest Florida International Airport (RSW) is helping drive this surge.

The COVID Effect

Due to the global pandemic and massive shutdowns people have been unable to travel overseas or take cruises which left many not only valuing home ownership more in general, but also looking for that “getaway” here in the states with Florida capturing a lot of that traffic. As a result, single family homes have been in extremely high demand for vacation rentals as buyers and institutional investors (who account for 20% of all sales right now across most markets) see the yield return potential given that other investment vehicles like US Treasuries have tanked and commercial real estate quickly became unappealing thanks to massive shutdowns.

Tax Benefits

Let’s not forget the many tax benefits of living here in Florida such as having no state income tax (1 of only 7 states) which means Social Security retirement benefits, pension income, and income from an IRA or a 401(k) are all untaxed. There’s also no estate or inheritance tax saving families a considerable amount of money after loved ones pass. Bottom line, your retirement accounts will go a lot further and it makes financial sense to live in Florida.

Interest Rates

On 15 separate occasions in 2020 we’ve broken all-time lows while bottoming out at 2.67%. Even though rates have bumped up a bit, they still remain historically low and are one of the many accelerants of the current market. With inflationary pressure mounting, some fear a drop in mortgage bonds which could have an adverse effect on interest rates causing them to rise.

Homestead Tax Exemption

Primary residents enjoy the benefit of a reduced taxable value, on top of protections capping any tax assessment increases at 3% per year vs 10% for non-homestead owners. Furthermore, per the “Save Our Homes” provision, any accrued savings over time up to $500,000 can be picked up and moved into a new homestead property which is considered “Portability”. We’re certainly seeing a shift in use as more people are making Florida their home-base and flocking north during the summer months, thus the term “snowbirds”.

Commercial Market

With the rise of remote working and concern for health and well-being of employees, expect more of a “hybrid-type” model for many companies going forward. Shared flex spaces are expected to be an area of growth while we might see some polarization between high-quality/adaptable buildings vs those outdated/less flexible. It’s still too early to tell but it’s no secret that online shopping has forced downward pressure on brick and mortar retail space and hotels have suffered as well.

According to the National Association of Realtors, Southwest Florida was ranked as the #1 commercial market in the US in 2020, more specifically Cape Coral and Fort Myers. This shows that investors are comfortable making moves here in Florida which is a big boost for the local economy, thus helping provide more jobs.

New Construction

Since the bubble burst 12 years ago, homebuilders have remained cautiously optimistic and as a result built only half as many homes over the past decade leaving us short on new inventory. We have officially hit a bottleneck point where our market cannot keep up with the current rate of demand thus maintaining an upward pressure on pricing as a result. New construction is our direct source to new supply of homes and their ongoing trends are always a good indication of what lies ahead.

Supply/Distribution Chain & Pricing

Given the nature of this past year with mass economic shutdowns and rising material costs across the board, inflation and supply chain issues continue to be an obstacle to economic recovery. Appliances, lumber, roofing & plumbing materials, have all taken longer to procure, and significantly more expensive than what it was pre-pandemic. We are seeing the added cost to new construction homes ($24k on average) and on remodels as a result. It’s estimated that the price of steel mill products has jumped 22% in the last 3 months alone.

Southwest Florida International Airport (RSW)

RSW Currently ranks #1 out of 50 airports in the US and has recovered 60% of its pre-pandemic traffic… more than any other airport. Construction continues on a new $80 million airport traffic control tower and the plans to build the $280 million 200,000 square foot terminal expansion will be bid this month, per Ben Siegel the Executive Director for the Lee County Port Authority. This would certainly indicate expected growth and future optimism here in Southwest Florida. Also, the addition of new non-stop routes into RSW from the west coast and Texas are fueling travel to the region.

Is There A Correction Coming?

Although it’s hard to say with absolute certainty, especially given the nature of this past year, but the short answer is no. We are in what is regarded one of the strongest and most sought-after real estate markets in the country and believe it or not, we have some serious foundational sustainability to our current local market. There’s just too much demand and projected future growth ahead for us to expect an imminent downturn. Furthermore, this market is not built on a house of cards like it was during the “Great Recession”. Here are a few related factors to consider:

Unemployment

As of February, it’s estimated that the Southwest Florida unemployment rate is down to 3.9% (compared with 6% nationally) which is pretty incredible considering where we were just a year ago. Construction jobs have boomed in March posting one of the largest monthly gains ever, and our local market is certainly reaping the benefit as a result. With the Southwest Florida commercial market being ranked #1 nationally per NAR, institutional money is pouring in as a result of their bullish outlook. What comes with that is more insulation and jobs.

Mortgage Forbearance

The overall forbearance rate has fallen below 5.5% for the first time in a year. It’s estimated that 90% of those currently in forbearance have at least 15% equity in their homes so even if people needed to sell, statistically speaking it should not be a distressed sale. The sellers should be able to walk away with some amount of money. Also, most lending institutions are working with their borrowers to help them stay in their homes as mortgage companies could face penalties if they don’t take steps to prevent a deluge of foreclosures. Let’s not forget the cash vs financing ratio in our market (48.3% in all of Southwest Florida).

Continued Growth

Per the Florida economic development directors, Lee County will receive $2 billion in funds while adding 6,500 jobs in the next 2 years and Collier County projects about $1.5 billion with an estimated 4,000 to 5,000 jobs. Barring any crazy unforeseen circumstance, Southwest Florida is poised to see long term and sustainable infrastructure and job growth. It is estimated that 850 people will be moving to Florida per day for the next 5 years as many seek the weather, lifestyle, and many tax benefits offered here.

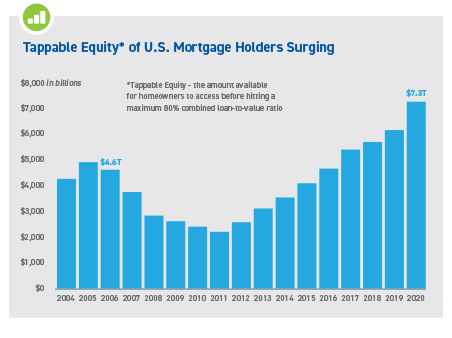

Equity

Americans are sitting on a record breaking $7.3 Trillion in untapped equity, up 18% since the end of 2019. Yet, we’re not tapping into them like our own personal piggy banks like during the “Great Recession”. In fact, in 2006 American’s cashed out $321 billion (89% of all refinances) vs $153 billion in 2020 (33% of all refinances), which represents only 47.7% of the total equity pulled back then.

Where Does the Market Go From Here?

Where Does the Market Go From Here?

Supply vs Demand

Until we find more of a balance between supply and buyer demand, we can expect these same trends to continue and drag on. Builders are pushing new homes out as fast as they can, but not fast enough to accommodate today’s demand thus creating a “bottleneck” Seller reluctance isn’t helping either. The shortage of available inventory is making sellers anxious about selling and thus finding themselves homeless. Demand has been consistently strong in spite of our international buyers mostly sidelined this past year, which is certainly an opportunity sector going forward. It’s not as easy as building more homes with material and labor costs continuing to rise, not to mention the tariff’s in place on Canadian lumber. At the current rate of production, it would take a few years to meet excess demand.

Where Does the Market Go From Here?

Where Does the Market Go From Here?

0 Comments