Typically, we think of credit as a relatively modern invention. However, “hard money” loans have been around since the earliest civilizations. The concept of hard money is one of the oldest kinds of credit financing.

Many history experts believe that Hammurabi, the ruler of Babylon during the 18th century B.C.E., implemented one of the first national lending systems. Over the centuries, other civilizations — from the Roman Empire to the Tang Dynasty in China to the Spanish Empire —have all used hard money loans in some form.

Today, the term “hard money” is used almost exclusively in the United States and Canada, where these types of loans are the most common.

A hard money loan is a short-term loan that comes from independent investors (i.e., private lenders). Aside from being subject to some restrictions on interest rates, hard money has largely remained formally unregulated by state and federal laws.

While modern banking systems have brought mortgages, credit cards, and other new forms of credit to the table, hard money has always been, and remains, vital to the real estate sector in particular.

The Origins of Modern “Hard Money”

The term “hard money” originated in the United States during the Great Depression. The collapse of the banking industry left individuals panicked — they took their money out of banks and kept it at home, reducing the amount of money in circulation.

As a result, people during the Great Depression had a very hard time rustling up extra cash when they needed it. One of the most sensible solutions for lenders of the time was to offer loans backed by real estate as collateral.

But because of their risky nature, “hard loans” had much higher interest rates than what banks would charge. However, property owners desperate for cash couldn’t get loans from banks, so they didn’t have many options.

Since the Great Depression, hard money lending has gone through its ups and downs. After World War II, private, short-term debt became vital to real estate development. As an example, in the 1950s, when the U.S. credit industry experienced dramatic changes, hard money developed as an alternative “last resort” for commercial property owners seeking capital against the equity in their holdings.

Then, in the 1980s and early 1990s, a turn in the commercial real estate market caused an unprecedented number of banks to fail and experience substantial losses. This gave rise to private lenders as an alternative form of financing.

And during the early 2000s, a lack of regulation and a rise in speculation created a real estate bubble. Eventually, it would all come crashing down: foreclosures spiked 225 percent from 2006–2008, and 3.1 million foreclosures were filed in 2008 alone.

Today, hard money loans have developed a bad reputation for being predatory, in large part because they’re largely misunderstood or misused.

In reality, hard money loans can serve a very functional purpose for real estate investors and borrowers, especially in times of national financial crisis.

The Hard Money Lending Renaissance

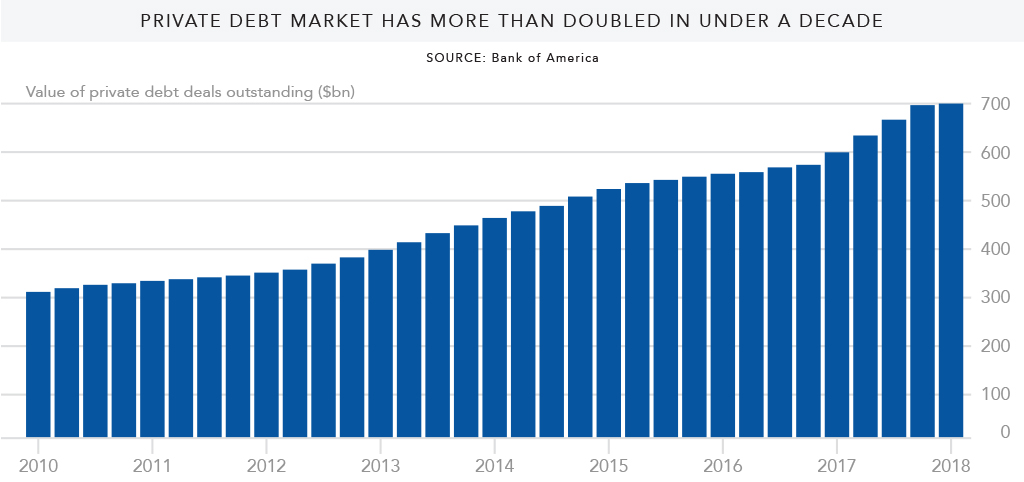

During the 2010s, private lending more than doubled, according to Bank of America research. Private debt in the U.S. now exceeds $700 billion.

Why did private lending rise to prominence so quickly? Due to the Great Recession, private lending has become a “workaround” form of financing for real estate investors frustrated with the Dodd-Frank Act.

Consequently, private lenders, once considered “back alley operators” in the eyes of Wall Street, are now well-established, above-board enterprises with hundreds to thousands of employees and billions of dollars in AUM.

Through smart private lending, enterprising real estate investors now enjoy access to a greater variety of investment opportunities, a wealth of choices for capital partners, and lower loan rates and terms.

Additionally, private lending offers significant benefits to real estate investors, such as:

Better Speed & Execution: Some lenders can often close loans in as few as seven days. You can’t get that speed and execution with traditional banks or Fannie Mae.

Unique Loan Terms: Hard money lenders provide financing that includes rehab costs and use after-repair values (ARV) as part of how they analyze investment strategies.

More Opportunities: Private lenders take on more risks than banks, such as providing higher leverage. This creates more opportunities for capable real estate entrepreneurs. These benefits, combined with recent market conditions, have made private lending more common than ever.

Hard Money Interest Rates Are Lower Than Ever

Consider how much has happened in lending over the past 10+ years. From 2009–2012, when the real estate market was at its lowest and little capital was available for private lending, hard money interest rates averaged 18 percent.

But when institutional lenders clammed up, real estate entrepreneurs were forced to rely on true hard money from private lenders. Private lenders used this as an opportunity to fill in the void that Wall Street left behind, and to prove that private lending can be scalable.

Today, as the real estate market continues to improve, interest rates on private loans have fallen as low as seven percent.

Why have interest rates gone down so much?

First, interest rate cuts made by the Federal Reserve in the 2010s have enabled private lenders to obtain cheaper capital, which allows them to offer better terms to real estate investors.

Second, homogenization has driven the compression of rates and fees. Since 2011, private lenders have entered real estate lending at an alarming rate, including Lima One Capital which opened their doors in 2011; Finance of America (formerly B2R) in 2013; LendingHome in 2013; and Direct Lending Partners in 2015.

Since the housing crisis, home flipping has gone mainstream, too. Television shows like Property Brothers (which first aired in 2011) teach millions how to fix and flip homes. This has generated a great deal of public attention on an industry that was traditionally exclusive to dedicated builders, developers, and real estate investors.

As data from CoreLogic shows, the number of home flippers has continually risen since 2010. With a variety of financing options now available and more knowledge available to the general public, it’s no surprise that many folks have carved out careers as real estate investors (ultimately creating a need for more capital).

The Return of Wall Street

As many investors have reached a large-enough scale and achieved sustainable success, Wall Street has taken notice. They’ve paid attention to what hard money lenders have done right, and they want a piece of the action.

That’s why names like Morgan Stanley, Credit Suisse, Goldman Sachs, Wells Fargo, and Deutsche Bank have entered the world of fix-and-flip loans. These banks extend lines of credit to lenders, lowering the cost of funding their loans.

The arrival of Wall Street in the hard money marketplace has led to securitizations, the ultimate proof that reflects institutional acceptance and support of the industry.

And, perhaps most importantly, the securitization of hard money lending has driven down the cost of capital for lenders, which has, in turn, driven down the rates that real estate investors can get.

As Wall Street becomes more involved in private lending, we can expect the industry to become increasingly legitimate in the eyes of investment bankers.

If hard money lenders can continue to offer reasonable rates and terms (along with the other benefits), private lending will only continue to grow.

It’s important to keep in mind that we’ve enjoyed good times in the housing market for nearly a decade. The bull cycle has been very long. So far, things still look good for 2020. But success in hard money lending and real estate investing requires being prepared for rainy days.

That’s why you have to make sure you have a long-term game plan.

New technology will remain an important factor in all aspects of hard money lending, from lead generation and property searches to risk modeling and asset management. Private money lenders will continue to innovate to offer improved financing products for investors.

We also expect to see continued diversification among hard money lenders (women and minorities are under-represented). But the competitive landscape is changing. New names and fresh faces will allow hard money to tap into a much larger, total addressable market.

The great success and staying power of hard money following the last housing crisis bodes well for the future. Major players in hard money lending filled a crucial gap in the economy and helped the housing market recover.

The hard money industry has finally found its place in the mainstream. As someone who has been working in this industry for over a decade, I’m very excited for what is to come.

0 Comments