It is odd out there. High-volatility markets have gone still. Long-term interest rates certain to rise have fallen, mortgages back in the threes.

The 242-seat Republican majority in the House is captive to 40 wild men, the party in many ways no longer a party. Vladimir’s latest excursion is only one miscalculation, one misidentified aircraft, one mis-targeted missile from a lot of people fighting each other who had not intended to. Europe refusing involvement in Syria now finds Syria on its roads, sleeping in its fields and railroad stations. China is silent and opaque.

Markets don’t like instability, but they do have a large tolerance for the misbehavior of politicians. That’s what politicians do, so may as well not bother to react.

But the disarray now extends to the Fed. Thanks to the Economic Cycle Research Institute (ECRI) via Advisor perspectives we have a nickname for Chair Yellen: the White Queen, found in “Through the Looking Glass.”

The White Queen: “The rule is, jam tomorrow and jam yesterday — but never jam today.” When Alice objects, “It must come sometimes to ‘jam today,’” the Queen retorts, “No, it can’t. It’s jam every other day: today isn’t any other day, you know.” Perfect. We’re going to raise our rate any minute, but that minute never comes.

Perhaps the Fed’s best option is to shut up

The Fed does have options. Perhaps the foremost: shut up. You look ridiculous. You have transcended the fable of the boy who cried “Wolf!”

An even better option: you have for more than a year seen conditions for an imminent rise in your overnight rate. What failure in your forecasting has caused imminent to be continuously non-imminent?

The error is plain. Painfully so. Worst of all, discrediting. If you’re the central bank, don’t say a word you’re not sure of. Everyone in the markets is exhausted with being Alice to Yellen’s White Queen. The stock market in its natural role as the Mad Hatter has decided that a Fed on hold is good news even though the hold depends on a weakening economy.

The Fed has over-relied on an ancient measure, the notion of “full employment” which if reached means inflation ahead which the Fed should lean against. It is now clear that the Fed either does not know how to define full employment or its level, nor in a globalized world the relationship between low unemployment and wage growth.

Internal disagreement at the Fed as expressed by regional presidents should usually be ignored, but Narayan Kocherlakota this week roused to a significant argument. He says the Fed prematurely tightened in 2013 by ending QE, and he has a lot of data on his side. The U.S. has not had a normal business cycle since the recession of 1991 (and even that was the first “jobless recovery”). All post-WW II recessions involved not just rising wages as unemployment fell, but an overheated credit cycle.

Today we have neither, bank credit flat-lining in September. The Fed has been guessing, and badly.

The Fed has word-played for two years: “We do not intend to tighten, just to remove excessive accommodation.” Oh, horsefeathers. They do not intend a minor, technical liftoff from zero, but to try to slow the economy down — in their plain words, and Congress, the White House, and the presidential-candidate freakshow all oblivious.

The UK has enjoyed the best financial leadership in the world since the financial crisis. The Bank of England’s Governor is Canadian Mark Carney, only 50 years old, appointed to the BOE in 2013 after guiding Canada through the crisis as Governor of the Bank of Canada. Carney this week: about 75% of the inflation undershoot has been due to “imported disinflation,” and “everyone should realize there’s not going to be a surge in demand from abroad. ”

He also seconded the IMF concern about the global surge in corporate debt, from $4 trillion to $18 trillion in ten years. “What worries me… the consequences of some policies in response to the crisis, specifically big build-ups of debt… a lot of it from outside the formal banking sector.”

By comparison the White Queen looks out of touch, looking backwards into her mirror. It is essential that the Fed chair appear on top of any situation even if not.

————————————————————–

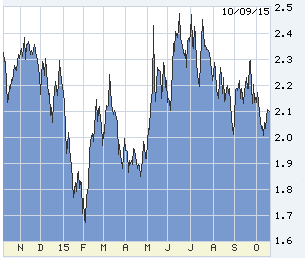

10-year T-note in the last 12 months. Double-bottom at 2.00%, but descending tops since July. The two trendlines will soon collide, but the global economy will decide the next trend.

2-year T-note, Fed-predictive, one year back… in complete disbelief of “normalizing” blather from the Fed:

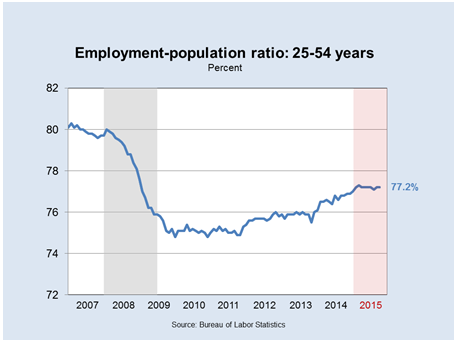

One of Kocherlakota’s charts. Not rocket science: 2015 is a stall, and at a low level:

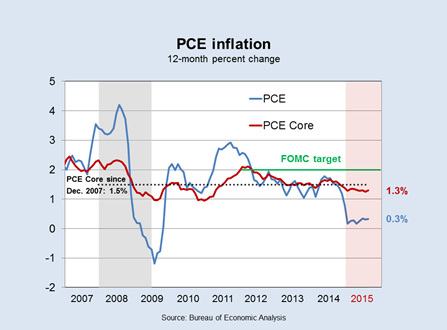

Another Kocherlakota. After stability, inflation is the Fed’s whole purpose, and it’s been falling for four years.

JOLTS ( Job openings and labor turnover) used to be a reasonable predictor of wage pressure. The more openings versus hires, the more deamnd for labor and employers competing by paying higher wages. If accurate today, wages would be screaming up — more openings than hires! Today’s chart painfully obvious: old, reliable metrics do not function now.

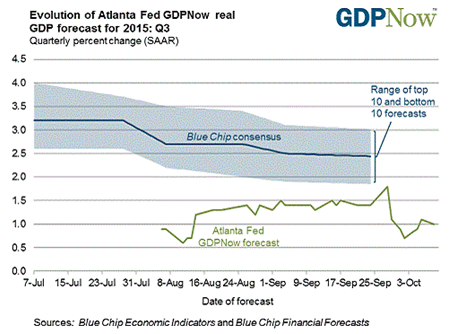

The Atlanta Fed tracker has been spooky-accurate. Many people believe the economy is trundling along at 2% growth. No, it’s not. BTW: for Blue Chip economists I would not give a bucket of warm expectorant. And the Fed has done little better.

0 Comments