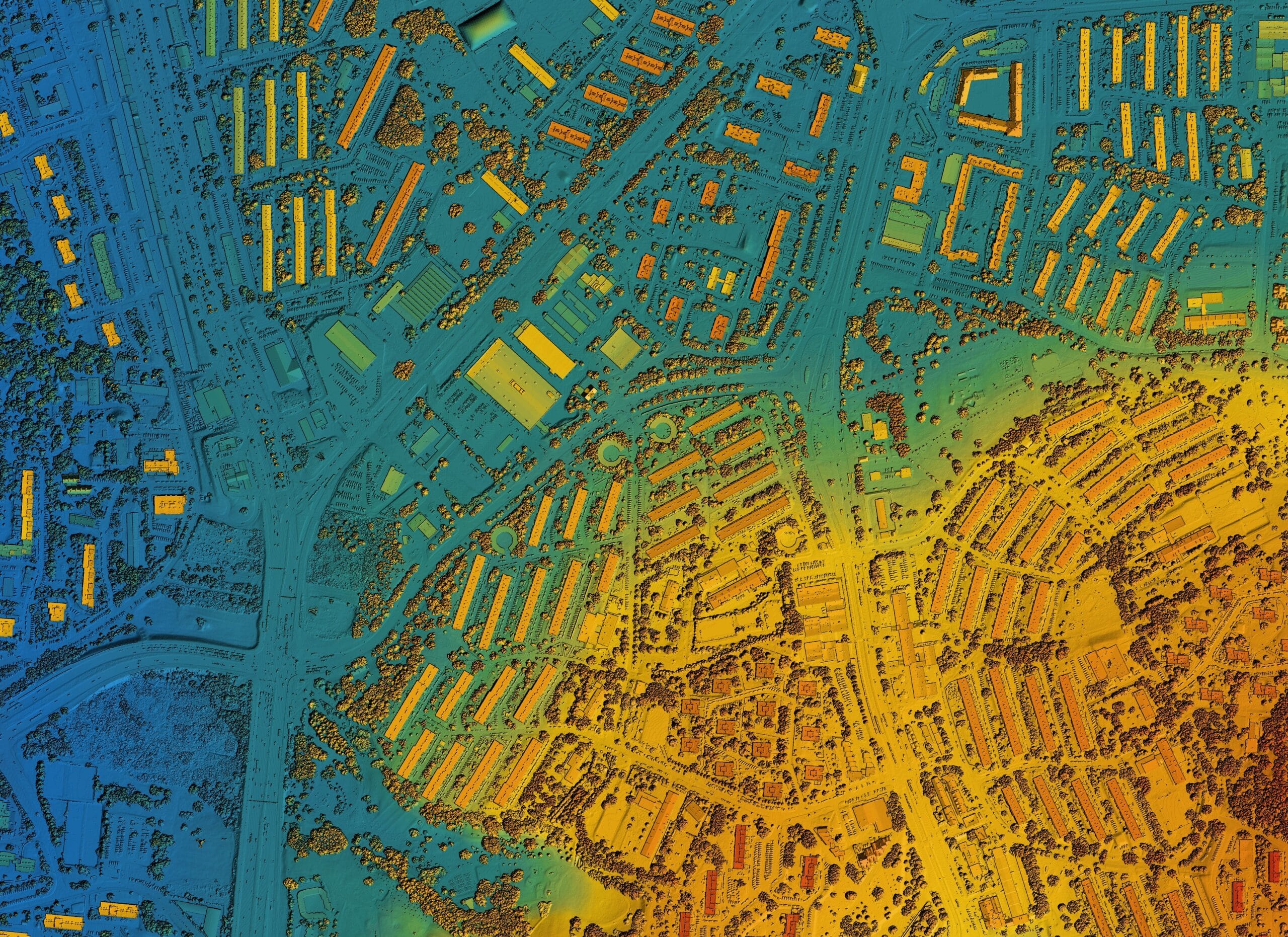

Track these trends and variables to help make informed desicions on how to promote, price, and manage your properties.

The U.S. rental market has been and continues to be a dynamic landscape. With so many factors influencing it, from the economy to availability to changing consumer preferences, real estate professionals have a lot to track.

Trends have much to do with how you market, price, and manage properties. Market predictability helps you make critical decisions. Predictably, tenets can still guide you even in times of rapid change or uncertainty. Let’s review key trends and how to adjust to align with them.

Key Rental Market Trends Impacting 2025

What’s happening in the rental market right now? There are four major trends to explore.

1. Urban vs. Suburban Shift. Since the pandemic, the country has seen a migration from urban to suburban living. A National Association of Realtors reviewed recent Census data in its research, finding that 41% of urban residents moved to suburban areas. Much of this was the result of the remote work revolution. In 2025, 28.1% of Americans are still working from home.

People no longer have to let being tethered to a company office dictate where they rent. They’re choosing suburbia because of a lower cost of living, the desire for a better quality of life, and the growing amenities available.

Overall, rental rates tend to be lower in the suburbs. A rental property analyst estimated the savings to be around 11% across the country. It can be even greater when comparing high-cost cities.

In this trend, there is some market predictability to add to your playbook. If you have rentals in suburban areas with an uptick in new residents exiting the city, you can count on continued demand. However, this may lead to an increase rental rates, depending on availability. It also helps you define specific groups to market to, creating inspiring promotions and messaging about moving from the city to the suburbs.

2. Rising Rent Prices and Affordability. Rental prices have been rising steadily since 2020. The latest data shows a 3.5% increase from February 2024 to February 2025, with the current average being $1,980. This dataset has positive news: The growth is slightly below pre-pandemic averages; however, it is still 33.9% higher than they were before.

There are more influences over pricing than demand and availability, which gets to the root of what a consumer considers affordable. Inflation, which had decreased in 2024, is back on the rise. Consumer confidence fell in the first quarter of 2025.

Demand takes a hit if those in the market simply can’t afford the rent. If this is the picture in your region, you can look for signs of market predictability, but that may be challenging in a volatile economy. You can look at the data from your properties’ rent history and what potential tenants are saying about their budget. If the gap is too wide, it may be time to apply creative pricing strategies to avoid longer vacancies.

3. Short-Term vs. Long-Term Rentals. Some markets are filling the availability gap with short-term rentals from platforms like Airbnb. These tend to be much more expensive and have restrictive rules for guests. Some renters may need to use it as a solution for their initial move while they decide where they want to put down roots.

Short-term rentals are increasingly subject to regulatory challenges and may be oversaturated in certain locations. One possible result is that property owners might choose to convert their listings to long-term rentals, as demand in this segment is higher, which could help you expand this area of your rental business.

4. Multifamily vs. Single-Family Rentals. Multifamily and single-family rentals have unique characteristics and investment profiles. Their cap rates may differ, but both may have low risk depending on their location and condition. Multifamily will increase operating income but require more maintenance, repairs, and management oversight.

Look at the specific demand trend in your region by property type and availability when considering where to invest your own dollars or make suggestions to clients.

Economic and Policy Factors

Economic and policy factors influence the rental market and its stability. Interest rates remain high in 2025, which means mortgages are still out of reach for many people and keep them renting.

Houses available to buy fluctuate and are location-specific, with new builds still moving forward. However, the evolving story of tariffs will affect this, as many materials are not widely available domestically. Inflation, wage growth, and employment rates also affect the affordability factor.

Rent control laws and tenant protections also fall under this category. This typically happens locally, with regulations in place to cap rent increases. Laws that protect tenants outside of national laws, like the Fair Housing Act, may determine how you screen tenants, the choices you can make, and the rules for evictions. Stay aware of those on the books and any proposed laws.

Technology and Tenant Preferences

Today’s tenant has a new set of preferences. It depends on their age group, whether they are a single renter or a family, and what’s most important to them. Many properties have amenities that can fill these needs, including proximity to shops, services, and entertainment.

For the property itself, many renters seek out must-haves like pet-friendly policies, smart technology, energy-efficient appliances, and properties with sustainability features. They may also prefer properties with office space for remote workers, an outside living area, and a garage.

Finally, many renters want more flexible lease terms. They may rent for a shorter term as they search for a property to buy; others may want to sign for longer than the standard year. Recognizing these trends can inform how you promote properties, highlighting flexibility.

How Real Estate Professionals Can Adapt

With so many trends, what’s the response? It depends on your market and who you represent. There are several strategies you can consider.

First, you can help landlords and property managers remain competitive by discussing the demand for the area and what renters want. Focusing on these trends enables them to stay competitive and avoid vacancies.

Be sure to review investment opportunities with people looking to buy, comparing cap rates to understand potential profitability. Provide them with data about the property and the demand for the area.

Also, leverage market data to anticipate shifts. Stay current on what’s happening locally and nationally. When you identify trends, follow them and make some assumptions about how they may impact rental demand and pricing.

A Moving Target

Rental market changes are part of the landscape. Sometimes, the changes are more turbulent than others. Beyond following trends and understanding how to respond, streamlining applications with tenant screening technology is critical to bringing renters and properties together.

The road ahead may be uncertain, but data is your best source for how to pivot. With these practical strategies, your rental business can flourish in 2025.

0 Comments