Real estate investors looking for top-dollar homes to flip can hone their prospects thanks to a recently released list of the richest counties in the U.S.

There are many usual suspects on the list, however, a few areas might surprise you as areas with the highest wages doesn’t necessarily correspond to the highest income.

“You may think you have a good sense of where in the country residents are making the most money,” Smart Asset wrote. “But the counties whose well-heeled, deep-pocketed denizens are pulling in the most coin may not include the fanciest zip codes you’re imagining. That’s because there’s more to income than just wages.”

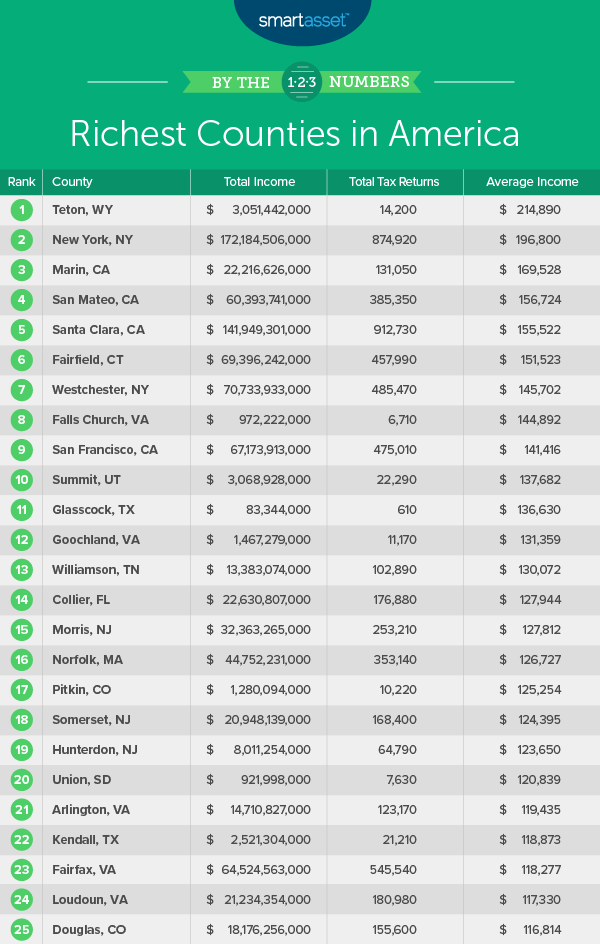

In a nationwide study, Smart Asset analyzed Internal Revenue Service data on 3,151 counties, evaluating total income in the county and the total number of returns with income. To create its final rankings, Smart Asset divided total income by the total number of returns with income, yielding the average income per return.

Among the findings, Smart Asset noted that there is stark income inequality between the county with the highest average income, Teton County, Wyoming, which has an average income 10 times higher than that of the county with the lowest average income in Hayes County, Nebraska.

Teton County boasts an average tax return of $214,800 in income. Unlike other wealthy counties, the majority of the roughly $3 billion earned in the area comes from investments.

It also found that the usual suspects top out the wealthiest metros in the United States: New York and San Francisco. New York County and San Francisco County both snagged top-10 spots for the richest U.S. counties.

Other counties with their metro areas but outside their city centers also — including Westchester County, New York and Marin County, California — are also in the top 10.

Below is a list for the top richest counties in the United States.

0 Comments