All good investors are visionaries.

All good investors are visionaries.

That is, before making an investment they make a prediction about the future – which may or may not come true.

That said, and working with the humility appropriate for any investor with a healthy appreciation for risk and instinct for survival, here is a summary of eight trends we believe will make their mark on rental real estate going into 2015 and beyond. See the full article

1. Rental Demand Will Be Strong

Despite a broad economic recovery from the 2008-2010 recession, Millennials and Generation Y members aren’t exactly emerging from their parents’ basements by the millions, nor are they particularly eager to get married and start families in little starter homes like their parents and grandparents before them did.

“14% of 24-35 year olds are still living with parents.” –2013 Gallup poll. Yes, we all know exceptions, but why is this a generational trend? Read more.

2. Vacancy Rates Will Decline

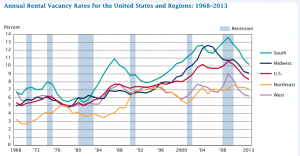

We present you exhibit A, the U.S. Census Bureau Housing trending graph.

This is a secular trend that transcends the traditional market cycle, and is reflective of the larger socioeconomic, demographic and cultural changes we hinted at above – changes in the nature of employment and work, and in changes in the priorities value systems of younger middle-class Americans with regard to education, employment and their willingness to start a family. Read more.

3. Smaller Cities Will Dominate ROI

Millenials aren’t exactly staying on Ma and Pa’s farm. But they don’t have to move to New York, Los Angeles and Chicago anymore to seek their fortunes. Indeed, many won’t, but will choose to live in areas with a more modest cost of living. Read more.

4. Walkability Will Matter

We are already seeing solid evidence of a “walkability” renter premium in recent years, beginning with this University of Arizona study that found that “on a 100-point scale, a 10-point increase in walkability increases property values by 1 to 9 percent, depending on the type.” Read more.

5. Tech Centers Will Rule

Technology centers are those areas that have a steady influx of technologically savvy younger workers, whether minted from local universities or attracted by major employers who have set up shop in the area. Think areas like the Research Triangle of North Carolina, for example, or areas rapidly spreading from Northern California up to Seattle along the I-5 corridor. Read more.

6. Mortgage Rates Will Rise

Monetary policy has held mortgage rates down – at the expense of savers – for many years now, and there are limits to how long that policy can last. Mortgage giant Freddie Mac’s team of economists are projecting mortgages to be approaching 5 percent by the end of 2015; increasing 1 percentage point isn’t going to make it any easier for the basement-dwellers and apartment residents to make the leap. Read more.

7. Economic Confidence Will Improve

Data from the National Association of Realtors (NAR) indicates that consumer confidence is on the rise, and now stands at the highest it’s been in 7 years (their consumer confidence index was 94.5 in October). Yet, Realtor confidence in the future is at a 2½ year low. Read more.

8. Empty Nesters Will Rent Again

Recently, observers noted a different trend of baby-boomers, who are now empty nesters, migrating to rentals at the rate of 200,000 households a year from 2010 to 2013, according to reporting from Multifamily Executive Magazine. These aren’t geriatrics, either. These 50+ and 60+ individuals and many of them are flocking to urban cores and centers of dining and recreation, rather than suburbia. What is driving the trend? Read more.

RealtyTrac’s numbers are confirming these trends, thus far. This means that rental property investors (and those property managers advising them and executing their strategy) have some marketing options. It’s not just about the 18-35 crowd anymore. The rental market is likely to be a mix of younger individuals and families who have not yet transitioned to homeownership on one hand – and baby boomers who are downsizing from homeownership on the other.

Are there other questions you have about managing your rental or finding an investment property? Consider having a professional property manager – one who deals with meeting the standards of the Millennials and Baby Boomers on a daily basis and could handle legal or maintenance issues. To find a professional property manager in your area, browse a list of our favorites or call us at 877-215-9182 today to learn more.

0 Comments