Although home prices have been rising briskly in many markets across the country, the prospects for investors in these markets can be quite different from market to market. This is especially true for investors in rental properties who need a longer-term perspective than those rehabbing and reselling.

Sure, rising home prices are an important part of your investment decision because they indicate a mismatch between the local supply and demand for housing. But you need to look beyond just prices to get a feel for what is likely to happen down the road.

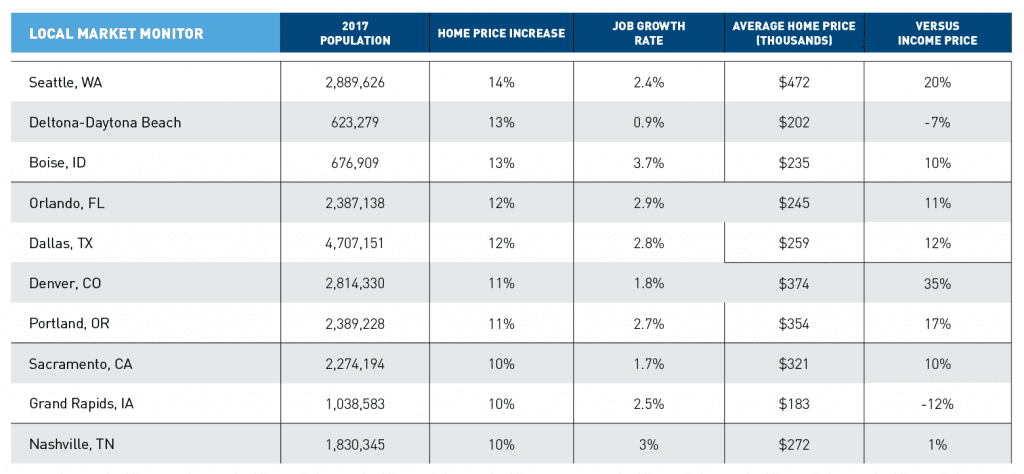

Our list of 10 markets with strong gains in home prices over the past year includes examples of several possible future outcomes for each market.

Markets Still Recovering

A couple of years ago, home prices in most of these markets were well below the Local Market Monitor’s “income price,” a measure of where prices “should” be. For example, the fact that prices are still below the income price in Deltona, Florida, and Grand Rapids, Michigan (though not by much) shows how long the road to recovery has been and highlights possible structural weakness. The problem in Grand Rapids was purely economic: Manufacturing jobs went away but now are back. When you look at the job growth rate, you can see that although it’s still tough to bet on manufacturing jobs that risk is creating opportunities for investors willing to take it. Furthermore, a rental investment in Grand Rapids is still pretty cheap.

On the other hand, the problem in Deltona was investor speculation and overbuilding of retirement and vacation properties, many of them condos. The economy now is not great either thanks to mediocre job growth, but future retirees and the workers who provide services to them will include many more renters than in the past. In light of that, a rental investment in Deltona makes sense.

Markets that are Booming

Home prices in Seattle, Washington, and Denver, Colorado, are not only high but also well above the income price, and Portland isn’t far behind. This doesn’t mean prices will blow off and crash any time soon, and there could be a soft landing when prices do peak, but investments in rentals are now very expensive at the very time when more people want to rent. Subdividing into multiple rental units is probably the best bet, but that commits you to an investment for a long time, so you need to have confidence in the longer-term economic situation.

Other Markets

The “other markets” in our list have differences, but they’re united in having good job growth and fairly moderate home prices. You’ll have to make up your own mind whether you’d rather have an investment in California or Tennessee, but the outlook for rental properties in those two states is actually quite similar.

Demand is strong in all of these markets, which means they’re ripe for thoughtful investments. Just be sure you think about what the differences in these markets will mean for the future of your investment strategies.

0 Comments