Most year-end forecasts are now on hold, or ought to be. Expectations for a faster economy and higher rates? Later, dear.

Some days the financial markets are beautiful things. Not just because you’re winning a bet, but by clarifying who has done what to whom. Not mere correlation as cause, offered by shills every day, but unmistakable event and effect. Click here to read what Personal Real Estate Investor Magazine says this means for investors.

Before New York markets opened on Thursday, news flashed: Markit’s measure of January manufacturing in Europe rose from 52.7 to 53.9, but in China fell from 50.5 to shrinkage at 49.6 and almost a percentage point below forecast. In New York the Dow opened 150 points below Wednesday’s close, and emerging-nation currencies tanked, Argentina almost 20%.

Lessons. Nobody believes in European recovery. China matters. In the old days, “When the US sneezes, the world catches cold.” Today, duck when China reaches for a hanky. World trade is a continuous conveyor connecting everyone, low-end goods exported from low-productivity economies to join high-end from high-end often in China to be re-exported all over hell and gone.

When the conveyor jumps a drive tooth at the China station, then so does demand for emerging-nation and commodity exports. Not good for stocks anywhere, and emergings suddenly struggle to pay foreign debts.

The 10-year T-note, under pressure from a quantitative easing-tapering Fed and accelerating economy was by now supposed to have broken through 3.00%, up into a range not seen since 2011. Instead it has fallen in each week of the New Year, on the China news now to 2.73%, crashing through technical “resistance.” But there is a lot more to this move than China. Certainly a weakening world would push money to the dollar and US bonds, but the 10-year has been doing better for weeks.

Sometimes a missing puzzle-piece is most illustrative. Scotland Yard: “Anything else of note?” Holmes: The curious incident of the dog in the night. Scotland Yard: “The dog did nothing in the night.” Holmes: That was the curious incident.

Why has the dog not barked? You’d never know from the media happy-talkers, certain that quantitative easing (QE) was an excessive stimulant, but the 10-year move says that quieter, wiser heads are worried about our economy with the Fed pulling back. If QE was good for the economy, its absence is not.

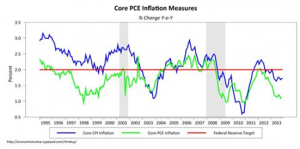

Then, the overall economy aside, too hard to predict in an unprecedented cycle becoming an era, the big deal for long term rates always is inflation. And it’s still trending down, core measures in the 1.0%-1.5% range. In the modern era the yield on a 10-year T-note tends to be a little less than 1.5% over inflation. Voila: the 10-year under 3.00% is not crazy — not unless you think either the Fed will be raising its overnight rate soon, or you believe that inflation is soon to rise.

Two groups think inflation will rise soon. One is the crowd eager to re-fight granddaddy’s war. The 1970s will be back any day! Put the gold bugs, the currency debasers, and money printers in this bunch. We have nothing to fear from them; they get a lot of ink but don’t move markets. The second group is worth study: the Fed. The Fed has insisted for a year that inflation will rise back to its 2% target. Delayed, perhaps, and contained, but will rise.

The downward pressure on inflation is real, but true deflation is not likely, and required to spook the Fed to new easing. The fracking boom is big, especially in oil, but natural gas really can’t fall below three bucks, too low for drilling. At that level a huge benefit to American commerce, but not a global-price under-cutter. Oil could drop, but a fall in its price is more stimulative than deflationary, low gasoline prices a booster.

Wages feel deflationary pressure, especially in the West and the emerging world. But they are not likely to go negative, just not rise much. One odd upward push on inflation: rents — depending on the measure, as much as 30% of inflation indices.

So, enjoy low inflation and this low-rate patch while they last, which may be quite a while. Not too hot, not too cold. One eye on China.

———————————————————————-

Dow Jones trading from Wednesday morning to 1:00 EDT Friday: Click on chart to enlarge.

10-Year T-note this week:

10-year T-note in the last year, below. There is plenty of resistance at 2.70%, but break 2.50% for any reason or none, and the elevator will go into freefall.

The theoretical rate of unemployment is the only job element going anywhere.

If the inflation decline in the last two years continues that trend, the Fed will have to scramble to find some way to stimulate the economy, and it’s not at all clear what. QE had clearly lost its oomph.

The “cost of shelter” can do some crazy things. In the Volcker era, Fed tightening to fight inflation drove mortgage rates from 10% to 18%, which through higher mortgage payments drove up the cost of shelter and the theoretical rate of inflation, which meant more tightening. At the time it felt like being punished for being punished.

Read Andrew Waite’s take on Lou Barnes comments, click here.

0 Comments