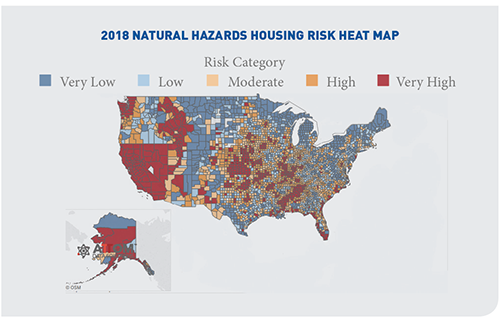

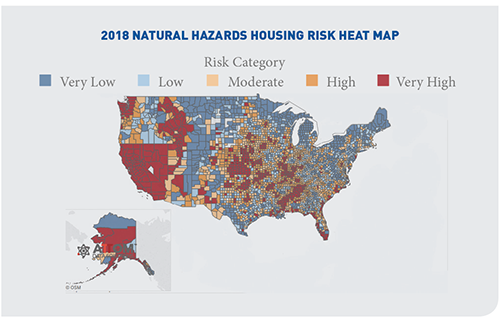

Real estate investors who want to avoid property damage caused by natural hazards should be looking in the Rust Belt, according to the ATTOM Data Solutions 2018 U.S. Natural Hazard Housing Risk Index.

For the report ATTOM indexed natural hazard risk in more than 3,000 counties and more than 22,000 U.S. cities based on the risk of six natural disasters: earthquakes, floods, hail, hurricane storm surge, tornadoes, and wildfires. ATTOM also analyzed housing trends in 2,616 cities and 440 counties — containing more than 53 million single family homes and condos — broken into five equal quintiles of natural hazard housing risk.

Homes selling at 4.4 percent discount in lowest-risk markets

Among the 440 counties with sufficient housing data, those with the lowest natural hazard housing risk were Milwaukee County, Wisconsin, Muskegon County Michigan, Cuyahoga County/Cleveland, Ohio, Kenosha County, Wisconsin in the greater Chicago metro area, and Monroe County/Rochester, New York.

Homes in counties in the bottom 20th percentile for natural hazard risk have a median sales price so far in 2018 that is 22 percent lower than the median sales price for all counties nationwide. Also, homes in those lowest-risk counties are selling at a 4.4 percent discount on average below their estimated full market value at the time of sale.

Home prices appreciated 1.6 times faster in highest-risk markets

Home prices appreciated 1.6 times faster in highest-risk markets

On the other end of the spectrum, counties with the highest natural hazard housing risk were Oklahoma County, Oklahoma, Monroe County/Key West, Florida, Santa Cruz County, California, Santa Clara County/San Jose, California, and Marin County, California in the San Francisco metro area.

The ATTOM analysis found that median home prices in cities with the top 80th percentile for natural hazard housing risk have appreciated 39 percent on average over the last 10 years — 1.6 times the 25 percent home price appreciation in the overall U.S. housing market during the same time period.

“While combined natural disaster risk has not seemed to hobble home price appreciation over the past decade, the story is much different for some individual hazard risks — namely flood, hurricane storm surge and wildfire risk,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “Home price appreciation in the overall U.S. housing market was double the rate of appreciation in cities with the highest flood risk and triple the rate of appreciation in cities with the highest hurricane storm surge risk over the past 10 years. The broader market has also outperformed appreciation in cities with the highest wildfire risk during the last decade, although the gap is much narrower.”

Foreclosure rates elevated in highest-risk flood cities

Foreclosure rates were lower in cities in the top 80th percentile for natural hazard housing risk, and this was true for all individual natural hazard risk types except for flood risk. In cities in the top 80th percentile for flood risk, active foreclosures represented 0.61 percent of all properties, well above the foreclosure rate of 0.38 percent across all risk categories.

“Weather is the largest external swing factor in U.S. economics and accounts for over $550 billion per year in lost revenue and up to 76,000 lost jobs,” said Mark Gibbas, president and CEO at Weather Source, a technology company that provides global weather and climate data along with advanced analytics. “Weather can have an enormous impact on homeowners and the housing market. When big weather events such as hurricanes, tornadoes and hail hit, many homeowners suffer financial hardship from various sources such as lost wages and losses due to inadequate insurance. And while the impact on homeowners can be severe, hurricanes like Harvey can change the landscape of the housing market region-wide, including shifts in the number of available homes and shifts in home values.”

Cities with the highest flood risk also posted seriously underwater rates (loan-to-value ratio of 125 percent or higher) above the overall market average — 8.9 percent of all homes with a mortgage compared to 8.5 percent nationwide. Tornado risk was the only other individual natural hazard risk factor with seriously underwater rates above the market average in the highest risk cities — 10.0 percent of all homes with a mortgage.

Home prices appreciated 1.6 times faster in highest-risk markets

Home prices appreciated 1.6 times faster in highest-risk markets

0 Comments