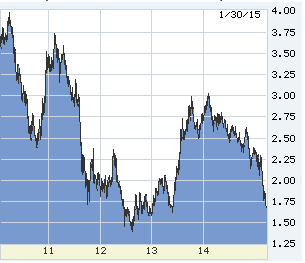

First the facts, then the ponderables. Long-term US interest rates fell again Friday, now to a 20-month low.

First the facts, then the ponderables. Long-term US interest rates fell again Friday, now to a 20-month low.

The 10-year T-note broke through the 1.70% prior low to 1.66%, down from 1.85% on Monday and from 2.30% in Christmas week.(Meanwhile, on Wednesday the Fed affirmed its intention to “liftoff” from 0%….)

Mortgages are a slightly different story. 30-fixed, low-fee loans are in the 3.75% area, depending on borrower characteristics, the spread widening to the 10-year T-note. A normal spread is about 1.80% and the 2.00% today signifies three things:

- An international flight to quality focuses on Treasurys, not mortgage backed securities (MBS).

- Second, the new refi wave chokes the market.

- Third, mortgages are approaching absolute zero. A retail rate includes incompressible costs of origination, securitizing, servicing, and compensation for prepayment/extension risk, and a credit spread over Treasurys. (The Fed’s post-meeting minutes: “…Economic activity… a solid pace.”)

This latest drop is the result of Friday’s estimate of 4th quarter GDP, a 2.6% gain versus expectations of 3.2%. Optimists are hooting happily at the consumption component, up 4.3%.

These pollyannas are unimpressed by being out-voted by global capital markets, which obviously gave more weight to weakness in inflation (the personal consumption expenditures (PCE) deflator to 1.1% from 1.4% in Q3), early-stage damage from a hyper-dollar (imports up, exports down), and business investment only 1.9% annualized. (The Fed confirmed its forecast that inflation would rise to its 2% target….)

Another datum pushing down on rates: orders for durable goods began to tank in late fall. A notoriously volatile series, but two-straight months, and stripping out super-volatile transportation: November’s initial minus-.4% was revised to minus-1.3%, and December’s expected plus-.8% arrived minus-.8%.(The Fed: “…Strong job gains and a lower unemployment rate.”)

Another downward force: the now-fantastic currency war underway, essentially every developed nation desperately trying to maintain competitive position versus the euro and yen, both falling fast via intentional debasement by their central banks. This week the German 10-year yield fell to 0.269%, crossing below the previously ultra-low Japanese 10s, now 0.282%. (The Fed: “…Assessment will take into account… [last in list] international events.”)

The exception to the currency war is China, still holding its dollar peg, but at the price of internal slowdown, and not sustainable. Add Singapore to the list of strong, fiscally sound economies forced to drop central-bank rates to prevent their currencies from rising too far above the yen and euro, Switzerland and Denmark now below zero. Everyone but China now in forceful devaluation versus the dollar.

Geopolitical risk is in play, but hard to separate from other currency events. Europe at cost to its own economy will expand sanction punishment of Russia, which seems to have cornered Czar Vladimir into a nothing-to-lose assault in Ukraine. Greece is a wild card, its new government the extremists typical of too much privation for too long: they want to keep good German money in their pockets but refuse to take the economic actions to justify the privilege.

The Fed seems captured by old rules in old models

Phew. Quite the run-down.

I am a Fed-fan, one of the faithful. I know that they see all of this, especially foreign funds pouring into US bonds and distorting economic signals from that market. But they seem captured by old rules in old models, especially their sensitivity to job gains — gains in lousy jobs which seem taken by throw-in-the-towel workers, nothing resembling “overheating.”

James Bullard, St. Louis Fed Prez was on the tape Friday. He competes with two other Fed-regionals for the title of Dimmest Bulb, but may have repeated emphasis heard from leaders.

“A tricky call… how are we going to react to mitigate the risk of bubbles? The only candidate is bonds, government debt and other kinds of debt.”

There we have it: bonds may signal imminent slowdown, but we should pull the plug on them, force rates up even though exactly backwards.

—————————————————

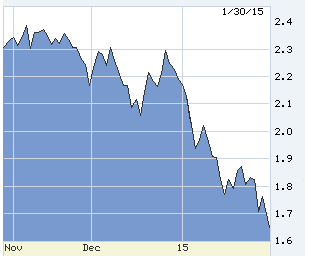

Danish krone/dollar in the last year. Inverted! Up is weak — but has not been weak enough to stay with the euro. The euro has fallen 20%, the krone only 15%, hence its central bank this week cut again, to minus .50%

Negative yields on long-term bonds. I understand the Fed’s bubble and overheating fear, but tightening into a picture like this which has spread from Japan and Europe outward, still spreading…

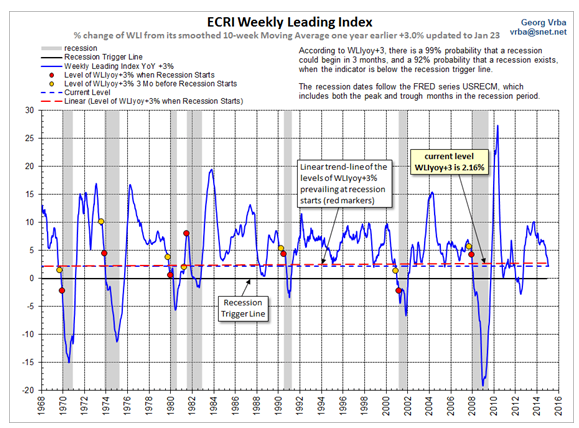

The Economic Cycle Recession Institute has correctly called every recession since 1968, and made only one false call, in 2011 when its key index fell to the “trigger line.” It is possible that without QE2 or even the despised QE3 that the ECRI would have been right again. That index has been rolling over for several months

[hs_form id=”4″]

0 Comments