Are you one of the many frustrated investors looking for real estate investment properties but finding very little from which to choose?

Are you one of the many frustrated investors looking for real estate investment properties but finding very little from which to choose?

You search far and wide and the cash flow just is not as strong as it used to be?

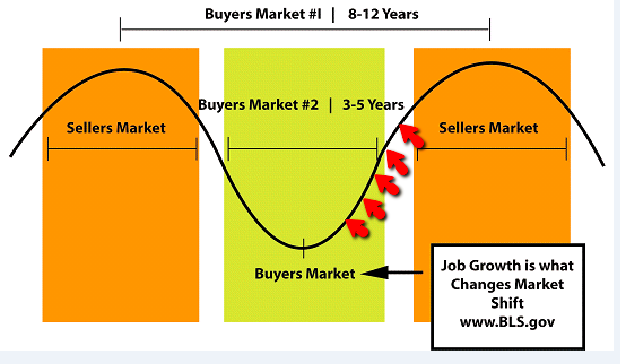

The cap rates are being reduced because of the rising prices. Frustration is a common occurrence as real estate investment markets change. I always suggest to my investors that to avoid these frustrations you want to do as seasoned investors do: Change with the tides.

For obvious reasons, cash flow investors were crawling out of the woodwork over the past five or six years. It was very easy to get spoiled with the low prices and high cash flow.

Now with increased prices, lower cash flow and reduced cap rates, it becomes important to adjust your real estate investment strategy. Cash flow is and always will be king, but there are a number of ways to invest as property investment market conditions change.

Now that the cream has been skimmed off the top as it relates to strong cash flow investing, what do you do? The game never changes, only the rules change, so as property investment market conditions adjust you want to adjust with them.

3 ways to capitalize on today’s real estate investment market conditions

No 1 – Investment in the best markets

There of course is no such thing as a national real estate market, but in general, today’s average real estate investment market is positioned within its growth phase.

Some markets such as Philadelphia or perhaps Birmingham are at the beginning of the phase, while other markets such as Dallas and Houston are well within the growth phase.

Growth phase markets typically mean a buy and hold strategy. Investing in best markets at the earlier stage of the growth (buy and hold) cycle will find you better prices and more sustainable ROI. We have many overseas investors who totally get this concept. They not only invest in best local markets, they find these best local markets in the U.S. a totally different situation with different attributes than those to which they are accustomed. They want markets that are poised and positioned for sustainable growth, with:

• Low unemployment

• Job growth

• Job diversification

• Population growth

• Undervalued markets

• Baby boomer appeal

• Local governments with 5-, 10- or even 20-year strategic growth plans

• Low taxes

• Low insurance

No. 2 – Invest for all of the 5 wealth building principles

All real estate investors like cash flow, but there are five income streams to consider: cash flow, tax savings, equity buildup, appreciation and, of course, leverage. Investors in cash flow markets tend to weigh very heavily on the cash flow as their primary calculations for investing.

The stronger the cash flow a property generates, typically the lower anticipated equity growth. The nicer properties tend to cost more, so the cash flow is reduced. The tradeoff, of course, is stronger back-end money (more equity buildup from appreciation).

As appreciation tends to be more speculative in nature, many people gloss over this and live by the premise that if it grows in value, great; but they do not want to factor this in. I always like to suggest that appreciation has created 90 percent of today’s millionaires. My take is to be extremely purposeful by diligently buying and investing in best markets as identified above. Then, purposefully looking at a long-term pro-forma based on not only cash flow but all the 5 wealth building principles to real estate.

Investing for cash flow is fairly straightforward and simple. When markets begin to shift, you want to be a very purposeful investor and put a lot of emphasis on a TRUE pro- forma.

No. 3 – Investment value plays

My personal favorite in real estate investing is equity growth, and the value play accelerates equity growth quicker than any other tool.

The Value play is essentially buying a property with a need, such as minor repairs, or perhaps a need for better or new management. Making these corrections can quickly accelerate the value.

Many people buy flips where they renovate and resell. In a buy and hold market, you may buy a property to renovate and hold. A value play may also be converting a property to highest and best use.

I see small old motels that are converted to office condos all the time. This is a quick increase in value. I personally have had great success in doing value plays where I convert to highest and best use. I turned duplexes into houses and multiplexes into condos. The quick equity growth, combined with a hold strategy until the market shifts to a sellers’ market, will generate awesome returns both in upfront cash flows and equity buildup.

I always suggest to investors who are frustrated with the shifting market that sometimes the best gifts come wrapped up in crappy wrapping paper.

The comparison, of course, is great cash flow markets have everyone investing. When markets shift, many stop investing or are simply incapable of finding the good deals.

This is when serious investors have less competition and are free to strut their stuff and make great investments.

Visit Larry’s site here.

[hs_form id=”4″]

0 Comments