Long-term mortgage rates have risen sharply, mortgages pressing 4.50% as the credit markets jumped on kitchen chairs at the sight of a Fed mouse. EEEK!!

Long-term mortgage rates have risen sharply, mortgages pressing 4.50% as the credit markets jumped on kitchen chairs at the sight of a Fed mouse. EEEK!!

The Fed met last week and made only this material change: reduced its forecast for 2015 GDP growth from 3.0-3.2% to 2.6-3.0%. It has of course been high-side mistaken in every forward forecast since 2008. It retained language that its rate would remain low for a “considerable period.”

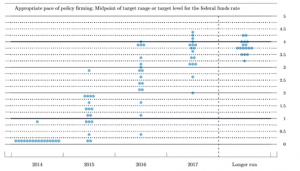

The mouse: the Fed also left unchanged its damned dots — the scattergram of Fed members’ guesses at the altitude of the Fed funds rate in the future. The dots have for more than a year forecast rate hikes in 2015; since they have stayed put, the threat has moved closer through the passage of time, not any creeping by the mouse.

The damned dots are anonymous. We know that at least three fruitcakes at regional Feds want the Fed to tighten hard and fast (Fisher, Plosser, George), joined by a few other regionals not crazy but very hawk-headed. Tossing out the high dots still leaves realistic Fed intentions of an overnight rate somewhere between .50% and 1.00% by the end of 2015. Two members of the Federal Open Market Committee (FOMC) think the funds rate will not change at all.

If the economy does not perform as expected, accelerating particularly in wages, and inflation at least at the top of the Fed’s target (2%), then this mouse in future scattergrams is going to begin to creep back out of the kitchen.

Core CPI in August was unchanged for the first time in four years, the year-over-year falling to 1.5%. In new data, the median household income did at last rise in 2013, for the first time in six years, by 0.3% to $51,939. Whee. That survey also found that for heads of household under 35 the median income was $35,509, 6% below the level of 1989. When today’s 35-year-old was 14. In this 35-and-under cohort, incomes were still falling in 2013, even among college grads.

Housing starts and permits and mortgage rates

Housing starts and permits had a bad August, off 5.6% and 14.4%, although due to volatile multifamilies. Lipstick will not cover the failure of all components of housing to perform as expected this year. The Fed’s flow of funds Z-1 this week found a new high in household net worth, but dependent on stocks and home equity is increasingly maldistributed. Z-1 also found no growth in mortgage lending.

And the Fed wants to tighten? As Henry Kissinger bellowed at a bad call by referees in a Washington *******s game, “Based on vot teory!?!” As I hunched last week, the Fed just wants to get above zero and see how much it has fluffed stocks. The Alibaba IPO went off today at $92, 35% above pre-market, $21 billion pouring from the NYSE into a venture in which China’s law determines shareholder rights, if any. Fluffy.

China is slowing so fast that the People’s Bank of China (PBOC) dumped 500 billion yuan ($91 billion) into banks last week. August industrial production fell .4%, new credit is off 40% (! per London Telegraph), and telltale electrical output is down 2.2% year-over-year. In the ominous signal appearing here in 2008 and in Europe in 2010, borrowers are backing away from new stimulus-generated offers of credit.

The Fed’s mouse was the catalyst for new drops in the value of yen (now less than 108/buck) and euro (below $1.29), each losing about 1% after the Fed meeting broke. China will soon have to devalue along with these two giant trading partners. The world devaluing versus the dollar is strongly defaltionary here. Gold in dollar terms has fallen $110 in two months, barely holding above $1200 and an open elevator shaft.

Part of the recent rate rise is due to relaxation of war fear. For the moment ISIS has degenerated into US offers to hold the coats of others, who decline to disrobe and put on gloves. France today bombed ISIS with both of the planes in its air force.

The Russian kleptocracy is seldom short of entertainment. Russia this week arrested billionaire Vladimir Evtushenko in an effort by Putinistas to steal his oil company. Not even big-money oligarchs can stop Czar Vladimir. A race is on: will Western cash prop up Ukraine until the Russian economy cracks?

Meantime, stick with Clinton’s Law to forecast the mouse.

The damned dots drive bond traders to homicidal rage. Each governor’s projection, not including the Chair, whose dot would trump them all. Click on the charts to enlarge.

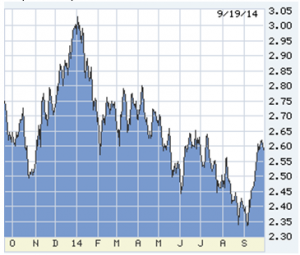

10-year T-note, last 12 months. Excellent proxy for mortgage rates: add 1.80% to get no-point 30-year.

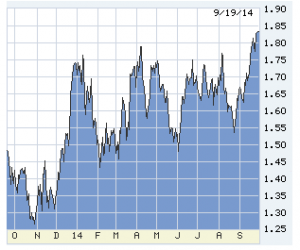

The 2-year T-note in the last 12 months. 2s are hyper-sensitive to the Fed, the best single future indicator.

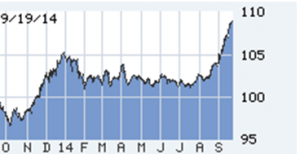

The 5-year T-note in the last year. Not Fed-nervous, not yet.

The euro in the last year. Look out below.

The yen in the last year — the euro is quoted in its dollar value, the yen as yen per dollar, thus up is weaker. Look out above.

Gold in dollars, last five years, falling despite big buys by China an India for primitive reasons. If short of capital, why put your money into the least-productive asset of all?

[hs_form id=”4″]

0 Comments