Until the recent development of online real estate financing marketplaces, it was difficult for smaller investors to participate in direct investments in commercial real estate projects. The development of these platforms also benefits institutional investors. How can marketplace investing and institutional investors work together?

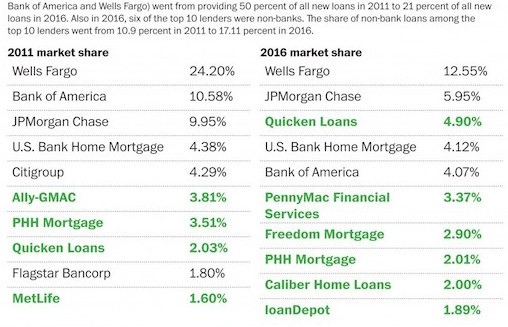

Real estate finance marketplaces have experienced significant recent growth, and there appears to be a lot of growth to come; the industry is still nascent. Other marketplace peer-to-peer lending companies continue to take an ever-larger market share from traditional banks. Indeed, the landscape of the lending market has shifted dramatically over the past few years, from domination by big banks to a market where more loans are made by non-banks — financial institutions that only make loans and do not offer deposit accounts such as a savings account or checking account.

Source: Washington Post

“For consumers, it doesn’t really matter whether you get your loan through a bank or a non-bank, although in some ways non-banks are a little more nimble and can offer more loan products,” says Paul Noring, a managing director of the financial-risk-management practice of Navigant Consulting in Washington. “The impact is bigger on the housing market overall, because without the non-banks we would be even further behind where we should be in terms of the number of transactions.”

How does this development of direct investment platforms affect institutional investors in commercial real estate? For one thing, many marketplace investment platforms like the one I work with have focused intently on value-add opportunities in commercial properties with property values typically of $50,000,000 or less — with the typical real estate valued at between $2,000,000 and $30,000,000. The real estate companies driving these projects seek to reposition a property to a higher and better use. The value-add opportunities at each property will vary, but generally can involve property upgrades or operational improvements that require only limited or moderate renovations, repositioning, re-tenanting or redevelopment at the property. These improvements are intended to increase net operating income at the property which should typically result in appreciation of the property.

Although the construction element in these opportunities presents an increased element of risk, these value-add and opportunistic investments often can offer better yields and more diversification than core, Class A properties. Institutional competition is already heavy with those more traditional opportunities, while value-add are not currently well-serviced by traditional institutions. If the deals are properly underwritten, however, marketplace platforms focusing on these opportunities companies can provide institutions with a prime source of deal flow relating to “non-core” real estate projects.

Strategic asset allocations to non-core markets or submarkets are often considered by institutions, but are sometimes rejected because additional expertise may be needed to properly understand those new market areas. Yet for those marketplace investment platforms that have themselves become savvy about the diligence, financial analytics, and other underwriting aspects of such investments, such institutional reluctance presents an opportunity – to be in a position to offer such institutions ready access to deals where the bulk of the screening has already been performed. Institutional investors are as interested as anyone else in higher-yielding opportunities, and marketplace platforms can be of great help in sourcing and underwriting this new market area for them and in making more efficient the deployment of capital on middle market transactions.

The new markets can be lucrative. Lending to investors rehabilitating single family homes, for example, can be more profitable than many other private lending opportunities. Most industry followers estimate that such “hard-money” loans account for about 1 percent of the residential mortgage market; assuming annual debt originations in the overall residential lending market of over $1 trillion, this leads to an annual residential fix-and-flip market size of approximately $10 billion. If these real estate loans are properly underwritten, this deal flow should be increasingly attractive to many institutions.

For marketplace platforms, these complementary relationships with institutional investors are increasingly driving much of the platform’s growth. While these platforms remain closely tied to the individual investors that drive the “peer-to-peer” portion of their business, having institutional investors available to them as well means that the platforms can remain focused on the deal origination and careful underwriting where they have particular expertise.

Additional real estate investment deal flow may be increasingly important to many institutions. Many pension funds, for example, have begun to divest themselves of other alternative investment asset classes. Such moves may well cause such funds to shift some of their assets toward additional real estate holdings.

Marketplace platforms are also keenly focused on becoming proficient at collecting data on their customers — and processing that data in a way that may give them an edge across a variety of areas of the commercial real estate investment business. A platform that makes good use of the credit data available to it on its borrowers, for example, might be able to modify its pricing algorithms accordingly. If done properly, this could conceivably lead to reduced loan losses and better overall returns for investors.

This points to another reason institutions may be interested in partnering with marketplace investment platforms — because of their potential to be a disruptive force in the industry. The movement of institutional investors toward marketplace investment platforms is already playing out in the consumer and small business credit space.

Can marketplace platforms do the same in the institutional real estate sector? As the larger platforms steer toward more and more high-level opportunities, institutional investors may well find that partnering with marketplace lenders becomes more of a competitive advantage. Institutional decision-makers might consider how partnering with these marketplace platforms may open up a path to new markets and products that are complementary to the institution’s existing areas of concentration.

About the Author

Lawrence Fassler, an attorney and real estate investor, is Corporate Counsel of RealtyShares, a leading real estate investment marketplace that places equity investments through North Capital Private Securities Corporation; a registered Securities broker-dealer, and member of FINRA/SIPC. RealtyShares as an institution does not advise on any legal issues, and this article is for general information only and does not represent professional legal advice. Contact the author at lawrence@realtyshares.com.

0 Comments