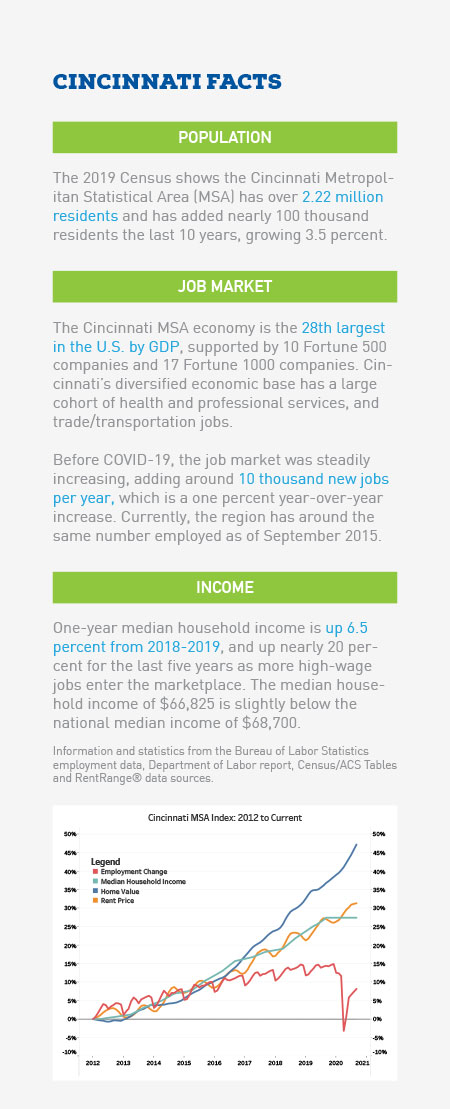

The Cincinnati, OH single-family investment market has been a great choice for many years. It has been a favorite target for investors since the last recession for several reasons, including solid equity and income appreciation supported by rising population, job growth, and wage increases.

HOME PRICE METRICS

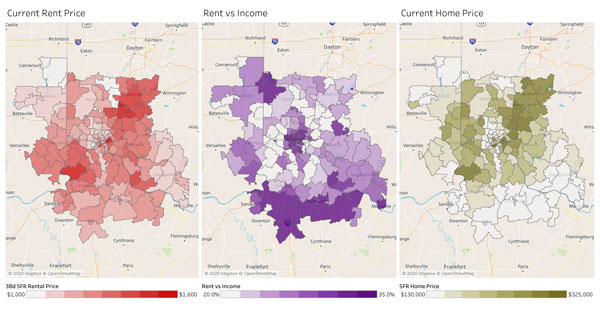

As of September 2020, the median single-family home value in the Cincinnati MSA was $228,000, a five-year increase of 35 percent and averaging seven percent year-over-year growth since 2015. Around the Cincinnati city proper, single-family homes have a median price near $150,000. Single-family rental (SFR) rates in this area are over $1,000 a month, leading to many high-yield opportunities for investors. The most expensive areas are to the northeast of the metro in Springdale and Mason with median prices between nearing $400,000.

Similar to many other markets in the U.S., low inventory, paired with increased buyer demand from historically low interest rates, led to surging home prices in summer 2020. Home values in the Cincinnati market have increased 16 percent year-over-year since last September. New listing inventory dipped 30 percent in April but has returned to normal levels by July through current, showing the demand impact from low-interest rates.

Cincinnati MSA Home Price Forecast through 2021

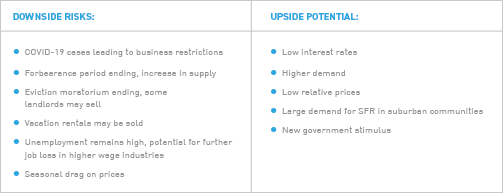

The historically low interest rates and comparatively low home prices will continue to motivate buyers to compete for available inventory through the winter. Prices will remain seasonally supported in the near term due to low interest rates, and increased buyer motivation towards single-family properties in more suburban areas.

2021 Cincinnati home prices should remain stable if COVID-19 outbreaks can be controlled, leading to a return in jobs. Real (non-stimulus) income will stay flat or decrease slightly as the economy ramps up. Mortgage interest rates are predicted to remain low through next year, and any dip in prices should encourage demand from both homebuyers and investors.

Demand will stay elevated in the suburban areas, while demand in the more populous areas may be muted. This will be a negative factor for the market if interest rates climb.

Other risks for 2021 include variability around expiring forbearance and eviction policies. Once the consumer protections expire, spikes in foreclosures and evictions will have a negative effect on prices.

Risks include tighter lending restrictions that are constraining otherwise qualified buyers, a slowing recovery for the job market, new-buyer attrition, and increasing defaults once the forbearance period ends.

2021 SFR Housing Price Forecast: -5 percent to 0 percent

Disclaimer: The variability around this forecast is wide and dependent upon data available as of September 2020. The severity and duration of the COVID-19 epidemic, as well as the response of the public and policymakers, continues to change daily.

RENTAL RATES

Real estate investors in the Cincinnati market have had very strong SFR price appreciation over the last five years with an increase in rent prices of nearly 20 percent. As of September 2020, the median three-bedroom, SFR home in the Cincinnati MSA is $1,315/mo; an increase of three percent from last year.

Anecdotal reports from many of the large institutional firms have reported excellent rent collection from their SFR portfolios through August. However, smaller landlords have begun reporting non payments on a quarter of their properties, partly due to limited plans they can offer tenants.

Cincinnati MSA rent prices have had a tight relationship with household income since 2012. This is very healthy and sustainable, leading to a moderate rent-to-income ratio of 25.2 percent for SFR properties. This is well below the national average of 32 percent. Central Cincinnati ranges between 30 percent and 40+ percent, as these areas have a larger segment of low-wage earners. Suburban areas show a very moderate rent-to-income of 20 to 30 percent.

WHERE DO RENTS GO FROM HERE?

WHERE DO RENTS GO FROM HERE?

Cincinnati Rental Rates Prediction 2021

In 2020 Rents have remained fairly level to this point, thanks in part to the federal stimulus. Rents typically decline into the winter, but the three main drivers for rental prices in 2021 are the CDC eviction moratorium expiring on the new year, unemployment rising, and the timing and conditions for a new federal stimulus package.

Risks stem from a significant number of lower-income jobs affected by the high unemployment, where a new stimulus package may be the only answer for some tenants to keep up with payments. Increased evictions will add to vacancies and lower overall demand. Depending how quickly the courts can process evictions, this could add a significant amount of vacant rental inventory in a short amount of time.

Mid- to high-priced rentals will see a drop in demand as some areas are less expensive to own than rent. Unemployment may remain elevated, reducing qualified tenants and putting further downside pressure on rents.

Demand will stay elevated for SFR rentals as families relocate from cramped multifamily structures.

Another challenge may be the number of “qualified” renters with no eviction or recent job loss will be significantly reduced. Landlords will likely have to lower their requirements to fill vacancies.

At the same time, renters in a good financial position are converting to buyers, further reducing rental demand.

Similar to the previous recessionary period, SFR rental rates may stagnate or drop lower until employment and wages recover. For the market to support higher rents, wages not only need to recover, but also increase above current levels, which could take several years.

2021 SFR Rent Price Forecast: -10 percent to -5 percent

CONCLUSIONS

Single-family homes are moderately priced verses other markets, while steadily increasing rental prices provide high yield and great cashflows. Even if there is a moderate pullback in the next one-two years, we don’t foresee price reductions as drastic as the last recession. Owners have a record amount of equity built up, and there is a myriad of government programs to work with borrowers to mitigate another foreclosure crisis.

Rent prices versus income are low, which will help limit the downside in rental rates. Investors currently looking at Cincinnati MSA would be wise to factor in a potential decrease in rental income for one-two years to make sure the numbers pencil on your next investment property due to a potential surge in evictions and ongoing unemployment challenges.

Bottom line, Cincinnati has stable fundamentals, low relative home prices, and historically good returns. However, there are some short-term risks building between the forbearance term and eviction moratoriums expiring around the new year. Cautious investors may want to see how the market reacts after the new year, as there could be better deals next spring from distressed sales.

Fred Heigold III is the senior data analyst at Altisource® / RentRange®, an industry leader in market data and analytics for the single-family rental housing industry.

0 Comments