On the first Friday every month: payroll roulette. No data is more important to the Fed and interest rates because jobs and incomes are so central to inflation prospects. But no report is so wildly, comically inaccurate.

Today’s factoid: a January payroll gain only about half the up-side guesses, 113,000. The miserable December figure, 74,000 jobs, which most expected would be revised up, was indeed revised up. By 1,000.

Everyone wonders at the impact of weather, and the dead of winter is not known for big economic movement in any direction. The agencies collecting and reporting data do their best to adjust for seasons, but how do we adjust for possibly anomalous seasons, in the thinnest activity of each year?

One painful stat has been the number of Americans working “involuntary part-time,” those who would take a full-time job if they could find one. In December 7.8 million people — inclusive of them, overall “U-6” unemployment 13%. Today’s report, straight-faced: 514,000 of those people found full-time jobs in January. Do I believe that? We also supposedly added 48,000 net construction jobs in January. This January?

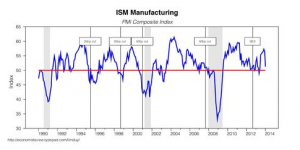

Pros look to multi-month trends, and crossfoot to other data. The twin ISM reports were iffy but not bad, granted some Kentucky windage for weather: manufacturing in January slid to 51.3 from 56.5, and the service sector crept up to 53.9 from 53.0. Hourly wages continued to poop along at a 1.9% annual pace… after inflation, flat.

There is obviously no acceleration in these numbers, and maybe not even the mythic “self-sustaining recovery.” But there is no recession risk in them at all. The Fed will continue to taper quantitative easing(QE), evidence growing that it detected a QE leak which bubbled stocks, and the World Bank said this week also bubbled emerging-nation economies — and QE in its last stage did little for the U.S.

Until and unless the US economy falters, or something big goes sour overseas, long-term rates have gone about as far down as they can. As smart Larry Fink (Blackrock) says, the stock market sell-off is thus far just an ordinary correction.

The US economy is not likely to falter, but overseas lies an unusually large group of vulnerabilities with one common thread: poor government. It is of course risky to try to analyze politics in places I’ve never lived, and in an unprecedented economic situation. However, the individual-nation misbehavior is a stark pattern.

Way too many places that know better will not or cannot act accordingly. Bill Gross of Pimco with as much information as anyone acknowledged China’s opacity. Yet, we all know that its excessive internal investment exports both deflation and unemployment, and that it must remake its political economy at the sacrifice of the Party and state-owned interests. Every road available leads to a slower economy there, which means pick-your-poison out here: status quo pain, or slowdown pain.

Europe is under the control of Germany. Things are good in Germany, which leads its people to think, not without reason, if the rest would behave like Germans all would be well. Overnight the German Constitutional Court after three years of grumbling acknowledged that bond-buying by the European Central Bank (ECB) is illegal under German law, but said it can’t do anything about it. Does that open the door for QE by the ECB, probably a damned good idea four years overdue? Nobody knows. If the ECB does embark on QE, expect interest rates and stocks here to rocket, no matter what the US economy does.

Germany, France, and the U.S.

are in a weird race for the gold medal of inert government. Germany leads, Angela Merkel invisible, re-election to her like adopting a pet of some kind which she can leave outdoors. France is set up for a strong president and has its weakest-ever, but has a very able class of civil servants moderating the damage. The U.S. government was designed not ever to do anything, all checks and balances, and so we are accustomed to moving along decapitated, better than any.

How all of this mismanagement interacts is beyond analysis, but we must look overseas as never before. Just watch the ballet and hope the ballerina doesn’t get tossed into the fourth row.

——————————————–

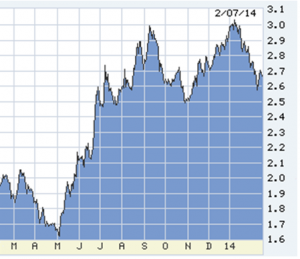

In times of uncertain economics, rely on “technicals.” Every bond trader on the planet is staring at that 2.50% notch last Halloween, between two 3.00% tops. Breach either and all hell breaks loose. Click on charts to enlarge.

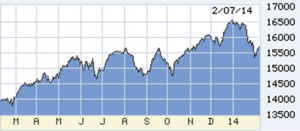

Very, very strong technical support at Dow 15,000.

ISM manufacturing has been a good real-time GDP indicator all the way back to the 1970s (this chart only to 1990). Maybe the January drop was a fluke, but no acceleration evident anyway.

GDP looks just like ISM:

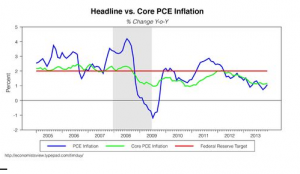

Every serious person is worried about a deflation shock coming out of China, Europe, or the emergings. If the ECB begins significant QE, then that worry will abate, rates and stocks rising accordingly. The deflation risk could not be more clear:

0 Comments