By Louis S. Barnes

As with all New Year look-aheads in this space, begin with Peter Drucker: “Nobody

can predict the future. Stick with a firm grasp of the present.” Thus a focus on where we are, and things to watch, not wild swings at the blue sky.

Then note that we focus on real estate, investors and owner-occupants, mortgages and credit. The stock market does affect the economy and interest rates from time to time, but its wanderings defy grasp, firm or otherwise.

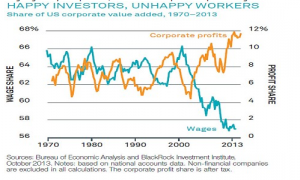

Changing my mind is a painful process. An original hypothesis may have grown obsolete, but a new one can double the chance of error. Nevertheless, the US economy is on a better footing and facing lighter headwinds than any time since 2007, and maybe since 1998. On the turn of the century we labored in the goo of a blown stock bubble, and then splattered credit and housing bubbles all over our faces. The bulk of those messes is past. The most durable and stiff breeze against us, still: since circa 1990 global competition has capped US wages.

The table set, here follows the watch list (the e-version has twelve charts):

Incomes. Above all else, watch incomes, especially wages in the bottom two-thirds of the work force. Stagnant income has been the primary force frustrating the Fed’s stimulus, and tripped every Fed forecast since the show stopped in 2008.

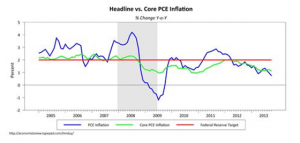

Inflation. Until incomes grow, a ramping of inflation is impossible. That was your dad’s — or granddad’s — problem.

The Fed. So long as incomes and inflation behave, the Fed can and will continue extreme stimulus. It has to pull back from QE and will, even if the economy slows.

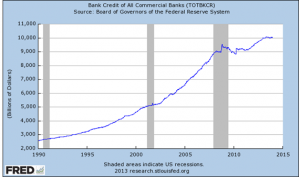

Credit. Next to incomes the most important thing to watch. We cannot accelerate, or even get off Fed life support without it. My very smart friend, Paul Kasriel, has detected an acceleration in bank credit, one strong enough to offset the gradual end of QE. I can’t find it. I will look, early and often.

Regulation. Ow and ouch. Most folks have noticed the difficulty the administration has had with ObamaCare. These are the same officials who have presided over implementation of Dodd-Frank. The nation has felt the chaos of ObamaCare for two months. The same people have been rearranging the financial world for four years. It’s amazing that we make any loans at all. At banks the combined effects of new capital requirements and the Volcker Rule are incalculable, but none lead to more credit.

Mortgages. Under the heading, Everybody Gets Lucky, the White House has at last succeeded in replacing the Fannie-Freddie regulator. The White House’s intentions (trying fitfully for three years): find somebody who would make life easier on underwater households, specifically by forgiving loan balances, a very bad idea. Now they’ve got their guy, Mel Watt, but the foreclosure tide has receded to scattered puddles. However, he may be just the man to lift the dead hand choking mortgage credit. At the top of the we’ll-see list.

Housing. Will not lead a cyclical recovery. Not. See “incomes,” above. Also far too many households damaged by the Great Recession. Good jobs replaced by poor ones, savings exhausted, credit damaged. Hey, Mel Watt! Want to do something useful for foreclosed families and the nation? Shorten the punitive lock-out intervals for new mortgages. Housing will over time repair itself the old-fashioned way: as rents rise, a new generation will grasp the big benefit of home-ownership: the monthly payment stays put, and the mortgage balance falls over time for the persistent and disciplined.

Wild Cards. The whole friggin’ outside world! Which is today a lot bigger relative to us than it used to be. One major nation is in genuine recovery, the UK. Europe is a wreck with no structural political progress at all, financial and social stresses rising. Japan’s risks are internal, but we’d all get wet in the tsunami following implosion. China is an all-time black box. Makes us look well-governed. Perverse benefits: trouble over there might help here, just as the UK looks safer for business than the Continent.

Rates. Oh, that. Mortgages will rise into the fives on the slope of GDP. Or not. 🙂

The most immediate thing to watch: the 10-year T-note, which drives mortgages. If it moves up too fast it can abort housing, and put the Fed’s plans in trouble. (click on the charts to make them larger)

The stock market. A lot of talk about bubble or not, the probability of mean-reversion in earnings, and the disconnect between earnings and US wages. This Morningstar chart describes one good answer to all three issues: US stock prices are very much in line with global GDP, and most big-company profits are earned overseas.

If profits are earned overseas, we should not expect them to turn up in US wages. The US wage adjustment began in 1990, was masked by the stock bubble, and then picked up speed during the Great Recession. Hunch: most of the adjustment is complete, US wages globally competitive, but downward pressure prevents growth.

The Q ratio — “Tobin’s Q” — measures the replacement cost of businesses, and the chart below compares to stock prices. Something clearly changed circa 1990. I think two things: globalization altered the notion of Q (many business franchises are now worth more than they cost), and the intellectual property aspect of replacement cost changed the game. How to quantify the cost of the benefit of Steve Jobs’ brain to Apple’s stock price?

This PIMCO chart is cautionary. Earnings per share and net income are both faltering in growth. No wonder a lot of investment cash has migrated to real estate.

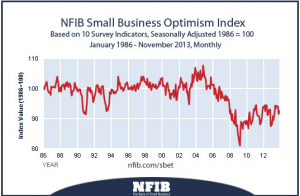

Big companies define the S&P500. Conditions are completely different in small businesses, still at recession levels, no acceleration at all.

Inflation is not the problem. If anything it is too low and falling mysteriously everywhere except Japan (for the moment). Global wage competition is still in play, a powerful deflationary force.

Total US bank loans and leases. See acceleration? Me neither.

“Total bank credit” includes another $3 trillion in stuff beyond loans and leases. The whole shebang. See the acceleration? Thought not.

Media give play to increasing bank loans, but the category is only 15% of a stagnant banking system.

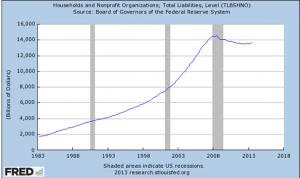

Total liabilities of households have declined slightly, “deleveraging.” But, if the Fed steps out of QE, and either banks won’t make loans or can’t, and households won’t borrow or can’t, where is the juice?

This is the tough one. After inflation, median household income. Until it moves up, everything is on hold and/or at risk.

0 Comments