More than half of real estate investors in first quarter 2022 described their local housing market as “overvalued with a correction possible,” but nearly nine out of 10 expect their property acquisitions to increase or remain the same this year, according to an Auction.com buyer survey conducted in March 2022.

Another question in the same survey helps shed some light on these seemingly incongruous responses.

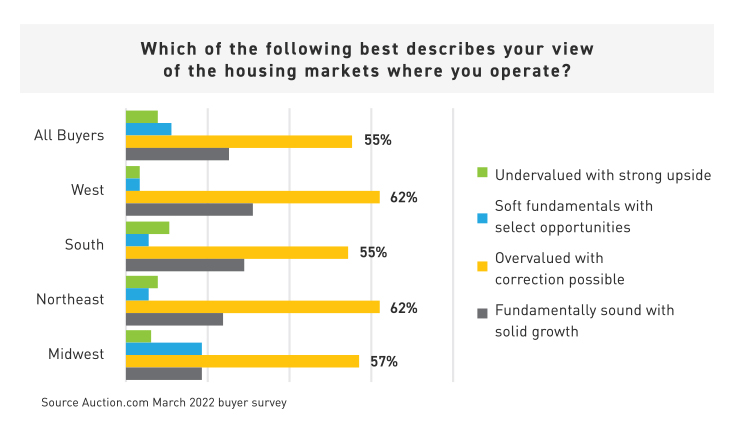

Which of the following best describes your view of the housing markets where you operate?

Although most investors think a price correction is possible at some point in the future, most don’t think that correction will happen in 2022: 17% said they expect flat or declining home price appreciation this year. That is up from 12% a year ago, but it still indicates more than eight in 10 buyers expect home prices will continue to increase in 2022.

Strong Demand for Distress

Buyers like Virginia-based Rick Starnes, who is trying to lock in three more houses to add to the five he’s purchased on Auction.com since 2018, aren’t just talking the talk when it comes to aggressive acquisitions. They are walking the walk as evidenced by key demand and sales metrics from the Auction.com platform.

Sixty-one percent of all properties brought to foreclosure auction on the Auction.com platform in the first quarter of 2022 were sold to third-party buyers, up from 56% in the previous quarter and up from 59% a year ago. The first quarter third-party sales rate was not far below the pandemic high of 63% in the second quarter of 2021.

A barometer of demand from real estate investors purchasing at the foreclosure auction, the third-party sales rate skyrocketed in the second half of 2020 following the pandemic-triggered foreclosure moratorium on government-backed mortgages. The rate continued to hover near 60% even after the moratorium expired in July 2021 and even as a foreclosure-preventing rule from the Consumer Financial Protection Bureau expired at the end of 2021.

In the five years before the pandemic (2015-2019), the third-party foreclosure sales rate averaged 39%. The near-60 percent rate over the last two years represents a paradigm shift in that rate.

Investors aren’t just buying a higher percentage of properties available at foreclosure auction; they’re willing to pay higher prices. The average sales price for properties sold via foreclosure auction on the Auction.com platform in the first quarter of 2022 was $193,597, up 4% from a previous quarter and up 41% from a year ago to a record high as far back as national data is available (Q1 2015).

Even more telling is the average sales price relative to the seller’s estimated as-is market value of homes being sold at foreclosure auction. That metric was at 89% in the first quarter of 2022, meaning that buyers paid 11% below the estimated as-is value on average. The 89% in first quarter 2022 was down slightly from 91% in first quarter 2021, but it still represented a substantial increase from the pre-pandemic market. In the five years before the pandemic (2015-2019), the sales price at foreclosure auction was 78% of the estimated as-is value on average, meaning buyers were paying 22% below that as-is value.

These paradigm-shifting distressed demand metrics continued in the first quarter of 2022, despite the sharp rise in mortgage rates near the end of the quarter. Historically, rising mortgage rates have dampened demand for distress because those rising mortgage rates foreshadow dampened demand in the retail market. Many foreclosure auction buyers renovate and resell to owner-occupant buyers and other buyers who rely on financing.

Three Drivers

The continued strong demand from real estate investors, even in the face of the rising mortgage rate headwind, is likely for three reasons:

- Scarcity of housing supply across all market segments, but especially in the more affordable market segments that most foreclosure auction buyers are reselling into

- A value-add investing strategy not highly reliant on rapid home price appreciation

- A red-hot rental market that provides investors with an alternative (but still profitable) exit strategy should a home price correction occur

Fewer than 1 million existing homes nationwide have been for sale in each of the four months ending in March 2022, according to the National Association of Realtors (NAR). In each month, that represented a supply of two months or less, well below the six-month supply considered a balanced market between supply and demand.

Given that most foreclosure auction buyers are reselling into the retail market—61% of Auction.com survey respondents said their primary investing strategy was renovating and reselling to owner-occupants—the scarcity of supply in that retail market works in their favor.

“We are still undersupplied,” said Atlanta-area buyer Tony Tritt, who has been buying and renovating distressed properties for about 25 years.

Like the majority of Auction.com buyers, Tritt is expecting a possible slowdown in his market, but he believes the undercurrent of undersupply will help cushion the market from a full-fledged home price crash like he witnessed in the aftermath of the 2008 recession.

“I hope that doesn’t happen, but … it’s a cyclical industry. We might see some pain again. A slowdown in price appreciation does not make a crash,” he said. “When I acquire a property, I look out six months from now. That six-month cycle causes me a little more anxiety in 2022 than it did in 2019.”

The housing market’s undercurrent of undersupply is especially favorable for local community developers like Tritt who are reselling their renovated properties at relatively affordable price points.

The average resale price of a renovated foreclosure in 2020 and 2021 was $261,543, 32% below the average sales price of $381,850 for all existing home sales during that same period. According to NAR data, March 2022 home sales were down 28% from a year ago in the $100,000-to-$250,000 price range and down 21% in the under-$100,000 price range. By contrast, home sales increased on a year-over-year basis for all price ranges above $500,000.

Second, the value-add investing strategy employed by local community developers like Tritt is not highly reliant on rapid home price appreciation. These investors buy distressed properties below after-repair value and resell at or above that after-repair value thanks to high-quality renovations that improve the intrinsic value of the property, even in the absence of market appreciation.

“You make your money in real estate when you buy a house, not when you sell it. If you buy right, then you’re going to renovate right,” said Tritt. “The market is going to tell us what the sales price is. We don’t get to choose that.”

Last, a strong rental market provides a cushion for local community developer buyers should a home price correction occur. Average rents increased 13% from a year ago in Feb. 2022, according to the latest CoreLogic Single Family Rent Index. February marked the 11th consecutive month of record-setting gains.

Starnes and Tritt both noted that a home price correction would also represent a more favorable property acquisition environment for buyers who have set aside some dry powder for such a scenario.

“If that happens again, I’ve got some money set aside. I’ll go out and buy four or five of them,” Starnes said.

Daren Blomquist is vice president of market economics at Auction.com. In this role, Blomquist analyzes and forecasts complex macro and microeconomic data trends within the marketplace and industry to provide value to both buyers and sellers using the Auction.com platform.

0 Comments