While I was uncovering the different real estate investing market cycles, what became clear was the difference between what real estate agents and the media talk about, and what seasoned investors talk about, when it comes to market cycles.

While I was uncovering the different real estate investing market cycles, what became clear was the difference between what real estate agents and the media talk about, and what seasoned investors talk about, when it comes to market cycles.

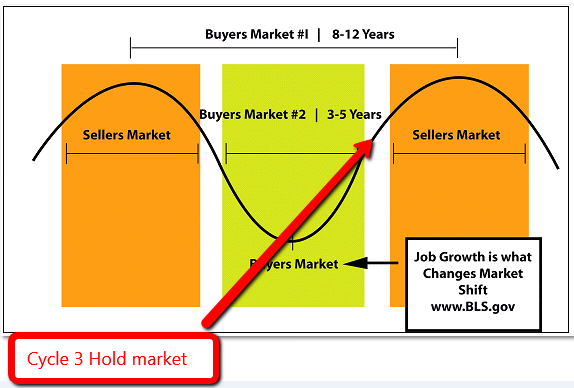

For the media and real estate agents, there is a buyers’ market and a sellers’ market.

What separates the purposeful investor from the average buyer or average investor is the knowledge of the different market cycles. Buying low and selling high requires you to understand the indicators that prepare a market to shift. Understanding the changing tides allows us to position ourselves in front of the tide so that we are not being drowned in the tide.

Markets do not overnight, swing from a seller’s market to a buyer’s market and indeed there is a transitioning period. This transitioning period happens quicker in some markets than others, but this transition can take several weeks and months to unfold.

My biggest discovery was that people make or lose money in stocks by watching the indicators that suggest a change in direction. I thought, WOW, stocks can change by the day or hour or even the minute. As real estate investors, we have weeks and months to monitor and observe these changes taking place. However, many real estate investors have not taken advantage of this simply because, like myself, they have not been exposed to it until now

The most exciting and safest market was the wealth market. When we as investors acquire property early on and can fully ride the entire wave of the wealth market we can amass great wealth. As mentioned before roughly 90% of Americans wealth has been acquired in this opportunistic wealth market. As markets continue to advance forward, sooner or later, they will transition into the next cycle, the hold market.

The hold market which may be perceived as a transition market

Because of the nice price increases that investors have realized, some who bought early on in the buyer’s market will quickly discover a nice equity position in their property. Many people like to sell now. Nothing wrong with doing so, necessarily. It tends to be more of a risk tolerance factor and everyone is different in this regard. In real estate investing it is about getting in early, buying low, riding the wave of appreciation, and then selling high.

In the hold cycle, we are now at a point where prices and demand for real estate is still very strong and therefore price increases are at the optimum.

Because of these rising prices, there are still opportunities for great investments. You will want to watch this cycle closely. Making great equity returns is all about strategically holding property during the hold cycle. Ride the wave of equity growth and hold until the seller’s market emerges.

The hold market

Distinctions of the hold market

- Housing inventory is being consumed

- Speculators are buying fast and buying often

- Unemployment is low and still shrinking

- Property prices are rising

- Rental prices are rising

- Demand for housing has reached its highest level

- Market time for property is short

Strategy for buying in this cycle

- Buying early in this cycle still makes good sense as prices are still rising, however your hold time will be reduced

- You will want to buy and hold property until the seller’s market.

- This is a great time to buy property for a value play, perhaps a dated property that can be renovated, rented for maximum cash flow and hold till seller’s market.

This is the market where the buzz is being generated; everyone is making money in real estate primarily because they bought early in the wealth market and are realizing the returns now. As most people follow the thundering herd everyone wants to buy now. This huge influx of buyers is what will make the tea kettle steam and ultimately boil over into thet seller’s market.

The transition to the sellers’ market

Identifying the indicators of a sellers’ market is by far the most important skill an investor can acquire. During any of the first three market cycles if you followed the cycle it still presented opportunity. Prices rise but returns were still strong, you simply need to adjust your buying strategy to capitalize on the best and most efficient strategy at the time.

All that prosperity that has been generated during the first three cycles provided a warm and fuzzy feeling causing everyone to want to get in and invest. The belief at this time is you cannot lose, causing the thundering herd to drive up prices while competing for a purchase. Eventually the market cannot sustain these increases and the wave subsides. Being able to recognize this before it actually happens is what separates the successful skill- based investor from the emotional-based investor. This cycle has a much different effect on the outcome of your investment as the values are subject to leveling off or even declining.

The sellers’ market

Distinction of the Seller’s Market

Demand is still strong, which is why everyone is still buying, meanwhile inventory levels are rising which are signs of a market shift, only the eager buyers have not yet noticed this change.

- Inventory levels are on the rise

- Speculators are still heavily buying

- Market times are actually starting to increase but sellers are still getting their price

- Desire for new construction is rising

- The new construction inventory is building up with a likelihood of over building

- Business and job creation is slowing down.

Strategy for buying: SELL

The strategy here is to sell in this market before the waves recedes. This is the time to sell, or do a 1031 exchange, and get your investments out of this overheated market and reposition for the next emerging market

Indeed, this can be a difficult transition to identify. Riding the economic wave of prosperity to squeeze out all the benefits you can get is, of course, natural. So if you are not certain when the exact time is to sell and reposition into the next emerging market, I will share this quote with you: “Pigs get fat, hogs gets slaughtered.”

Of course it is a metaphor. You want to get as much as you can from your investment. But if you try and get too greedy, you may wind up holding a property too long and miss the opportunity to sell for top dollar. Thousands of well-intended investors experienced this first hand who bought during the 2006 and 2007 sellers’ market

Remember your exit strategy: for many investors the exit strategy is to sell the property for the most amount of money to a retail buyer. To do this, you must carefully watch and sell when the market suggests you have reached a peak.

Buy low and sell high

What we investors are doing now, as the market recovery is taking place throughout the country, is we are being purposeful. We are monitoring these market cycles and we are buying at the buyer’s market and the wealth market. We are watching these markets cycle through the phases. As the markets suggest we sell we will sell for top dollar and reposition our assets. We intend to do 1031 exchanges on our properties and we will reposition into the next emerging market.

We have identified that the buy and hold strategy never said you have to buy one property and hold it forever.

We learned you want to buy property and hold property with these steps:

- Buy property at the bottom of an emerging market

- Sell it at the top of the seller’s market

- Reposition to the next emerging market

- This is the best buy and hold strategy and definitely a buy low sell high win

0 Comments