Dallas and Denver home prices reached new highs in the latest data through March, released by by S&P Dow Jones Indices for its S&P/Case-Shiller[1] Home Price Indices, according to a release from PRNewswire.

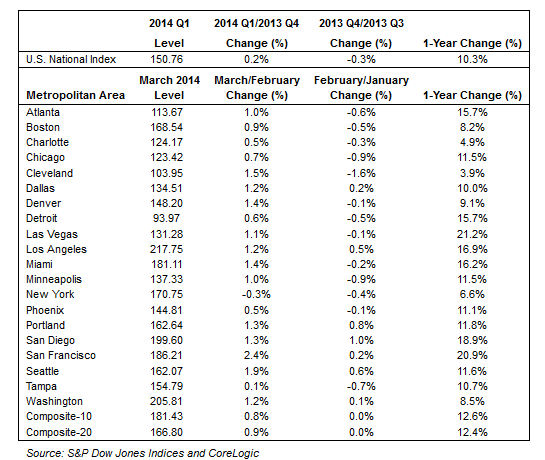

The report shows the 10-City and 20-City Composite Indices gained 0.8% and 0.9% month-over-month. In the first quarter of 2014, the National Index gained 0.2%. Nineteen of the 20 cities showed positive returns in March – New York was the only city to decline. Dallas and Denver reached new index peaks.

In March, the National and Composite Indices saw their annual rates of gain slow significantly. Chicago showed its highest year-over-year return of 11.5% since December 1988. Las Vegas and San Francisco, the

cities with the highest returns, saw their rates of gain slow to approximately 21%; their post-crisis peak returns were 29.2% and 25.7%. At the lower end was Cleveland with a gain of 3.9% in the 12 months ending March 2014.

The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 10.3% gain in the first quarter of 2014 over the first quarter of 2013. The 10- and 20-City Composites posted year-over-year increases of 12.6% and 12.4% in March 2014.

“The year-over-year changes suggest that prices are rising more slowly,” David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices, said in the release. “Annual price increases for the two Composites have slowed in the last four months and 13 cities saw annual price changes moderate in March. The National Index also showed decelerating gains in the last quarter. Among those markets seeing substantial slowdowns in price gains were some of the leading boom-bust markets including Las Vegas, Los Angeles, Phoenix, San Francisco and Tampa.

“Housing indicators remain mixed. April housing starts recovered the drop in March but virtually all the gain was in apartment construction, not single family homes. New home sales also rebounded from recent weakness but remain soft. Mortgage rates are near a seven month low but recent comments from the Fed point to bank lending standards as a problem. Other comments include arguments that student loan debt is preventing many potential first time buyers from entering the housing market.”

The table below summarizes the results for March 2014. The S&P/Case-Shiller Home Price Indices are revised for the 24 prior months, based on the receipt of additional source data.

These indices are generated and published under agreements between S&P Dow Jones Indices and CoreLogic.

[hs_form id=”4″]

0 Comments