Greg Rand is founder and CEO of OwnAmerica, a real estate technology and services company that provides rental property owners a detailed analysis of their portfolio and enables them to buy and sell properties with other owners. Prior to becoming an entrepreneur, Rand was managing partner at Better Homes and Gardens Rand Realty, growing revenues more than sevenfold in seven years. He is the author of “Crash Boom! Make a Fortune in Today’s Volatile Real Estate Market,” a primer on real estate investing after the Great Recession. In this One-to-One interview with Think Realty contributing writer Robert Springer, Rand talks about the continuing, transformative impact of technology on real estate investing.

Have the benefits of the real estate technology revolution trickled down to single-family rental investors?

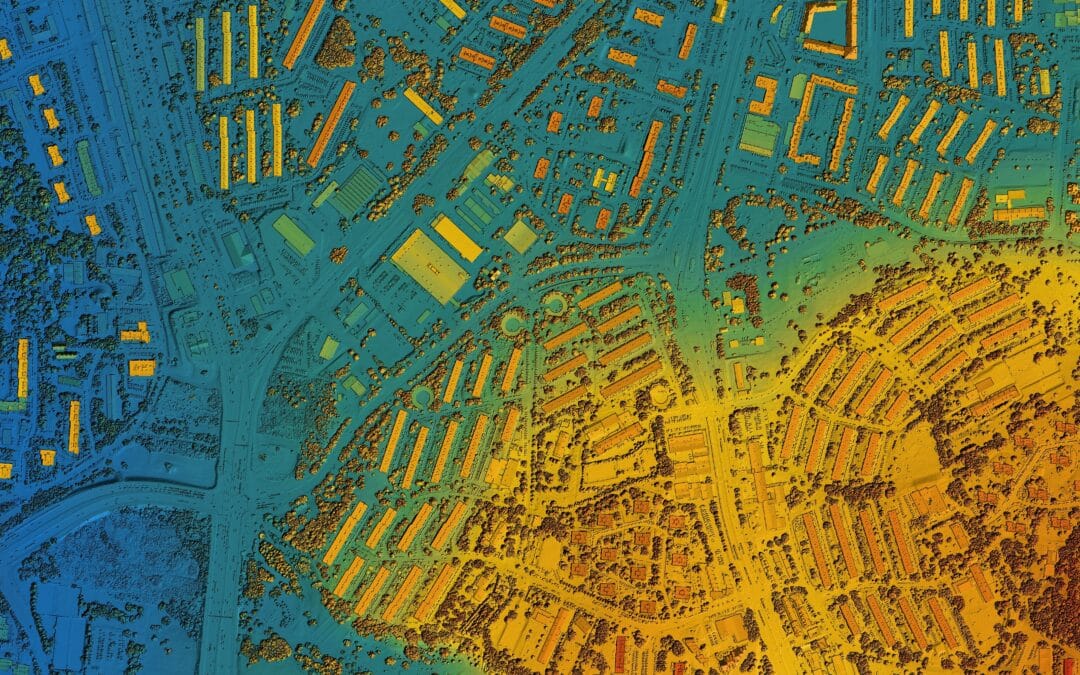

Greg Rand: These are people that have been neglected by the residential real estate business and the commercial real estate business for decades. We’re giving investors expensive data and expensive technology to allow them to see and absorb their property portfolio in a way they never have before. Graphs on yields, price appreciation—all the calculators are there. They can make projections based upon their assumptions, and view long-term appreciation trends, employment stats, migration, population charts and things like that.

We have investment management technology for owners of rental property portfolios. Our target audience is the guy, gal or company that owns five, 50 or 5,000 rental homes. The investment management technology allows them to upload their spreadsheet, which they all have, and get an instant valuation and visualization of the portfolio.

Why hasn’t anyone used real estate technology in this way previously?

Greg Rand: The real estate portal of property for sale has been around forever; it’s just that nobody’s bothered to apply it to the single-family market until recently. We’re one of a few companies that are doing this, and it’s amazing that Zillow, Trulia and Realtor.com didn’t. It’s also amazing that thousands of broker websites and hundreds of thousands of agents’ websites didn’t do it. It’s really a neglected customer category.

One of the ways to look at the breakthrough that’s happening in the industry right now is that the single-family rental with tenants in place has never really been a product except for the people in your readership, who have been, many of them, turnkey providers that have been buying and renovating, and renting out, and then selling turnkey investments. That turnkey, occupied, performing rental has not been mass-marketed before.

You can see ads on Zillow, but you can’t see rental houses on Zillow. That’s the new thing. Being able to buy rental property that’s already performing … it changes the whole game. All you’ve got to do is look at the biggest investors in the country, the institutional ones. All they want to buy is portfolios of rentals now. They don’t want to buy vacant houses anymore.

Can investors buy and sell properties on OwnAmerica?

Greg Rand: Once you put your portfolio there, you can then decide if you want to sell it. When owners of single-family rentals upload their information, they have the ability just to hold it and not do anything with it, just use it, look at it every month as it updates and keep track of the value. But they’re literally a click away from another owner who may be buying if they want to sell. We’re providing a matchmaking service between different single-family rental owners, some that want to buy, some that want to sell, creating a private marketplace where we introduce two parties that have similar interests. We’re able to effect very discreet transactions that don’t disturb the tenants, yet give pretty widespread transparency to the buyers, and to our sellers as they get matched up.

From an investors’ perspective, what creates the most wealth in the single-family rental market?

Greg Rand: Well, we’re very big into accumulation and having a long-term perspective, and so I don’t subscribe to the idea that you have to get a great deal on a property, if you define a great deal as getting a cheap deal. I see a lot of people selling what they thought were their best deals because they bought crappy property for what they thought was a great deal and now they can’t wait to get rid of it. The way to accumulate wealth is by accumulating quality property that is going to have endless upward pressure on value and endless upward pressure on rents. To do this, track the population, track the jobs, figure out who’s moving where and why. Then accumulate in those areas, and don’t worry about getting a steal, worry about getting very high-quality rental property.

Okay, so you don’t value cash flow over appreciation?

Greg Rand: It’s a combination of both. Obviously, you should have both, so one of the things that we’ve learned over these last several years of looking at data and analyzing properties all over the country for all kinds of investors is that there’s a certain equilibrium in the housing market. If you go to Sun Belt cities like Charlotte, Dallas, Nashville and Orlando, you’ll see that they have a lower cost of living, a high quality of life and good job growth, and they’re pulling people out of California, Chicago and New York and Boston. If you buy a house in good condition in a good school district and rent it out for market rent, you’re going to get a 5.5 percent yield. You’re going to get 2 to 3.5 percent annual appreciation, so you wind up with something in the mid-eights if you add the two together.

If you go to Cincinnati, Cleveland or Birmingham, Alabama, you’ve got 8 percent yields because the prices are lower and the rents keep up pretty well. But you don’t get much in the way of appreciation—you get a point, point-and-a-half in appreciation, so you’re still hovering around a nine. You go to D.C., or Los Angeles, you’re going to get a 3.5 percent yield, but you’re going to get a 4.5 percent appreciation rate. Investors may be more comfortable in certain parts of the country, just because of where you live and where you grew up.

A dependable, predictable investment that generates a 9 percent return is amazing.

If you had one single piece of advice to give to an SFR investor today, what would it be?

Greg Rand: That’s a good question. I would say double down on your efforts. We’re at the early stages of a renaissance in this asset class, so whatever your plan was as an investor, try to find a better lender. If you need more money, try to find partners. If you need more money, double your plan, and then plan on redoubling it again in a few years because you’re at the cusp of something huge.

If you’re an experienced investor, then you should be benefiting from the fact that finally the industry has come of age—so if you know what you’re doing, you should do a heck of a lot more of it. If you’re new to it, then you chose a heck of a time to get in, because it’s a great time to be alive in the real estate investment business in the United States.

Looking to the future, what’s next for Greg Rand and Own America?

Greg Rand: We’re going to see if we can’t get a million units enrolled on this platform [there are 11,000 now], so that a healthy portion of the owners in the U.S. are here, tracking the value, making smarter decisions and transacting. Our goal is to be the leader of technology and services to experienced rental property owners. We aim to build a big company.

0 Comments