Online marketplaces like RealtyShares can allow investors to take advantage of investment opportunities across the spectrum of commercial property types. One of the primary market sectors is that of office buildings, which can range from large multi-tenant structures in city business districts to single-tenant buildings that might be built to suit a specific lessee. What seems to be in store for office buildings in 2017?

Office Buildings are Different

Office space is driven by somewhat different factors than for other real property. Rents and valuations are primarily influenced by specific types of employment — those that utilize service and professional employees such as attorneys, accountants, engineers, insurance personnel, real estate brokers. And related service providers, like title and escrow providers, people working in banking, financial services, technology, consulting, medical, dental, and pharmaceutical fields. A region’s industry focus is thus key.

Even though tenants often have solid finances and can sometimes afford to own their offices, like retailers, these tenants look at their space as just another input in the production of their services sold from that location. The office is just a factor affecting operating expenses and revenues, and is viewed more in the context of how the location might maximize profit — does the building really contribute to the company’s business, by, for example, allowing it to better advertise? Even if a business can occupy an entire building, it might still choose to lease in order to increase its operating flexibility; a corporate move otherwise becomes a difficult undertaking. Thus, the vast majority of office buildings are leased and not owned.

Office space rents vary by locations within office properties, and owners may charge premium rents for higher floors, building corners, and spaces contiguous with elevator banks. Tenants often demand special features in the leases, including rights of first refusal to rent contiguous space, signage rights, or even building purchase options. Office properties often have longer-term leases that can lag current market lease rates, so that “step-ups,” or conceivably, step-downs, of rental rates are not infrequent when leases expire.

Despite the longer lease periods, office buildings have their own set of risks. Economic downturns can affect commercial real estate — including office buildings — more than residential buildings, and businesses can go bankrupt even while people continue to need housing. After the early 2000s dot-com crash, for example, Silicon Valley rents dropped in some properties by more than 30 percent. For this reason, the credit quality of tenants is key; re-leases of office space can often require significant lead time to consummate. Because of these issues, cash-flow oriented investors try to focus on office buildings with multiple tenants, so that no single tenant vacancy jeopardizes the entire property investment.

2017 – Markets Vary by Region and Economic Base

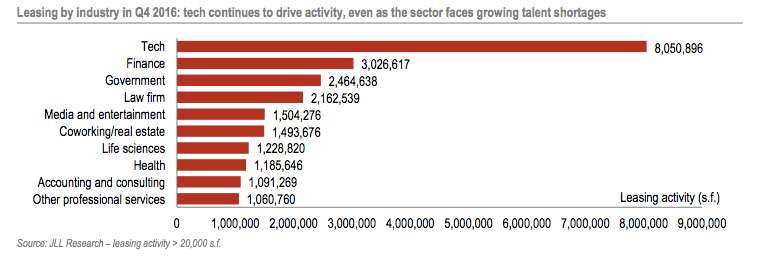

New and different employment sectors and markets are driving the current office market. The technology sector, for example, is now a key driver of office demand; JLL reports that technology industries represent over 24 percent of recent office leasing activity. This particularly benefits the Austin, Silicon Valley and Seattle markets.

There has also been significantly large occupancy growth in secondary markets, particularly in Atlanta, Dallas and Philadelphia. This could potentially indicate that employers are seeking to expand in these more cost-efficient areas. Interestingly, though, the legal and financial sectors in primary markets like New York City and Washington, D.C had the greatest drops in net absorption.

A Standing-Still Market?

The office sector currently features the highest CMBS delinquency rate of all major property types; last month, the sector’s reading was 7.11 percent. These rates may continue to trend upward, too; many 10-year loans issued from 2005 to 2007 across most property types were aggressively underwritten, with relatively weak credit standards.

Increased supply is coming online as well — JLL reports that overall construction volumes have risen significantly, posing a risk of future oversupply. Completions for 2017 are expected to exceed demand for the first time in the current cycle.

Less expensive secondary markets are increasingly driving occupancy growth. Together with a booming tech industry, it could be that some investors begin to veer away from conventional office properties in some of the larger “gateway” markets. In general, though, the office sector still posted stable activity in 2016, reaching $143.0 billion in transactions over the full year, including roughly $18.4 billion issued in CMBS office loans.

Although not a raging bull, the office sector in 2017 will likely continue to benefit from asset allocations that drive incremental capital to the sector, in tandem with the recent run-up in equities and commodities. More investors may also be drawn to real estate generally as an inflation hedge, as short-term interest rates remain below GDP growth rates and inflation expectations continue to rise.

About the Author

Lawrence Fassler, an attorney and real estate investor, is Corporate Counsel of RealtyShares, a leading real estate investment marketplace that places equity investments through North Capital Private Securities Corporation; a registered Securities broker-dealer, and member of FINRA/SIPC. RealtyShares as an institution does not advise on any legal issues, and this article is for general information only and does not represent professional legal advice. Contact the author at lawrence@realtyshares.com.

0 Comments