A number of pension funds, both public and private, have recently had difficulties – some have gone insolvent, or are otherwise are on the brink. Most of these funds hold more than half of their assets in equities – even though the famous (and successful) Yale Endowment model stresses the importance of a diversified portfolio including alternative assets like real estate. Will necessity finally push these funds toward a more diversified allocation of assets?

Pension Funds Continue to Reduce Their Goals

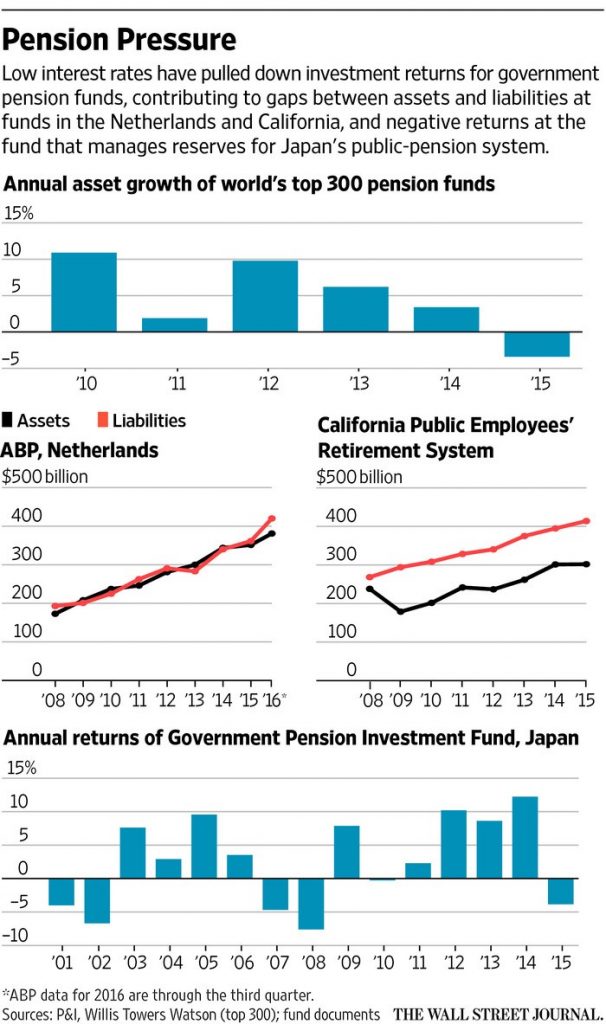

The experience of public pension funds offers lessons. Central bankers have, over the last several years, lowered interest rates to near zero (or below!) to try to revive their gasping economies. But investment managers never expected rates to stay this low for so long – and now the world is starved for the healthy yields that pension funds have long needed to survive. The current situation has pulled down investment returns and made it difficult for funds to meet mounting obligations to workers and retirees who are drawing government pensions.

The problem is that investment-grade bonds that once churned out 7.5% a year are now barely yielding anything. And global pensions have, on average, roughly 30% of their money in bonds.

Public pensions have often been allowed to play games with the discount rates used on future payment streams – using 7.6 percent on average, while corporate funds are required to use long-term AA-rated corporate bond yields, which are more in the range of 4 percent. Such high returns are unlikely; many investment firms expect nominal returns for a balanced portfolio of between 4 to 5 percent. And equities can only make up part of the difference; 2015’s one year return of the S&P 500, for example, ended up just barely in the black after recovering from the earlier summer swoon. Although the S&P 500 rallied in 2016, and into 2017, the volatility of equities makes it potentially unreliable in solely providing the returns needed for future liabilities.

Calpers, for example, recently expressed its desire to lower its investment target, setting an increasingly cautious tone for those managing U.S. investment assets. Some observers worry that the moves may not be coming fast enough amid mounting cash crunches and declining estimates of future earnings. The hesitancy is understandable, though; the maneuver would have real-life consequences, with painful increases in yearly pension bills for municipal agencies that participate in similar state plans, and higher required contributions from state taxpayers.

The Yale Endowment Model and Alternative Assets

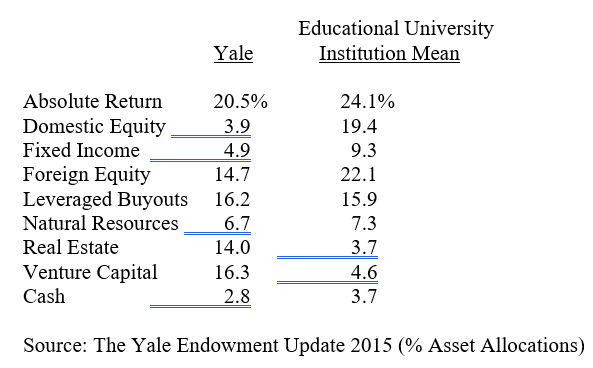

This is where the Yale Endowment model may prove instructive, particularly since its 30-year investment return rate has been strong. As of June 30, 2015, the Yale Endowment differed from most of its peer funds in several respects, perhaps most notably with its outsized allocation to real estate.

“Investments in real estate provide meaningful diversification to the Endowment,” it said in its 2015 annual report. “A steady flow of income with equity upside creates a natural hedge against unanticipated inflation without sacrificing expected return… While real estate markets sometimes produce dramatically cyclical returns, pricing inefficiencies in the asset class and opportunities to add value allow superior managers to generate excess returns over long time horizons,” the report continued.

Institutional Investment Models Are Now Available to Individual Investors

With the advent of real estate crowdfunding companies like RealtyShares, investors can invest directly into commercial real estate projects, similar to large institutional investors.

Previously, introductions to these opportunities might have required specially arranged meetings with attorneys, bankers or financial advisers – that is, if the investor had such connections at all. The opportunities were also often still limited to institutions or persons of very substantial wealth, since project syndicators wouldn’t typically concern themselves with investments of only $10 to $20,000.

Technology, however, has enabled large numbers of unrelated investors to pool their contributions and make a significant investment through a single legal entity – keeping things easy for syndicators while broadening the source of potential investors.

Real estate is one of the most popular asset classes for potentially generating recurring, passive cash flow. Until recently though, other than through a publicly traded REIT, even accredited investors had little prospect of participating in commercial real estate investments. The advent of real estate crowdfunding sites like RealtyShares has allowed people without pre-existing industry connections to participate in specific real estate projects, and with smaller individual investment amounts than ever before.

Many argue that commercial real estate has other desirable characteristics — such as its serving as a hedge against inflation, offering a portfolio diversification away from stocks and bonds, offering potential tax benefits for equity interests, and nature as a hard asset. Its ability to provide current cash flow is, in particular, a key component in making it a compelling asset class. When done correctly, commercial real estate investing encapsulates the age-old investment theme of focusing on investments that can maintain, and even grow, their income over time.

Risk Factors for Private Direct Participation Vehicles

The direct participation vehicles discussed above still carry significant risk. All of the investments offered by RealtyShares are private offerings, exempt from registration with the SEC, and the disclosures are less detailed than would be expected from a registered public offering. Ongoing disclosure requirements are negligible. The investments are also illiquid, with undetermined holding periods and no real preset liquidity terms. These offerings are also only available to accredited investors, so the illiquid nature of any investment is heightened – further emphasizing the differences of these securities compared to registered, publicly-traded securities.

Important Links

http://crr.bc.edu/wp-content/uploads/2015/06/SLP45.pdf

http://crr.bc.edu/wp-content/uploads/2015/06/SLP45.pdf

About the Author

Lawrence Fassler, an attorney and real estate investor, is Corporate Counsel of RealtyShares, a leading real estate investment marketplace that places equity investments through North Capital Private Securities Corporation; a registered Securities broker-dealer, and member of FINRA/SIPC. RealtyShares as an institution does not advise on any legal issues, and this article is for general information only and does not represent professional legal advice. Contact the author at lawrence@realtyshares.com.

0 Comments