*Sponsored Content

Taxpayers are earning record gains on both their investment real estate and personal residence, which means potential record taxes. But did you know you can avoid all taxes on a sale through creatively combining Internal Revenue Code (IRC) Sections 1031 and 121?

When you both live in and hold a property for investment, such as living in one of the units in an apartment building you own, or occasionally using a vacation home you rent out, or living in a residence that sits on land held for investment, you may qualify for two tax breaks under IRC Section 121 and also Section 1031.

Many people are familiar with IRC Section 121 which allows an individual a $250,000 gain exclusion ($500,000.000 if you are married filing jointly) on the sale of your principal residence. The property must have been your residence for at least two (2) years out of the past five (5) year period. The period begins on the date of the sale of the property. But what many people do not know is that one can combine section 121 with section 1031 in a transaction, and utilize section 1031 on the same transaction for the portion of the property the taxpayer is not living in. Suppose a couple lives in one unit in a multifamily building and uses section 1031 to exchange the portion of the property in which they do not reside. In this way, the unit they reside in is sheltered up to $500,000 in gain, and the remainder of the building is valued and exchanged as investment property under section 1031.

How do you divide the value between your residence and your investment property?

This calculation may be based on the square footage, or you may use any appraisal which has been conducted for the unit one is living in and calculate the difference from the sales price for the investment part of the property.

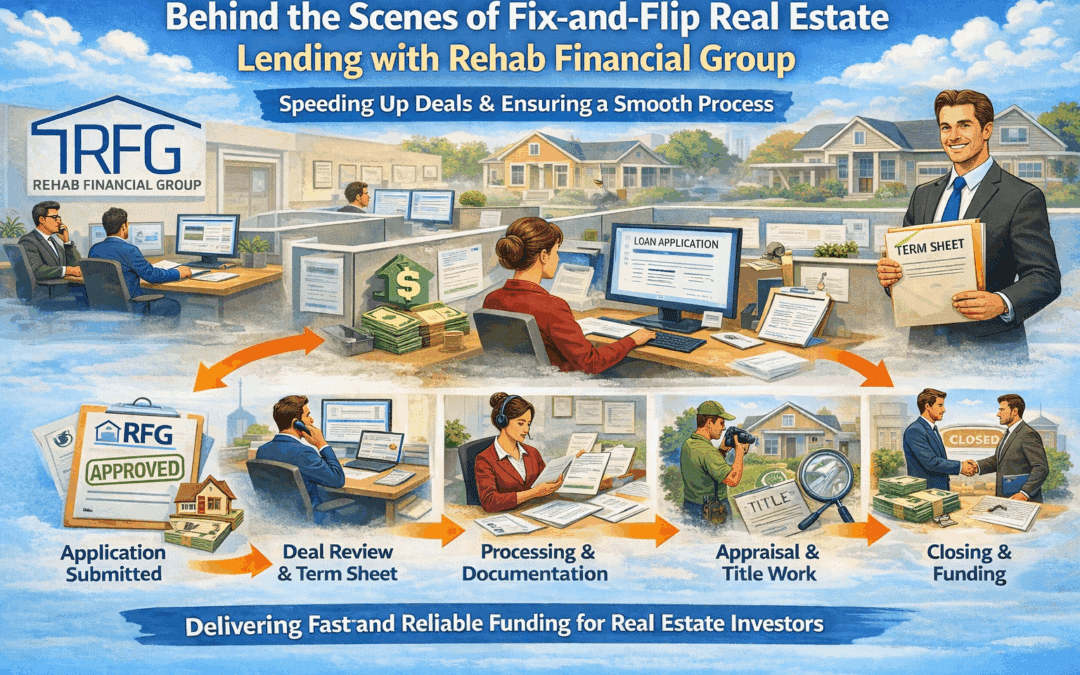

How is the exchange/transaction conducted?

The closing agent should prepare two closing statements, one for the value and adjustments relative to the personal residence, and one for the remainder of the property. The exchange accommodator will prepare exchange documents which describe only that portion of the property that is being exchanged. When the monies are disbursed at closing, the funds that relate to the personal residence portion of the property are disbursed directly to the taxpayer. The remainder of the funds are disbursed to the exchange accommodator who processes the exchange. The taxpayer reports the transaction on form 1040 schedule D for the personal residence sale and the 1031 exchange portion of the transaction is reported on forms 4797 and 8824. In this manner, a taxpayer who has resided at the property while renting out the remainder of the building can successfully avoid taxes on the gain for the entire parcel and exchange into a new investment using tax free dollars to purchase it.

This type of mixed use transaction need not only be performed in a multifamily unit property but can be used for a transaction when the “non residence” portion of the property is any other kind of investment property; commercial or land. In the instance of land, an allocation issue does arise. The land which surrounds the residence can be exchanged under section 1031 and the personal residence will qualify for section 121 treatment. An appraisal should be done and the value of the residence should be sectioned out of the value of the adjoining land.

What about a vacation home qualifying for 1031 treatment?

In most cases, homes that are exclusively used for vacation residences will not qualify for treatment under section 1031. There is no specific formula to use and cases of “incidental use” have been permissible. If one were to look to section 280a which doesn’t specifically deal with 1031 matters but talks about the deductibility of losses on vacation homes the rules are more straightforward. They say 14 days per year or 10% of the time the property is rented throughout the year may be dedicated to personal use. There are no straight forward rules for vacation homes and section 1031; however, one can extrapolate that if property were held for personal use and then rented over a period of time, at least for a few years before doing an exchange one would be able to exchange it as property which has been used primarily for rental/investment.

The clear victory comes when the taxpayer who resides in a mixed use property takes advantage of section 121 and 1031 to remove all taxes on gains and diversify into other properties. Clearly, living in a property that appreciates and does not present you with a tax bill when you leave makes for a very welcomed stay.

Will an exchange work for your investment property? Find out when you schedule a complimentary attorney consultation with David and his team.

David P. Greenberger, Esq. is General Counsel of the licensed and bonded accommodation firm 1031 Exchange Advantage ™ Inc., and provides no-charge 1031 exchange guidance to Creative Real Estate Magazine readers through www.my1031place.com or toll-free at 866-944-1031

0 Comments