Solid returns await investors if they consider looking outside their comfort zone.

Rising mortgage rates and slowing home price appreciation have compressed returns for real estate investors, but solid returns are still available in often-overlooked markets across the country for investors willing to step outside of their comfort zone.

“The news for Salt Lake City for real estate is not the same as Davenport, Iowa,” said Jared Garfield, a real estate investor who has shifted his focus in recent years to smaller markets that have experienced steady and sustainable home price growth rather than rapid and likely unsustainable home price growth.

“Some of the markets that have gone up 25% a year for five years, of course there’s room for a correction,” he said, noting that smaller markets like Davenport are more attractive to him because other investors often overlook them. “Most people are not willing to go to these types of markets.”

Compressed Returns

The sharp slowdown in price appreciation and even price correction in many of the larger and more popular markets for investors are compressing potential returns nationwide.

Potential profits on home flips ticked slightly higher in the second quarter of 2023, but they were still down by more than half from the recent peak in 2021, according to ATTOM Data Solutions. The gross flipping return on investment for homes flipped in the second quarter of 2023 was 27.5%, up from a recent low of 22.3% in fourth quarter 2022 but less than half the 61% peak in second quarter 2021.

Local community developers like Garfield who typically purchase distressed properties at a discount are shielded somewhat from slowing home price appreciation. Still, data from www.auction.com shows that even these distressed property buyers experienced compressed returns in 2022.

The average gross renovate-and-resell return was 49.4% for distressed properties purchased on www.auction.com in 2022, down from 61.7% for distressed properties purchased in 2021. The average gross return for distressed properties purchased so far in 2023 has rebounded to 53.9% but is still below the 2021 level.

The average gross renovate-and-resell return is the gross profit as a percentage of the original purchase price. The gross profit is simply the resale price minus the purchase price and does not include any rehab costs, holding costs or sales costs.

“We’re doing less high-end flips,” said Garfield. “I’m not sure how many $400,000 houses I want to do, because with rising interest rates there are a lot fewer people who can afford that.”

Shift to Rentals

The compression of fix-and-flip profits has pushed more local community developers like Garfield to shift their investing strategy toward renovate-and-rent. A March 2023 survey of nearly 450 Auction.com buyers found that 39% identified renovate-and-rent as their primary investing strategy, up from 32% in a 2022 survey.

Furthermore, an analysis of public record data for properties sold on Auction.com shows a dip in those being resold within a year, implying that more are being held as rentals after renovation. The data shows that 37% of those purchased on Auction.com in the first six months of 2022 had been resold a year later, down from 43% for those purchased in 2021 and down from a recent peak of 47% for those purchased in 2018.

“We’re trying to stick to turnkey properties,” Garfield said, referring to properties he purchases, renovates, and resells to other investors, typically passive part-time investors who are holding down a day job while looking for an investment vehicle that will help them build generational wealth and save for retirement. “We know we can sell it to investors who are wanting to get out of the stock market.”

The shift toward renovate-and-rent is one strategy that real estate investors can employ in a high interest rate environment. That shift aligns them with the shift away from buying and toward renting that is occurring in the retail market as more prospective buyers are priced out of purchasing a home.

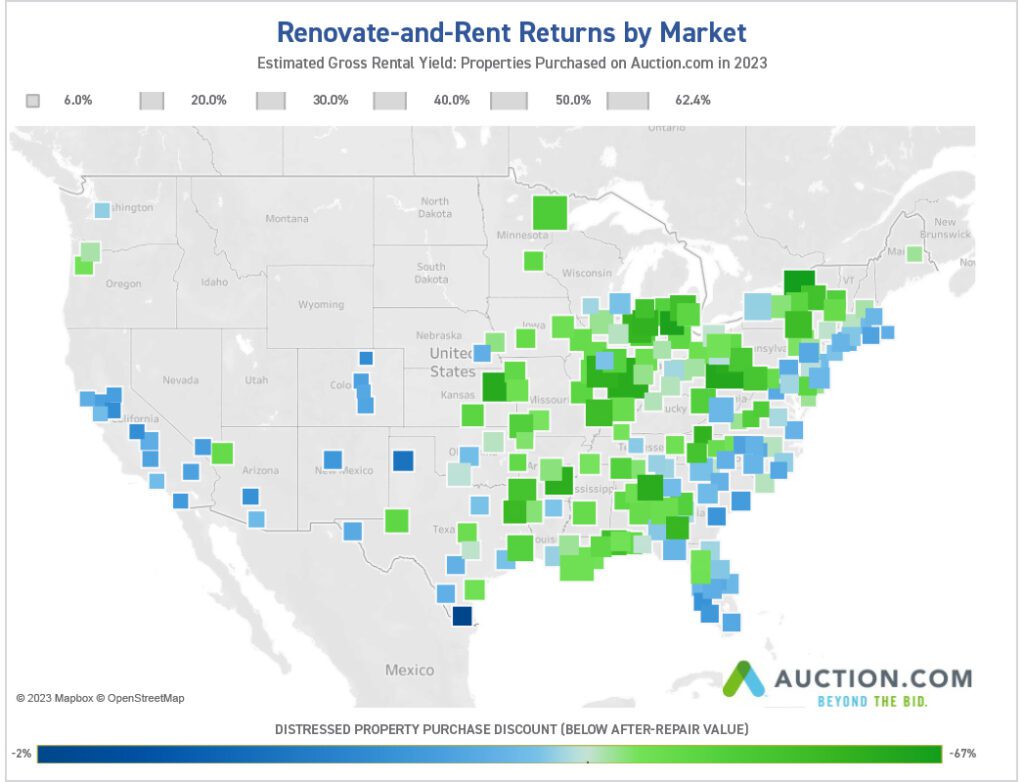

But not all local markets represent the same opportunity when it comes to the renovate-and-rent strategy. The rapid rise in home prices and values over the last three years in many major markets means even distressed property buyers will have more difficulty finding deals that generate healthy returns in those inflated markets.

Overlooked Renovate-and-Rent Markets

An analysis of potential rental yields for distressed property purchases on Auction.com in the first half of 2023 in more than 200 metro areas nationwide reveals that many of the best renovate-and-rent returns come in smaller markets that are often overlooked by investors.

The top five markets with the highest potential gross rental yields for distressed properties purchased in 2023 were Terre Haute, Indiana; Wheeling, West Virginia; Duluth, Minnesota; Houma-Thibodaux, Louisiana; and Decatur, Illinois.

“(These) are markets that have not had massive appreciation,” Garfield said. “No one is going to convince me that Rock Island, Illinois, is overinflated.”

Rounding out the top 10 were a similar group of markets: Watertown, New York; Topeka, Kansas; Niles-Benton Harbor, Michigan; Texarkana, Texas-Arkansas; and Lansing, Michigan.

An Aussie Falls in Love with Smalltown Alabama

Local community developer Kerry Wojtala has fallen in love with smalltown Alabama since moving there six years ago from Australia.

“If you had asked me … where would you like to live in the U.S. … Alabama would not have been in the top 49 states,” she said. “However, I absolutely love it. I love the people here. I love the south, even the heat.”

Wojtala buys and renovates distressed properties in Coffee County, Alabama, a market too small to show up in the 200 markets analyzed for this article. The closest market ranked on the list is Mobile, Alabama, about 150 miles away. Mobile ranked 22 on the list in terms of highest potential gross rental yields.

Although Wojtala primarily purchases single-family homes in her own town of Enterprise, she recently purchased a commercial property in nearby Elba, the county seat of Coffee County, in hopes of being part of a downtown revival there.

“Four-thousand, five-hundred square feet of problem to be solved,” said Wojtala, describing the property. “But I’m determined, and there are a few other people in Elba who feel the same passion for the town. … When I first saw it, I just thought, wouldn’t this be cool if it could have new life breathed into it? Wouldn’t it be cool if it was me?”

Wojtala, who recently attended a foreclosure auction in Dallas County, Texas, said her smalltown market is often overlooked by the larger investors who show up in places like Dallas. That allows her and other “mum-and-dad investors” like her to compete and win.

“Dallas is chaotic and frenetic compared to little old Enterprise,” she said. “I think there are a lot of people that are very put off by foreclosures … It really isn’t that hard. It isn’t something to be daunted by. And there are people that will help … we spoke to an Auction.com representative recently and needed her advice on how to do remote bidding. So, there’s always someone who can answer questions for you.”

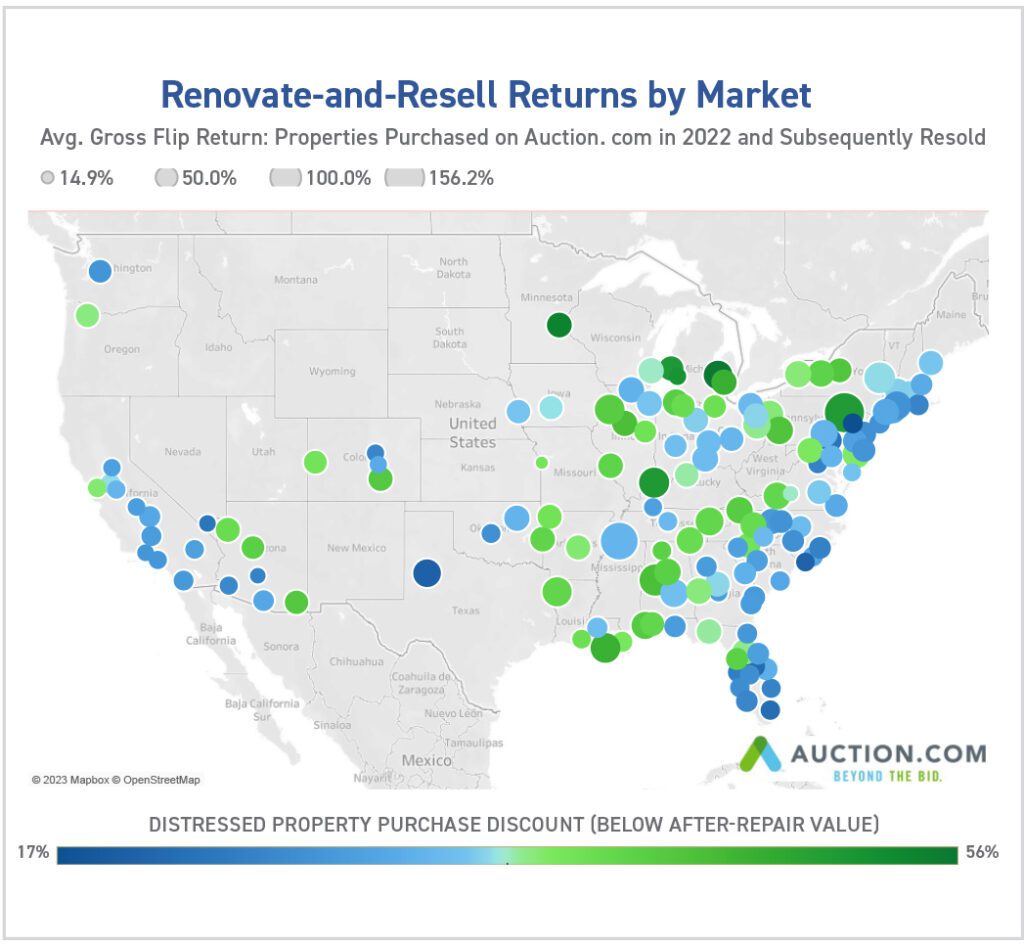

Although slowing home price appreciation driven by rising mortgage rates has compressed potential returns for renovate-and-resell investors nationwide, the returns are still solid in many markets, particularly those where investors haven’t had the luxury of relying on rapidly rising home prices to pad their profits in the past.

Overlooked Renovate-and-Resell Markets

An analysis of homes renovated and resold after being purchased on Auction.com in 2022 in nearly 150 metro areas nationwide shows the top markets for renovate-and-resell returns are also mostly in smaller, often overlooked areas—with a few exceptions.

The top five markets for highest gross flipping returns—not including rehab, holding, and resale costs—were Scranton, Pennsylvania; Memphis, Tennessee; Tuscaloosa, Alabama; Albany, New York; and Evansville, Indiana.

Rounding out the top 10 markets with the highest gross home-flipping profits on distressed property purchases were Houma-Thibodaux, Louisiana; the Quad Cities straddling the Iowa and Illinois border; Shreveport, Louisiana; Flint, Michigan; and Hartford, Connecticut.

“Part of the SOLUTION“ in Underserved Neighborhoods

In exchange for the potentially heady returns in these markets, local community developers are often taking a risk on highly distressed properties in underserved neighborhoods that other homebuyers are avoiding.

“I remember being at the courthouse steps, a couple guys they were telling me how I made a big mistake: That homes won’t appraise over there. That homes are not going to sell because distressed properties or buying foreclosed properties diminishes the value,” said local community developer Jermaine Morgan of a recent foreclosure auction purchase in his hometown of Columbus, Georgia. “The risk was could I get this property to appraise based on the amount of work that I was going to put into that property. So, I took the risk. After I finished renovating it, not only did I get it under contract, it had multiple offers.”

Morgan has been rewarded financially for the risks he’s taken in underserved neighborhoods, but he’s also been rewarded with the satisfaction that comes from being part of the solution rather than part of the problem in these communities.

“Those areas that I’m now developing, I grew up in,” he said. “And I remember being in those areas without hot water. I remember what it’s like to have slumlords … I can’t just be a part of that problem. I want to be a part of the solution.”

0 Comments