Discover how savvy real estate investors are seizing profitable opportunities by partnering with a reliable private money lender.

There’s nothing more exciting as a real estate investor than finding the perfect investment opportunity.

Too often, though, investors are unable to move quickly on lucrative business deals or get them closed because of issues related to securing financing.

This not only can damage your current deal but can also tarnish your credibility in the marketplace and damage future deals.

That’s why choosing the right private money lender is essential to scaling your real estate investing business. Keep reading to discover how you can amplify your success when you have the right lender on your side.

A Hidden Gem Is Unearthed in Hawaii Kai

One of the advantages of having a strong lending relationship is being able to take bold risks that can yield significant rewards.

This is the case for Ernesto Simões, a seasoned real estate investor and partner with Kauai Bahia Investments and Hawaii Bahia Investments.

He discovered a property in an area of Honolulu called Hawaii Kai. With a view of the Koko Head Crater, the property sat right on Kuapa Pond.

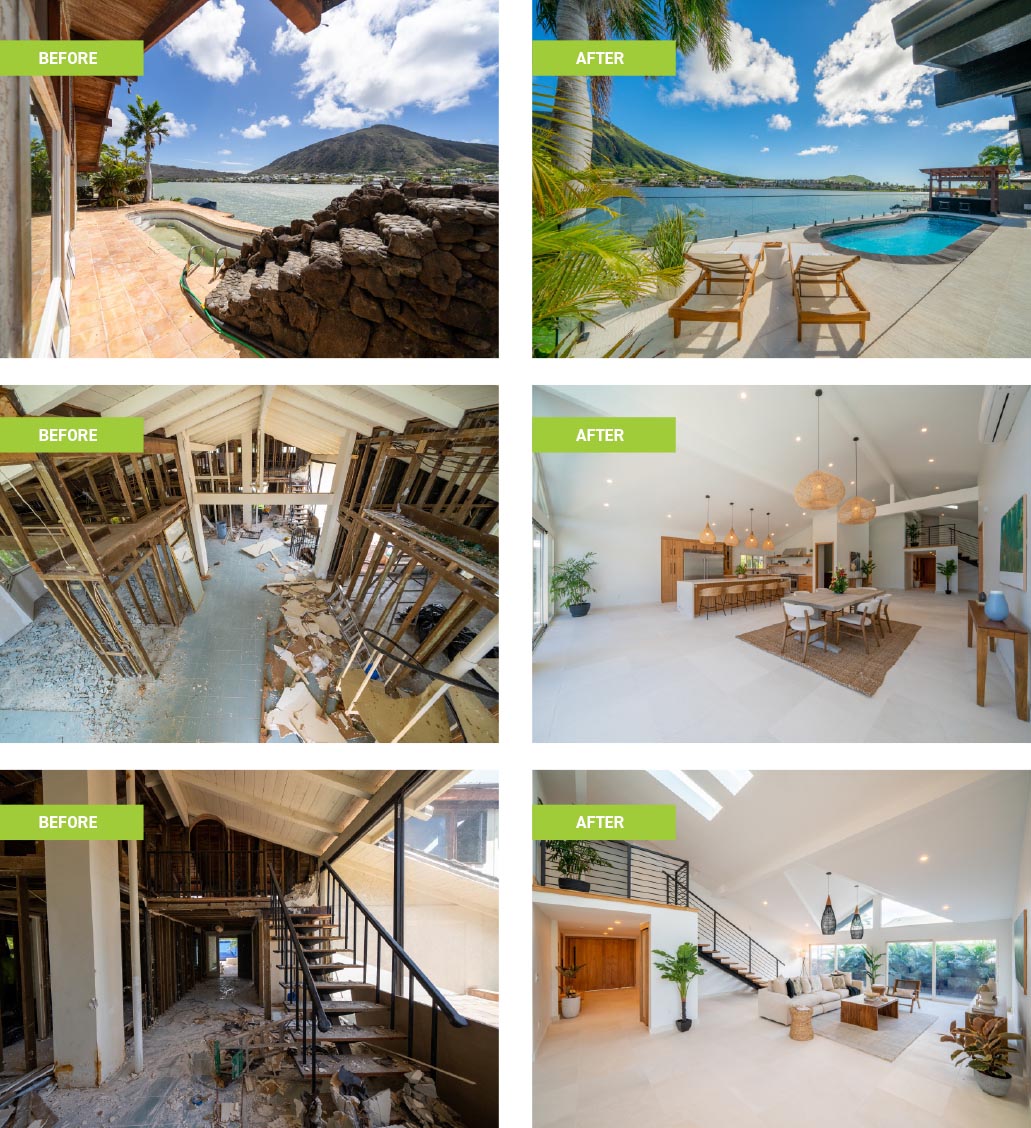

Because of the stunning views, a pool, and waterfront access, Ernesto knew the property held incredible potential. However, the home had been vacant for years due to a flood. Two other investors tried to rehab the property but failed because of the extent of the damage.

Although another lender would have had major hesitations about extending a loan on a risky property like this, Ernesto had an established relationship with Temple View Capital. We were familiar with who he was as an investor and as a businessperson—he wasn’t just the numbers and data on an application.

Our Chief Credit Officer Lauren Shea, who was closely involved with the Hawaii Kai project, had this to share about Temple View Capital’s involvement in the project:

“When you hear that two other investors backed out of a project, it is concerning. However, we knew Ernesto’s track record, business plan, and his ability to get the job done.

In a time where many faced supply-chain issues and drastically surging material costs, Ernesto had the ingenuity to directly source his own high-end luxury materials from places like Bali, Brazil, and Indonesia. He personally traveled to those areas and set up direct sourcing relationships to get these materials he would need for this project and others. The same quality stuff you would get from a place like Restoration Hardware but for a fraction of the price.

We also saw his vision to market and sell the property as a luxurious lifestyle opportunity where the resident could hop on their Jet Ski after a long day, taking it down to the local restaurant and grab a bite to eat or just play around in the channel. This wasn’t just any fix and flip. When you work with most lenders, they aren’t going to get past your application forms to find out those details that make all the difference and make us happy to say ‘Yes.’”

In the end, Ernesto and his team not only repaired the damage from the flood and the subsequent years of vacancy but also turned the Hawaii Kai home into an exquisite property buyers were clamoring for.

With a $1.5 million original purchase price and $1 million in rehab work, this home sold for $3.5 million with a profit of over $1 million. By choosing to work with a private money lender like Temple View Capital that was interested in Ernesto’s vision—not just the black-and-white facts—he was able to reap significant rewards.

The Advantage of Having a Trusted Private Money Lender on Your Side

Just like Ernesto, you probably see opportunities in the marketplace to generate sizable returns—you just need the financial backing to do it.

Just like Ernesto, you probably see opportunities in the marketplace to generate sizable returns—you just need the financial backing to do it.

In fact, it’s the reason Temple View Capital was created more than 15 years ago. Too often, a traditional lending company like a bank or credit union is not set up to understand the value or the unique needs associated with real estate investor loans.

However, as a private money lender, Temple View Capital’s structure, customer experience, and underwriting approach are all tailored to the needs of nontraditional real estate financing.

The Temple View Capital Advantage

At a time when inventory is low and demand is high, it’s never been more critical to have a private money lender on your side who can move quickly and get a deal closed.

In fact, here’s what one of our clients, Bridget Rose De Lierre, had to say about the persistence of the Temple View team in getting their deal to the finish line:

“Joe and Temple View are simply the BEST in hard money/private money lending. I came to them with a very complex deal, after attempting to close with two other lenders. Just when I was ready to give up on this deal and move on, Joe and Temple View came in and saved the day. They are extremely professional, responsive, reasonable, and will go the extra mile(s) to make the deal work for you. Everyone I have dealt with at Temple View has been excellent. I can honestly say that they have become my trusted partner in lending, and I will never go elsewhere!”

One of our secrets is that at Temple View, your underwriting team is completely in-house, so you don’t have to worry about the miscommunication and delays that are more likely to occur with other lenders.

A Partner for the Long-Haul

Whether your next real estate investment opportunity is a fix-and-flip, ground-up construction, or a short-term or long-term rental, Temple View Capital offers competitive rates and terms to help make your project a success.

For fix-and-flip investors, Temple View is one of the rare companies that offers advanced rehab draws. That way you get the money you need to complete your project upfront, rather than getting reimbursed after the work is complete.

And with ground-up construction, you can have some of the highest leverage available, with a 90% loan-to-cost ratio.

You also don’t have to be concerned about a slowdown in the process because of limited funds. Due to the partnerships that our principals have developed over 30 years in the industry, Temple View Capital has never stopped lending.

Even during the beginning of the COVID pandemic, when many lenders withheld money because they were nervous about market conditions, Temple View Capital was the lender that never stopped lending.

When searching for a private money lender, it’s important to know your lender will be there, no matter what the ups and downs of the market may be.

In all of these ways, our team and our products go the extra mile so we can fulfill our purpose of serving the needs of our real estate investor clients.

If you’re ready to have a private money lender on your side that understands your needs and appreciates your aspirations, contact us at Temple View Capital today. Visit us at www.TempleViewCap.com or call our team at (844) 232-7878.

0 Comments