Does investor sentiment align with market conditions?

There’s no doubt the past year has been challenging for residential real estate investors. How daunting has the challenge been? What’s going on in today’s market? As we move into the second half of 2023, let’s take a look back at the first half of the year and a look ahead at 2024, by attempting to answer a few important questions.

What Hath the Fed Wrought?

The Federal Reserve has set up quite a conundrum for the housing market—and the economy itself—during the past few years: implementing a zero-interest rate policy during and after the COVID-19 pandemic and then executing its quantitative easing (QE) program, buying billions of dollars of mortgage-backed securities (MBS) and flooding the capital markets with liquidity. These actions resulted in historically low mortgage rates, throwing fuel onto what was already a red-hot housing market, stimulating demand, precipitating bidding wars, and driving home prices to historical highs.

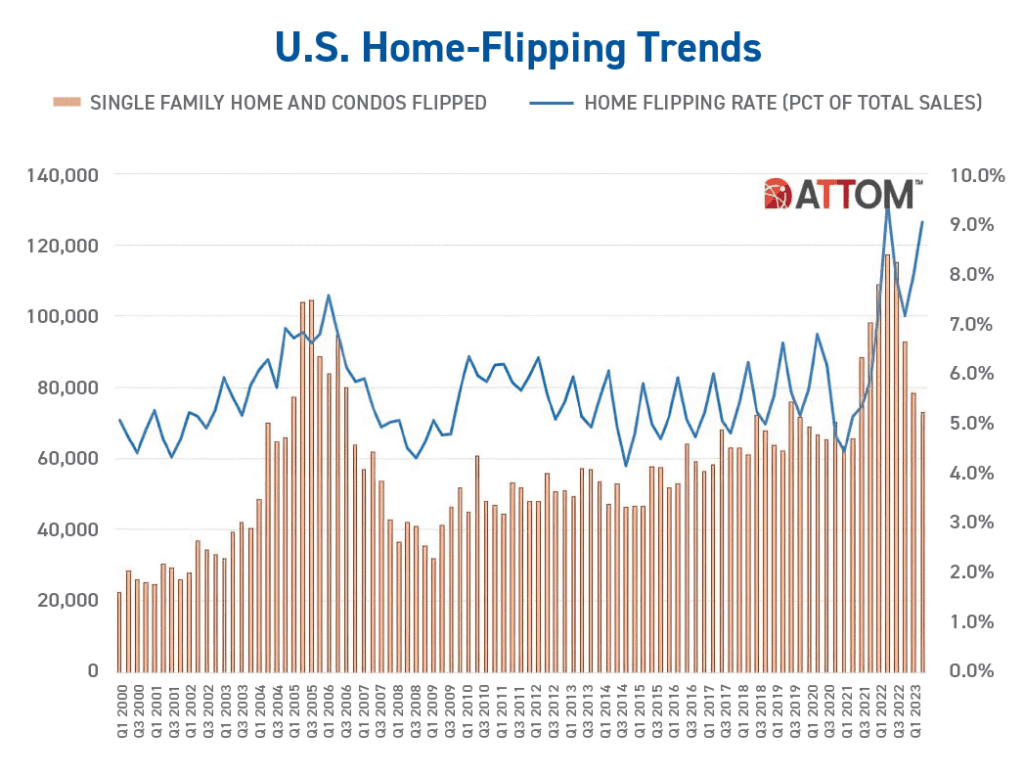

This was great news for real estate professionals, mortgage lenders, and real estate investors. Sales of existing homes soared to more than 6 million units in 2021; loan volume exceeded $4.5 trillion, driven largely by a booming refinance market; and there were a record number of fix-and-flip sales—almost 120,000—in the first quarter of 2022. Rising home prices increased homeowner equity to an all-time high of $27 trillion.

But escalating home prices, along with fiscal and monetary policies that overstimulated the economy, contributed to the highest rate of inflation in more than 40 years, forcing the Fed to take drastic measures to get inflation under control. So, it raised the federal funds rate more rapidly than at any time in history and began quantitative tightening, selling off billions of dollars of its MBS portfolio. These actions roiled the financial markets and caused mortgage rates to more than double in a few short months (the only time this has ever happened, according to Freddie Mac), peaking at a little more than 7% for a 30-year fixed-rate loan.

Predictably, the refinance market shriveled up, because more than 70% of homeowners with a mortgage had an interest rate of 4% or lower. The impact on home sales wasn’t quite as severe, but sales volume fell dramatically as well, from more than 6 million home sales in 2021 to just over 5 million in 2022. Homebuyers who missed their chance at leveraging those sub-4% mortgage rates were faced with monthly mortgage payments that were 45%-60% higher due to the higher costs of financing. Demand weakened and home prices understandably began to drift lower, which was part of the Fed’s inflation-fighting strategy.

But the combination of higher mortgage rates and weakening home prices discouraged current homeowners from listing their homes. The inventory of homes for sale today is down by more than 50% from 2019 levels, according to Altos Research. Homeowners simply have no incentive to sell their property and trade in a 3.5% mortgage rate for a new loan at 7%. Much to the Fed’s chagrin, this lack of inventory led to bidding wars on the few homes coming to market, causing home prices to begin to increase again. According to the National Association of Realtors, the median price of a home sold in June 2023 was only 0.9% lower than the median price at the peak of the market in June 2022. The FHFA reported that prices on homes purchased with loans backed by Fannie Mae and Freddie Mac were actually 2.4% higher than the prior year.

For investors, a triple whammy: extremely limited supply, unpredictable home prices, and significantly higher finance costs. The typical interest on a fix-and-flip loan jumped from between 7%-9% in 2022 to between 11%-12%, and many private lenders tightened credit requirements. Investors without an established track record of success or without preexisting relationships with lenders found it harder to secure a loan, as lenders looked to mitigate risk in what had become a much more volatile market.

Where’s That Foreclosure Tsunami?

Many investors, especially with market conditions like those described previously, look for distressed properties. These are often homes that are in foreclosure or have been repossessed by the lender. Both fix-and-flip and buy-and-hold investors can purchase these properties at a discount and then repair and renovate them, adding value and generating a profit in the process.

Despite dire predictions of millions of foreclosures and evictions in the early stages of the pandemic, the distressed property market virtually dried up, because the federal government enacted unprecedented consumer protection programs to protect homeowners from foreclosures caused by COVID-induced economic distress.

First, it declared a moratorium on foreclosures for any loans backed by a government entity (i.e., Fannie Mae, Freddie Mac, the FHA, VA, and USDA), which comprises between 65% and 70% of all active mortgage loans. This moratorium ultimately lasted for more than two years, and foreclosures were largely limited to vacant and abandoned properties or commercial assets.

Next, as part of the CARES Act, the government launched a first-of-its kind forbearance program, allowing borrowers to skip mortgage payments for more than two years by simply notifying their mortgage servicer that their income had been impacted by COVID. Consumer advocates fretted that borrowers would default on their loans once they were no longer protected by the program, creating a tidal wave of defaults.

But that simply hasn’t been the case. More than 8 million borrowers entered forbearance, which began in March 2020, and there are now only about 200,000 borrowers left in the program. Of those borrowers who exited the program, about 36% either had their loans fully reinstated or paid them off. Roughly 46% entered into a loan modification or loan deferral program which reduced their monthly payments; to-date, 75% of those borrowers have maintained on-time payments. And about 18% left the program while still negotiating with their servicer. Less than one-half of 1% of borrowers who exited the forbearance program have defaulted on their loans.

Meanwhile, a booming economy, a thriving jobs market with a very low 3.5% unemployment rate, rising wages, and strong borrower credit combined to ensure lower-than-normal mortgage delinquencies and defaults even as the government programs expired. The Mortgage Bankers Association noted that mortgage delinquencies dipped below normal levels—down to 3.65%—at the end of the first quarter. Black Knight reported that delinquency rates dropped to a nearly historic low of 3.12% in June.

Fewer delinquencies generally means fewer foreclosures, and the data supports this. According to a report from ATTOM on first half 2023 foreclosure activity, there were slightly more than 185,000 foreclosure actions in the first six months of the year, representing a 37.5% decline from the same period in 2019, before the pandemic. Foreclosure starts were recovering more quickly, at about 80% of pre-pandemic levels, but only about 50% as many properties were going to foreclosure sales according to an analysis done by Auction.com. Bank repossessions were off from 2019 levels by about 70%. What’s happening to all those properties between the first notice of default and the ultimate foreclosure?

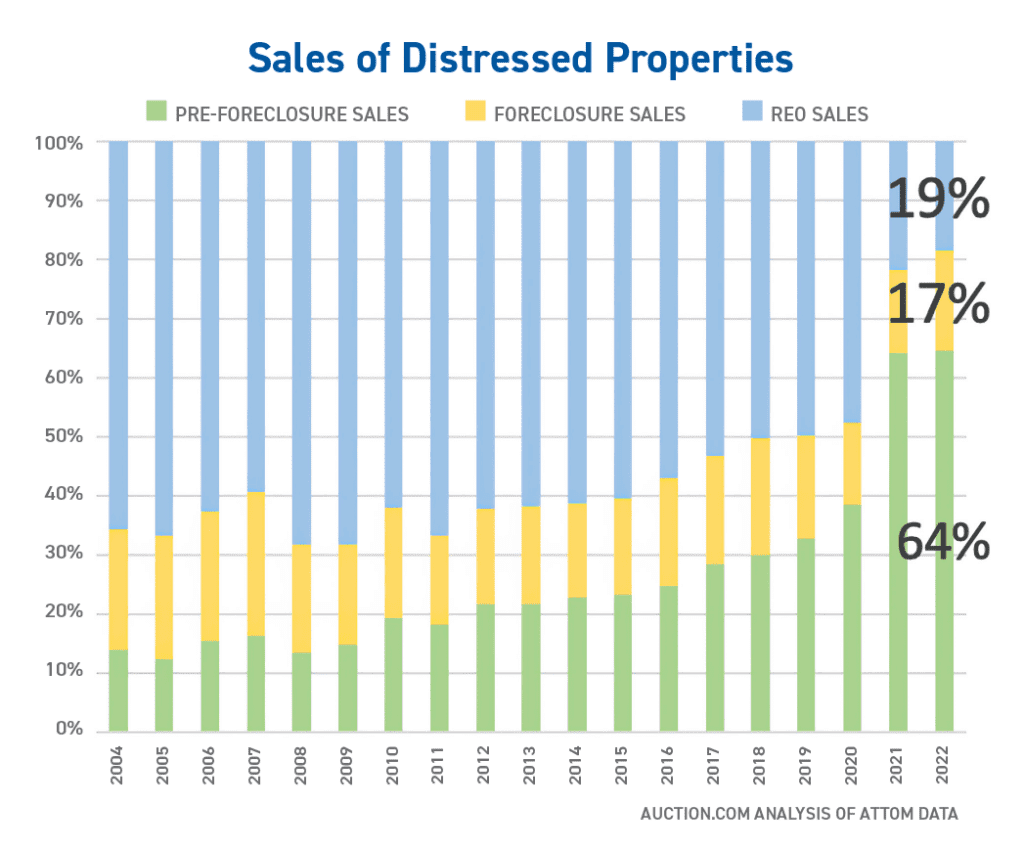

It turns out that, according to data from ATTOM, about 92% of homeowners in foreclosure have positive equity in their homes—a lot of equity. Just over 88% of homeowners in foreclosure have at least 20% equity, and thousands have 50%, 75%, or more. These financially distressed homeowners are opting to sell their homes before the foreclosure auction in order to protect that equity. An analysis by Daren Blomquist, Auction.com’s vice president of market economics, estimates that almost two-thirds of distressed property sales today are selling during the pre-foreclosure period.

For investors looking for distressed properties, this isn’t a rosy scenario: fewer delinquencies, fewer defaults, fewer properties going to auction, and even fewer properties not selling at those auctions and ultimately being repossessed by the lenders. Although the inventory of homes for sale is constrained, the inventory of distressed properties is almost non-existent.

What Does the Road Ahead Look Like for Investors?

None of these trends has been particularly helpful for real estate investors, and their mood and activity reflect this. In RCN Capital’s Spring 2023 Investor Sentiment Survey, 76% of investors said that today’s environment for investing was no better, worse, or much worse than it was a year earlier. Not surprisingly, these investors also pointed to the high cost of financing and limited inventory as their biggest challenges. About 24% also cited difficulty in securing a loan.

Investors also noted that they’d had to adjust their business models to changing consumer behavior; 83% said that they’d seen demand for owner-occupied homes weaken and demand for rental properties increase once mortgage rates rose. This may be why a majority (53%) of the survey respondents were buying and holding properties as rentals while less than one-third (29%) were flipping homes.

ATTOM’s report on home flipping backed this up. Just over 70,000 homes were flipped in the first quarter of 2023, the lowest number in more than two years, and the fourth consecutive quarter with fewer flips than the quarter before.

Even the single-family rental (SFR) market wasn’t immune from some problems. According to data from Beekin, asking rents on SFR homes was down a little over 2% year-over-year, although this decline wasn’t universal. States like California saw larger declines, while others (e.g., Florida) saw modest increases.

All is not doom and gloom though.

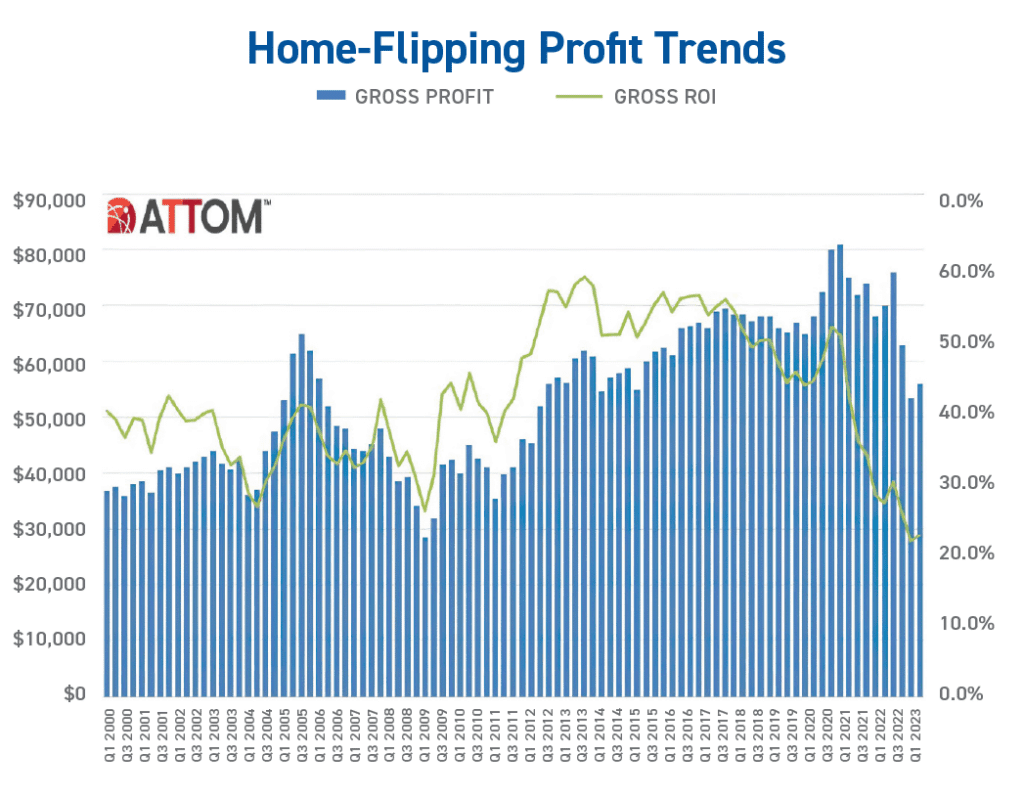

In its first quarter flipping report, ATTOM noted that for the first time after several years of declining margins, flippers’ gross profits (the difference between the amount paid for the property and the amount for which it was sold) had increased.

There is pent-up demand for housing, which will continue to provide a strong tail wind for the market. The largest cohort of young adults between the ages of 25 and 34 is reaching the prime age for household formation. Most of them are looking to buy a home but failing that, they will need to find a rental property, presenting opportunities for both flippers and rental owners.

Foreclosure activity is steadily—but very, very slowly—working its way back to normal levels. Investors should plan to swim upstream during this cycle, negotiating a purchase from distressed homeowners rather than waiting for the foreclosure auction or targeting REO homes.

More broadly, the Federal Reserve’s aggressive rate hikes appear to be having the desired effect on inflation, with recent reports showing the rate of inflation at 3%, just shy of the Fed’s 2% target. This should allow the Fed to stand down and the markets to settle down, which should start to drive financing costs down for traditional homebuyers and real estate investors. Lower mortgage rates will, eventually, encourage more homeowners to list their homes for sale and improve inventory levels at least a bit.

Even as home sales and prices in some regions are in decline, there are parts of the country that are still experiencing rapid growth in population and jobs, which translates into a growing need for both owner-occupied and rental properties. States across the South and Southeast (e.g., Texas, Florida, the Carolinas, and Tennessee) are fertile grounds for investors.

In the RCN Investor Sentiment Survey, respondents believed that the environment for investing will improve in the months ahead. And with strong demand for housing, the likelihood of lower financing costs, more inventory, and more predictable home prices, they may just be right.

0 Comments