No country in the world receives more foreign direct investment (FDI) than the United States. In 2019, the USA received $251 billion in FDI, according to United Nations data. The second was China, with $140 billion.

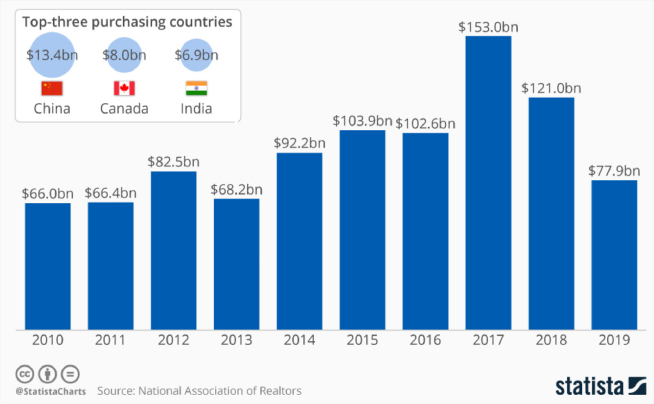

Of that $251 billion that flowed into America, $78 billion, or 31 percent, went to real estate from April 2018 through March 2019. If we look back over the last decade, we see continuous high levels of foreign investment in U.S. housing.

What data like this tells us is: American real estate has been one of the most preferred worldwide investments.

But is that still true?

The COVID-19 pandemic has battered the U.S. economy, trade tensions pose ongoing risks, and social rest has created uncertainties around our future. Naturally, given what has happened this year, there has been a decline in foreign investment.

Yet it all appears to be a momentary blip.

After all, the American economy is battle-tested. When the housing market crashed in 2008, we came out stronger and had a historic bull run.

History should provide investors with confidence that the American real estate market will remain stable and strong over the long run. Of course, they have to be more strategic about how they invest, given the current situation.

A little background

From April 2019 through March 2020, international investors bought 154,000 homes in the U.S., spending a total of $74 billion. Despite trade war tensions and the beginnings of the Coronavirus pandemic, overseas investments held up, only declining five percent from the previous 12 months.

As the COVID-19 pandemic carries on, it would seem America has lost the edge as a secure destination for overseas capital. The economy did contract 34.3 percent in the 2nd quarter, the biggest decline on record, according to data from the Bureau of Economic Analysis.

For international investors, despite America’s gloomy economic news, societal issues, and uncertainties around the pandemic, it is important to keep perspective. If history tells us anything, it is that the American economy is highly resilient.

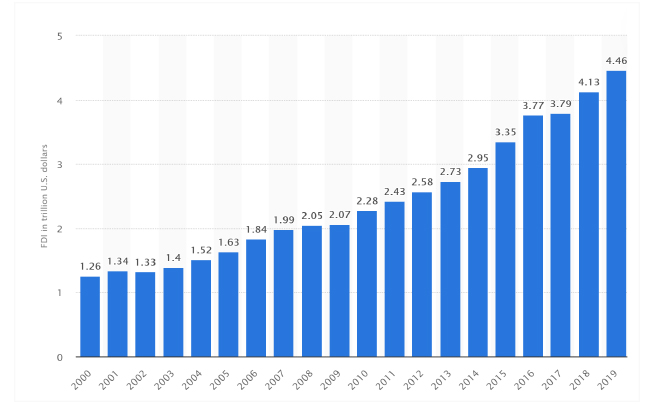

Despite the ebbs and flows of the American economy, the total value of assets held by international investors continues to rise. Even from 2008-2009 that value didn’t drop.

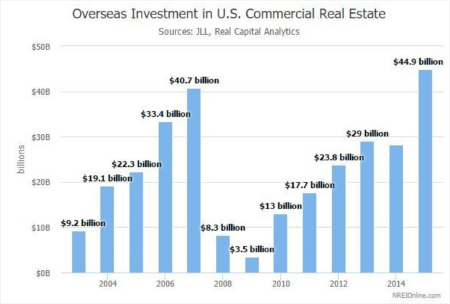

If we analyze various real estate sectors during the 2008 Housing Crisis, we also see that international investors come back during the recovery. Take a look at how overseas investment in commercial real estate declined sharply in 2008, then increased rapidly during the recovery.

Source

The chart above also reminds us of this: The international investors that got in early during the recovery, when asset prices were at rock bottom, profited the most.

As the American economy emerges from the lows of the pandemic and we address societal issues, international investment in U.S. real estate will again increase. Not only is there historical evidence supporting this theory, but the U.S. still has the advantages that make it an attractive destination for capital.

Why U.S. real estate will remain attractive to international investors

Now that we’ve covered how foreign direct investment has increased over the years, and how overseas money flowed in U.S. real estate following the last crash, let’s take a look at some of the advantages the U.S. market offers. International investors should have confidence that long-term investments in real estate here will perform well.

Risk diversification

America has long been thought of as a safe place to store capital. Even when returns are low, foreign investors have parked their money here.

The National Bureau of Economic Research highlights that U.S. real estate, stocks, and other assets are a way for wealthy overseas investors to diversify their portfolio. For those in countries where markets are more volatile, U.S. real estate is a great way to preserve and grow wealth.

Developed markets

The U.S. financial markets have a long track record of stability. This makes overseas investors confident they can put their money here freely and safely.

Research from the University of California-Irvine attests that the strong rule of law here plays a role in attracting FDI. Investors prefer countries that protect contract rights, and U.S. markets do just that.

A strong market and workforce

As the U.S. International Trade Administration notes, the U.S. market has distinct advantages, such as:

- A great climate for innovation

- The world’s largest consumer market

- A skilled and productive workforce

This is why you see companies like Taiwan Semiconductor Manufacturing Co. investing $12 billion to build a chip factory in Arizona, even in the middle of the pandemic.

Solid returns

The S&P 500 has achieved an average annual return of 9.8% over the last 90 years. That’s quite a track record.

If we examine American real estate, we see great returns as well—without the volatility. For instance, multifamily real estate has an average annual return of 9.75%. That’s about on par with stock market returns, but multifamily housing offers investors much less volatility. No wonder multifamily investments from overseas individuals had been increasing before the pandemic.

Ease of access

With open capital markets, the U.S. makes it easy for foreign individuals to invest in stocks, bonds, real estate, and other assets. There simply aren’t the same barriers to foreign real estate ownership that some other countries have in place.

This means that international investors typically don’t run into issues buying U.S. assets such as real estate. And when they need to liquidate the asset, they can do so effectively.

Solid returns will come with challenges

Perhaps even more notable is how American real estate has withstood this crisis. Home prices have risen in 96 percent of U.S. markets this year. Fundamentals are still strong and with low inventory, demand should continue to drive prices up.

With that said, investing in U.S. real estate has become trickier.

First, the Coronavirus has made market analysis and active investing in U.S. real estate more difficult. International investors simply can’t analyze the situation on the ground and manage properties in the manner they did before.

Second, the market is moving in different ways than it did following the 2008 housing crisis. While we saw real estate prices skyrocket in major cities like San Francisco and New York City, it seems that the suburbs and second- and third-tier cities will see the biggest gains this time around.

For example, the median sales price in Manhattan fell 18 percent in the second quarter of 2020. However, the median sales price rose 4.2 percent overall, according to the National Association of Realtors.

Third, uncertainty exists around which direction the real estate market will take. There has been talk of an eviction crisis, which is saddening. Even if a stimulus package and greater economic recovery prevent a flood of evictions, more distressed assets should hit the market. This presents great buying opportunities for investors who know where to find them.

Considerations for successful investing

- Consider passive investing. Geographic distance between yourself and your real estate makes it difficult to manage the investment. There are plenty of REITs to consider. For instance, our DLP Housing Fund provides monthly distributions to passive international investors.

- Understanding where the opportunity is. Ideally, you have a partner with boots on the ground. The Coronavirus housing market has changed things a lot, and opportunities aren’t in the same places as before. Take a look at the hottest markets in the U.S. during the third quarter of 2020. The top three are Colorado Springs (CO), Reynoldsburg (OH), and Rochester (NY). Finding the best opportunities necessitates having a partner, as it’s hard for international investors to pinpoint good buys in this market when they’re not physically present.

- Staying updated on market swings. Now more than ever, investors have to pay attention to economic data, political developments, and current events. The passing of stimulus, for example, could hold up the multifamily rental market. An improved third quarter could mean a quicker rebound for commercial real estate.

Succeeding with U.S. real estate investments

Good investment opportunities exist around the world. However, given that the foundation remains intact, U.S. real estate continues to present opportunity for investors here and abroad.

For real estate investors everywhere, refine your approach to ensure you stay ahead of the market. If there is a geographic distance, or if you want expert guidance, partnering with a real estate investment company can lower your risk and put you in a better position to achieve solid, steady returns.

0 Comments