Make sense of all of this for real estate investors? May as well start with facts.

Make sense of all of this for real estate investors? May as well start with facts.

The U.S. 10-year Treasury broke to 2.36% overnight, it’s lowest in more than a year. That is good news for real estate investors watching mortgage rates. German 10s reached an all-time low 1.04%, their 2s trading below zero briefly, now paying 0.004% (ours are 0.432%), and Italian 10s are rising in yield.

These moves are “flight to quality.” The marker: no follow through in US mortgages, still sitting close to 4.25%. When the world is scared it wants sovereign IOUs, not mortgage backed securities (MBS) even if government guaranteed. Unless the sovereign looks like it’s in trouble itself.

To make sense, isolate the economic effects of this geopolitical circus from other forms of misery, and from the general course of economies.

U.S. domestic data is on fire. Maybe. The Institute for Supply Management (ISM) reports have for a long time been excellent barometers, and in July both jumped to post-recession highs. New claims for unemployment insurance have reached weekly lows consistent with full-scale recovery. But maybe these reports do not reflect today’s economy. A WSJ/NBC poll this week: Will life for our children be better than for us? 21% yes, 76%, no.

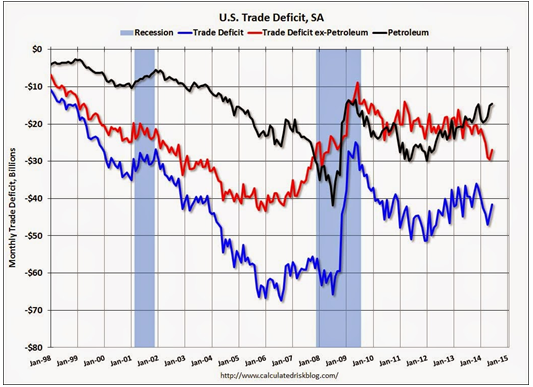

Another head-fake: our June trade deficit fell big, 7% on one month to $41 billion, which should mean higher GDP. However, all trade fell, both imports and exports, and the imports falling the most were consumer goods, which does not speak well of domestic demand. Or the global economy. Netherlands-based central planning bureau (CPB) has found an overall decline in world trade. No matter its harm to U.S. wages, global trade has been the 25-year engine enriching the world.

Isolate, isolate… new European data is far weaker than forecast, and sooner than could be explained by sanctions on Russia. GDP in Portugal and Italy slipped negative, and even Germany may have done so. Euro-zone inflation is down to 0.4%, which means some sectors and some entire nations are deep into deflation.

Geopolitics. The situation is Orwellian. Doublespeak. Economic recoveries which are black jokes on the word. Enemies are suddenly allies, or simultaneously allies and enemies. The US has begun airstrikes in Iraq for humanitarian reasons, hitting ISIS and its allies the Sunnis, who when allied with us brought the Iraq war to its end. The Shia government of Iraq, semi-supported by the US, is also striking ISIS/Sunni with newly arrived Russian SU-25s. Mr. Kerry this morning spoke of “genocide” in Iraq, an eye-blinker to most of the world, which has been watching Syria and Gaza unaffected by civilization — Gaza the work of newly allied Israel, Egypt, and Saudi Arabia.

Minor spats can run out of control, but we seem able to spill vast amounts of blood in long-running but contained score-settling. Watching so many places in conflict at once is unsettling, especially as the US has pulled back from power engagement without forethought or skill. However, ugly as it all is, only the Ukraine has a chance to go Sarajevo. (Later, emboldened Israel versus Iran, but later.)

Ambrose Evans-Pritchard, economics editor at the UK Telegraph has thought it through. “Russia’s economy is no bigger than California’s. This is an economic showdown between a $40 trillion power structure, and a $2 trillion producer of raw materials that has hollowed out its industrial core.” Evans-Pritchard and several others this week concluded that Czar Vladimir’s only card is an outright invasion of Ukraine, time not on his side, and his play/no-play decision is close, perhaps a few days.

About half of today’s flight to quality is Ukraine/Iraq, and the rest from new European recession. The direct effects on the US?

Ahem. Beneficial. Rates are down. The dollar is stronger which minimizes any threat of inflation. We are less dependent on external trade than anybody.

Enough to put the Fed on hold? Uh-uh. In 1998 the Fed eased into global economic trouble and was wrong, only a stock bubble for its trouble. The Fed was puzzled 2004-2006 that its .25%-per-meeting water-torture, taking the Fed funds rate from 1.00% to 5.25%, did not cause mortgage rates to rise much, and thus failed to intercept a housing bubble. If Yellen thinks the economy is heating, she’ll be comin’.

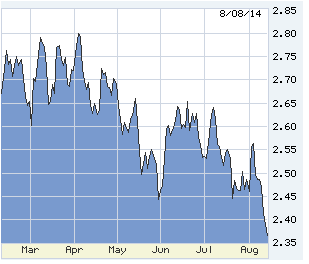

Real estate investors: See what the 10-year T-note did this week

10s last six months. NOT following the US economy; the primary force is from overseas.

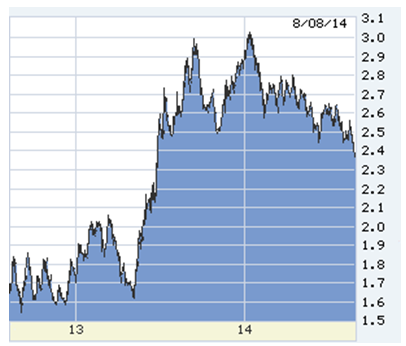

For context, 10s in the last two years. A long, long way to go to the mortgage lows.

The drop in imports is disconcerting, but a big deal only if continued.

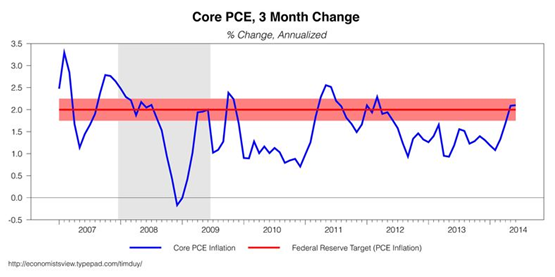

The manufacturing ISM index looks the same. We should feel acceleration like this in wages and hiring, but we don’t. So we don’t know what the ISMs are telling us.

On first glance, hair-trigger for the Fed? Probably not – it’s been hoping inflation would rise as high as 2%, and global events are a distinct and new suppressant.

[hs_form id=”13″]

0 Comments