In the real estate market, many rightfully worried the COVID-19 pandemic would lead to another crisis. But we didn’t see the 2008 housing collapse play out again, as some predicted. From January 2020 to January 2021, CoreLogic research shows the average home price jumped 11.21 percent, with total home sales reaching their highest level since 2006.

Thanks to the vaccine rollout, unprecedented federal stimulus, and gradual reopening, the broader economy has great momentum too. Economic growth is expected to skyrocket in 2021, with some experts calling for eight percent plus growth.

So, we’re well past a year into the COVID-19 pandemic. Not only is the real estate market still standing strong, but we have more clarity on what to expect on the road ahead. There are a myriad of opportunities and market fundamentals that remain solid, but risks do remain and there are weak spots.

In this article, we’ll touch on the new reality in the real estate sector. And we’ll give you a risk management playbook to put you in a strong position going forward.

Threats remain! Stay committed to risk mitigation

At the onset of the pandemic, social distancing and the closing of non-essential businesses led to tremendous economic uncertainty. We had never seen disruption like this, as even residential housing construction was halted in states like Washington, Michigan, and New York. To navigate that unpredictable landscape, many lenders and investors wisely adopted a more conservative approach.

While there’s much more reason for optimism now, that doesn’t mean you should abandon the risk mitigation practices that got you through the pandemic. Because risks do remain.

Questions about the strength of workforce housing

An eviction ban, expanded unemployment benefits, and billions in rental relief helped prevent a full-blown eviction crisis. However, the continued economic fallout of the pandemic has caused higher unemployment to persist. Rental housing investors should be aware of risks once stimulus money and protections curb in the future.

An evolving commercial real estate landscape

COVID-19 led to a remote work boom, and office space and retail stores suffered greatly. Global commercial real estate deal volume dropped 36 percent in 2020, according to Deloitte. Some cities were hit worse than others. For instance, San Francisco had office vacancy rates near 20 percent in the first quarter of 2021 (versus six percent in 2020). Considering the pandemic will lead to long-term changes in how we work, shop, and live, commercial real estate still has a unique set of risks to consider going forward.

More expensive financing

Interest rates were incredibly low during 2020, and that helped prop up the residential housing market and made it cheaper for investors to buy properties. While average mortgage rates still remain low from a historical standpoint, investors should keep a close eye on rate rises.

Rising lumber prices

The price of lumber has increased by over 200 percent from a year ago. Experts predict pre-COVID lumber prices may never return. This will make renovations and new construction more expensive than before.

Have a conservative, research-oriented capital plan

Given these risks, and others, we still advise real estate entrepreneurs to keep a conservative capital plan, even as we come out of the pandemic. As we tell our clients at DLP Real Estate Capital, the main reason we see deals fail is because of undercapitalization. You must prepare for every phase of the investment.

That means you should:

- Use conservative numbers when analyzing deals. Don’t assume market values will accelerate, even as the economy reopens.

- Have ample cash reserves. This ensures you have enough money to buy, reposition, and exit. Too often, we see investors spend too much on the acquisition, which leaves them undercapitalized for the next phases of the investment.

- Focus on value creation. Take control of what you can control — your deals and properties. Accurately calculate the capital you need for renovations and pad the numbers a little so you have enough cash on hand

Be aware of other common mistakes investors make. These include only getting one bid for renovation projects, mis-analyzing as-is and after-repair values, expecting quick dispositions, etc.

Additionally, make sure to do your market research. Read reports from firms like ATTOM Data Solutions, House Canary, and Collateral Analytics to learn about investment trends, get accurate valuations, and find out what investment strategies will be most successful (new construction, fix-and-flip, etc.) Analyze both macro data, which will help with understanding national and regional market trends, as well as micro data, which will help with deal-level decisions in local markets.

Be cautious, but opportunistic

So, we’ve talked about risks and the need to stay conservative, even as the worst of the pandemic is behind us. With that said, there are lots of opportunities out there. As long as you stick to a conservative, research-focused approach, now’s the time to hop on these opportunities. We’ve listed some below.

Residential New Construction

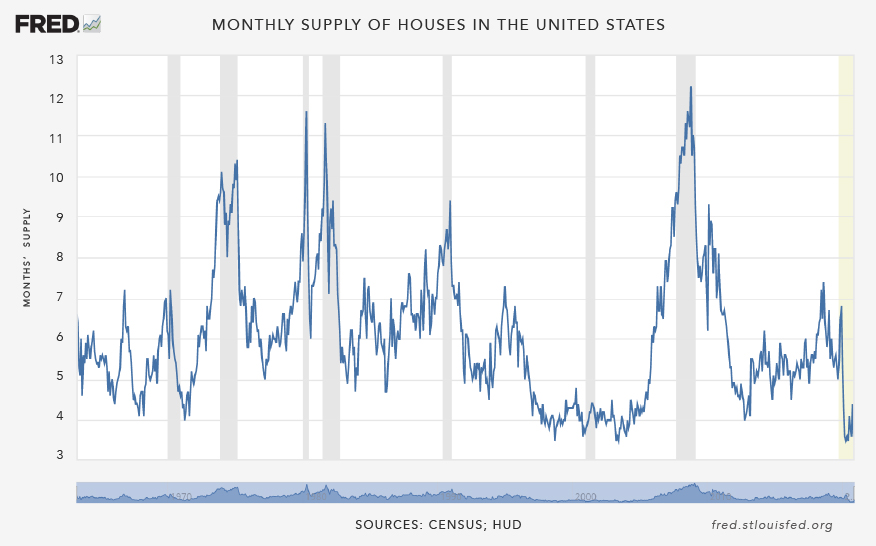

Housing supply remains historically low. As of February 2021, it would only take 4.8 months to sell all existing homes on the market. (Federal Reserve chart below).

Real estate entrepreneurs should take note of this inventory issue. If you have experience in residential construction, there are lots of opportunities. As you know, prices are a function of supply and demand. Right now, supply isn’t keeping up with demand. Those who invest in increasing the housing supply through new construction stand to gain.

Industrial and e-commerce real estate

Online shopping rose 44 percent in 2020, and while that growth rate may slow, e-commerce will still grow overall. This has impacted the real estate game. It’s why we’re seeing all types of properties turn into industrial warehouses, from old golf courses to office buildings. In 2020, demand for industrial warehouses, such as distribution centers, rose 25 percent. Investors would be wise to capitalize on this bright spot in commercial real estate.

Fix-and-flip properties

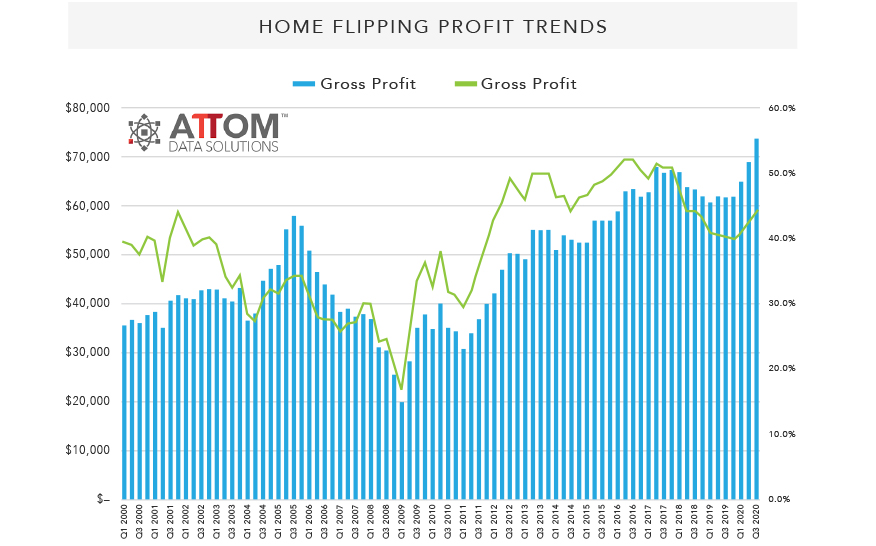

With supply low, fix-and-flip remains a bright spot for investors too. As data from ATTOM shows, home flipping profits reached a new high in the third quarter of 2020.

Given that home prices are expected to increase in 2021, home flipping profits should continue to be impressive.

Reopen plays

The COVID-19 pandemic was tough on hotels, restaurants, and other service-oriented businesses (and therefore tough on those who owned that sort of real estate). As vaccine distribution continues and it becomes safe to fully reopen, good investment deals may present themselves. For instance, a PwC report predicts a rebound for the hospitality sector in the second half of 2021. If you discover a good deal, it makes sense to get out ahead of such reopen plays.

Find a reliable capital partner

We saw lenders tighten requirements during the pandemic as they sought to mitigate risks. For real estate entrepreneurs, that meant lower leverage, a higher cost of capital, and a need for more cash reserves.

As we have more clarity on the road ahead, such requirements may become less strict. However, one thing remains true for borrowers: You need a lending partner you can count on.

Traditional banks may offer great terms, but take longer to process applications. If you spot a great opportunity, the deal won’t last long in this market. That’s why you also need a lender who can execute fast.

Winning in the new reality

There’s no one-size-fits-all approach to risk management in real estate. In 2021 and beyond, those who stick to their best risk mitigation practices and leverage their expertise will win. As you look for deals, have a conservative capital plan and do your market research. This will ensure you can be opportunistic when the time comes. Finally, don’t forget to always have a reliable lending partner at your side.

By sticking to that playbook and having the discipline to execute, you’ll propel ahead as we emerge from the pandemic. And that will put you in a position for long-term success.

Don Wenner is Founder and CEO of DLP Real Estate Capital.

0 Comments