In this article, we pick up our Taste of Texas series, exploring the Texas real estate market at the beginning of 2019. Read the full intro here.

‘Alamo City’ Takes Aim at Housing

A recent report by the San Antonio mayor’s Housing Policy Task Force claims that the home of the Alamo is “beginning to experience more severe affordable housing problems than in the past.”

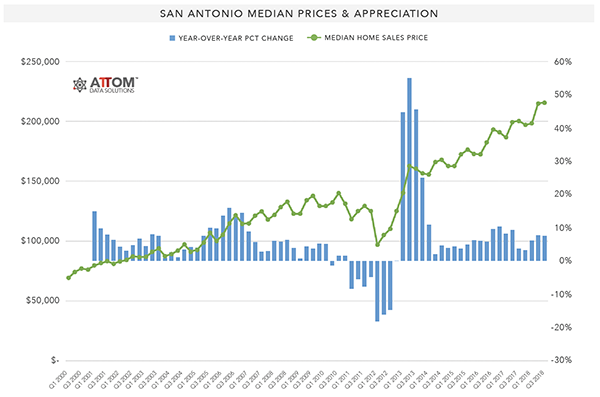

Third quarter 2018 results from ATTOM Data Solutions showed a 12 percent decline in housing affordability in Bexar County while the median home sales price for the quarter was $208,125, up 10 percent over the same quarter the previous year.

According to a Forbes report from May 2018, San Antonio was the city with the largest population boom in the nation through 2017.

Unemployment rose slightly for the San Antonio metro area to 3.1 percent for October 2018 from 3 percent the year before. On the job front, the metro area reported a 13.6 percent increase in net new jobs over the five-year period ending October 2018, but only 0.88 percent job growth for the previous 12 months through October of this year, according to data from Stewart Title.

“In San Antonio there’s a diverse population there. And there’s a lot of gentrification going on in San Antonio,” Amuchastegui said. “San Antonio has a lot of redevelopment and rebuilding going on.”

Amuchastegui said his company buys rental homes outside of the city limits at an average price of around $150,000 for a 1,500 square foot, three bedroom, two bath with a garage.

“I think most investors when investing within the city limits are looking for flipping opportunities. If you’re looking for buy and hold then you’re going to be 30 minutes outside of the city limits,” he said.

According to ATTOM Data Solutions, the median sales price on a home in the San Antonio metro area was $215,710 in the third quarter 2018, a 7.6 percent increase from a year ago, and a 123 percent upswing from the metro’s post-recession trough in Q1 2012.

In Bexar County, ATTOM reported that a three-bedroom single-family home was rented for $1,407 a month in 2018, a 4 percent increase from 2017, resulting in a potential annual gross rental yield of 9.1 percent.

Foreclosure auctions in the San Antonio metro area are down nearly 80 percent from their January 2006 peak, and total foreclosure filings are down 78.5 percent from the same time frame. A total of 2,801 San Antonio-area properties were scheduled for public foreclosure auction through November 2018, down 3 percent from the same period in 2017.

0 Comments