Fixed mortgage rates have reached a 12-month low, according to a report from Freddie Mac.

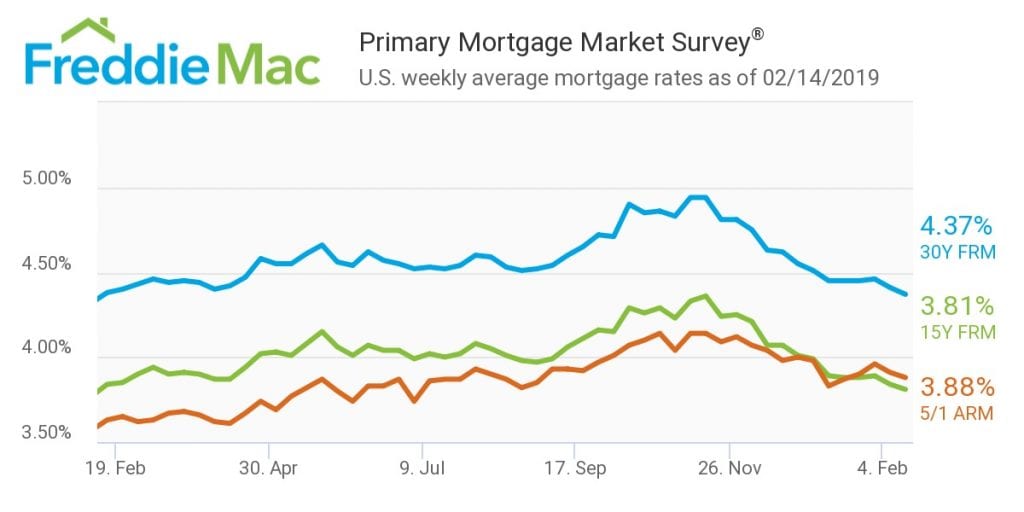

Freddie on Thursday released results of its Primary Mortgage Market Survey, which found that 30-year fixed-rate mortgages have hit their lowest levels since early 2018.

“The combination of cooling inflation and slower global economic growth led mortgage rates to drift down to the lowest levels in a year,” Freddie Mac chief economist Sam Khater said. “While housing activity has clearly softened over the last nine months and the lingering effects of higher rates from last year are still being felt, lower mortgage rates and a strong job market should rekindle demand for the spring home-buying season.”

Rates reached a seven-year high in November, but have been declining for the last six weeks, according to Freddie. The 30-year fixed-rate mortgage averaged 4.37 percent in the week ending February 14, down from the previous week when it averaged 4.41 percent.

Despite lower rates, mortgage applications fell 7 percent from a week ago, according to the Mortgage Bankers Association’s survey. Although mortgage applications are slowing, home buyers are optimistic about buying this year. The Fannie Mae Home Purchase Sentiment Index, which measures consumer attitudes toward housing conditions, rose 1.2 points in January to 84.7.

The shift in consumer attitudes is the result of an eight-point jump in the net share of Americans who say their household income is higher today than a year ago.

“Fewer consumers since last summer, on net, believe that mortgage rates will rise over the next year – a sentiment consistent with the Fed’s statement at its January meeting that it will be patient with future target rate adjustments,” said Doug Duncan, senior vice president at Fannie Mae. “Overall, these results are in line with our forecast that, amid improving affordability conditions, home sales should stabilize in 2019 after declining last year for the first time in four years.”

0 Comments