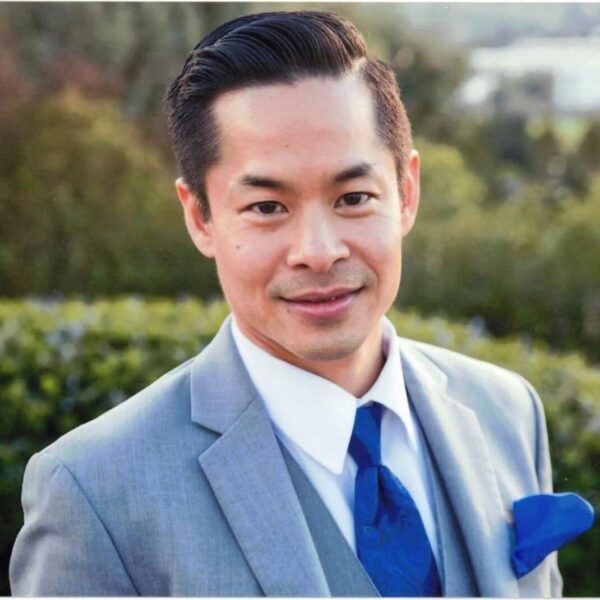

In this episode of the Think Realty Podcast, we sit down with Chihiro Kurokawa from ZT Corporate, a firm that has built a powerhouse investment strategy by combining healthcare, auto dealerships, real estate, and private equity. Chihiro shares how ZT Corporate navigates market shifts, why they prioritize directly operating their investments, and how their unique capital-raising approach sets them apart.

We also dive into:

✅ The evolution of ZT Corporate from stock trading to multi-industry investments

✅ Why freestanding emergency rooms and auto dealerships are key pillars of their strategy

✅ How they acquired a $47M hotel portfolio with zero debt risk

✅ The roll-up strategy they use to scale and maximize investor exits If you’re an investor looking for insights on private equity, real estate, and high-yield strategies, this is an episode you won’t want to miss!

Visit ztcorporate.com and learn how they are shaping the future of investment success!

0 Comments