The long-term forecast from Ten-X’s U.S. Office Market Outlook, released on February 8, 2017, reveals the sector’s fundamentals appear to be stalling after years of slow recovery, as vacancy rates have plateaued despite a healthy labor market and growing national economy.

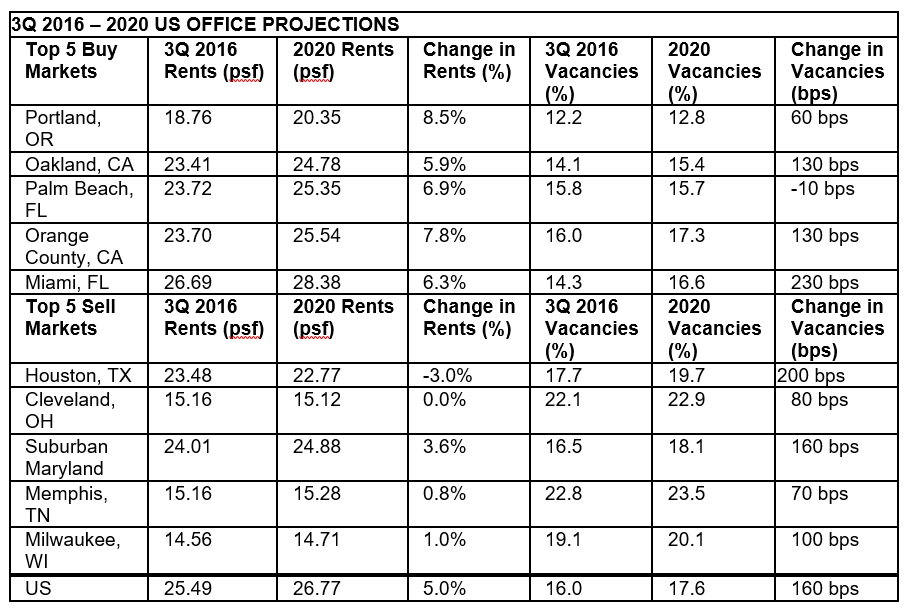

The Top Five Buy Markets forecast indicates Portland, Oregon; Oakland; Palm Beach, Florida; Orange County, California; and Miami are the top markets in which investors should consider buying office assets. These regions, concentrated in Florida and the West Coast, are being fueled by growing economies, where strong demographics and consistent job growth are fueling robust demand for office space.

Houston, Cleveland, Suburban Maryland, Memphis and Milwaukee are the top markets where Ten-X Research projects market conditions might cause office investors to consider selling their properties. These cities are being undermined by weakening labor markets, which have reduced demand for office space and significantly slowed absorption rates.

The Ten-X Research report notes Reis data shows the national vacancy rate measuring steady at 16 percent for three consecutive quarters. While vacancies are now 40 bps lower than a year ago, and 160 bps below their cyclical peak, they remain well above levels seen during the last economic cycle. The slowdown can be traced to weak absorption, as only 70 million square feet of new supply has been occupied during each of the last two quarters. Rent growth has hit a similar slump, with effective rents edging up just 0.4 percent in the third quarter and 2.8 percent over the past year – the slowest annual growth since mid-2014.

The downturn comes despite a strong labor market that continues to add jobs and a steadily expanding economy. Low unemployment, consistent payroll gains and rising wages should offer a boost to overall demand for office space, though the national economic picture is marked by stark differences among markets in different regions, according to Ten-X Research.

Although the office sector still faces significant long-term headwinds driven by the rise of shared offices, cloud computing and remote teleconferencing, Ten-X models project moderate improvement as the current economic expansion advances. Cyclical factors are expected to drive vacancies to a low of 15.3 percent in 2018 before regressing to roughly 17.6 percent during a downturn scenario in the following two years.

Rent growth is also projected to emerge from its cooling period to post roughly 3 percent increases per annum from 2017-2018, reaching a peak of over $27 per square foot before contracting as vacancies begin to rise again.

“After a long, gradual recovery following the last recession, the office sector has seen its progress slow significantly over the last year. While it faces long-term challenges as technology increases the viability of non-traditional working arrangements, the resilient economy makes it likely that the current malaise is only temporary,” said Ten-X Chief Economist Peter Muoio. “Overall demand should increase as employers continue to add jobs over the next two years, which bodes well for investors’ long-term prospects in most areas of the country.”

Overall investment sales volume in the sector totaled $35 billion during the third quarter of 2016. Effective rents are up 2.8 percent and have now surpassed their pre-recession peak, while cap rates rose 20 basis points – bps – to average 6 percent.

The Office Sector’s Top Five Buy Markets

Portland

Oregon’s largest city boasts a strong economic profile, as the city’s employment has increased 2.7 percent over the last year while Portland’s population has risen 1.7 percent — more than double the U.S. rate. With the thriving financial and business services sectors driving the growth, the city’s office vacancies have declined to near pre-recession levels. Rents have been growing steadily over recent quarters, and are now up more than 4 percent year-over-year. Ten-X Research projects they will reach record highs of more than $20 per square foot in 2018. Despite a cyclical downturn scenario in 2020, NOI should continue to grow by an average of 2.9 percent, making Portland the most promising market for office investors.

Oakland

Effective rents in Oakland grew a whopping 7.8 percent over the last year, driven by healthy demand for office space and a sparse pipeline of supply that has sharply reduced vacancies in the region. Ten-X Research models project a booming economy – particularly in the construction and education/healthcare sectors – should continue to push vacancies down through at least 2018. As the area continues to add both population and jobs, office owners and investors can expect to see rents increase over the next couple of years. Market NOI should grow roughly 6.6 percent over the next two years before slowing to 4.4 percent during 2019 and 2020.

Palm Beach

Palm Beach’s population is growing at its fastest pace in a decade, and the city’s economy is commensurately strong — employment in Palm Beach is at an all-time high after jobs increased 2.2 percent over the last year, and the jobless rate has been steadily declining and now sits at roughly 5.1 percent. Combined with a quiet supply pipeline, the area’s strong economy has fueled a steady reduction in office vacancies since 2011. Effective rents rose 2.1 percent over the last year, and Ten-X Research projects they will grow by more than 3 percent through 2018 as new supply remains muted and demand stays strong. Annual NOI growth should reach nearly 4 percent through 2018 before hitting a mild decline due in the event of a cyclical downturn.

Orange County, California

Office rents in Orange County produced their strongest growth of the cycle over the last year, improving 4.8 percent to a post-recession peak of $23.70 per square foot. Healthy demand and sporadic completions are expected to carry the growth through 2018 before a slight pullback, though a healthy economy should keep the market appealing for investors. A thriving leisure and hospitality sector has helped drive total employment to an all-time peak, while unemployment is at a cycle-low 3.6 percent, well below the national average. Ten-X Research projects roughly 5.4 percent annual NOI growth for Orange County office properties through 2018.

Miami

Total employment in Miami has increased 1.6 percent over the last year and is now up 7 percent from its pre-recession peak, helping lower office vacancies to a cycle-low 14.3 percent. Rents are at an all-time high after increasing 3 percent year-over-year, and are forecasted to continue to grow by roughly the same rate through 2018. The city’s strong economy, growing population and modest supply pipeline should keep vacancies low over the next two years, making it among the most attractive markets for office investors.

The Office Sector’s Top Five Sell Markets

Houston

A slight increase in oil prices has failed to translate to a rebound for Houston’s floundering economy, as energy sector payrolls are down 22 percent from their prior peak and the overall unemployment rate has risen to 5.1 percent. While the city boasts strong demographics, its lackluster job market makes it a risky bet for office investors. A heavy infusion of supply into the office market has been pushing vacancies up since 2013, and with nearly 5 million square feet of new space hitting the market in 2016 and additional completions in the coming years, the city’s vacancy rate will approach 20 percent by 2020. Per Ten-X Research, NOIs will grow just 0.9 percent through 2018.

Cleveland

Cleveland’s office market has posted negative absorption for three consecutive quarters, boosting vacancies to 22.1 percent even as completions have been absent for more than three years. While supply additions will eventually resume, a struggling economy appears unlikely to generate significant demand. Total employment remains below pre-recession levels after increasing by just 0.8 percent year-over-year, while jobs in the city’s crucial manufacturing sector declined by 4 percent over the same period. With a shrinking population and unemployment above the national average, there is little reason for optimism in Cleveland, and investors can expect flat rents and NOI growth of just 0.2 percent through 2018.

Suburban Maryland

While the region is at peak employment, Suburban Maryland’s office market is mired in a prolonged slump. Professional/business employment declined 1 percent over the past year, while information jobs sank by 1.4 percent. Supply additions are meeting with tepid demand, pushing vacancies up 20 bps to 16.5 percent. Effective rents gained 1.3 percent year-over-year to reach a new high for the cycle, and market NOI is projected to grow a modest 2.5 percent through 2018.

Memphis

Memphis’ office market has maintained a vacancy rate of at least 22 percent dating back to 2010, despite only two quarters that saw new supply hit the market. The city has seen job growth of 1.3 percent over the last 12 months, but with unemployment still above the national average and a continuing trend of minimal population growth, Memphis’ economic profile remains mediocre. Effective office rents rose 1.2 percent over the last year and are expected to reach their prior peak by 2018, before declining in the modeled 2019-2020 recession. Combined with minimal availability declines, this sluggish rent growth is projected to generate NOI growth of just 2.1 percent through 2018.

Milwaukee

Although Milwaukee’s economy had shown signs of progress in recent quarters, its job market has recently taken a step in the wrong direction. In the third quarter of 2016, overall employment was down 0.2 percent from 12 months prior, and the city’s vital manufacturing and education/healthcare industries have each shed jobs over the last year. The city holds little promise for economic growth, leading to weak demand as a huge infusion of supply comes to market. Vacancies are projected to remain above 18 percent over the next three years, while rents should see lackluster growth lagging well behind national averages. Ten-X Research projects annual NOI growth of 2.6 percent through 2018.

To read the full report by Ten-X click here.

About Ten-X

Ten-X is one of the leading online real estate transaction marketplace and the parent to Ten-X Homes, Ten-X Commercial and Auction.com. To date, the company has sold 260,000+ residential and commercial properties totaling more than $43 billion. Leveraging desktop and mobile technology, Ten-X allows people to safely and easily complete real estate transactions online. Ten-X is headquartered in Irvine and Silicon Valley, California and has offices in key markets nationwide. Investors in the company include CapitalG (formerly Google Capital) and Stone Point Capital. For more information, visit

Ten-X.com.

0 Comments