Foreclosures were started for the first time on 48,605 properties in October and there were 36,582 properties repossessed by lenders in October, according to a new report from RealtyTrac.

The report shows:

- U.S. foreclosure starts increased 12 percent from the previous month – the largest monthly increase since August 2011.

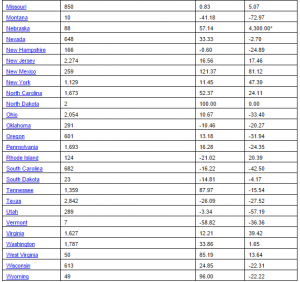

- October foreclosure starts were up from the previous month in 34 states, including California (up 21%), Florida (13%), New Jersey (15%), Illinois (20%), Maryland (300%), Washington (34%) and Michigan (37%).

• U.S. bank repossessions (REOs) were up 31 percent from a year ago in October – the eighth consecutive month with a year-over-year increase in REOs. - REOs were up from a year ago in 36 states in October, including New York (up 320%), New Jersey (275%), Texas (119%), North Carolina (89%), Nevada (83%) and Illinois (62%).

- Atlantic City, N.J., posted the highest metro foreclosure rate for the fourth consecutive month. Other metro areas in the top five for foreclosure rates were Columbia, S.C.; Trenton, N.J.; Baltimore, Md.; and Fayetteville, N.C.

“We’ve seen a seasonal increase in foreclosure starts in October for the past five consecutive years, so it’s not too surprising to see the monthly increase this October,” Daren Blomquist, vice president at RealtyTrac, said in the release.

“However, the 12 percent increase this October is more than double the average 5 percent monthly increase in the past five Octobers, and the even more dramatic monthly increases in some states is certainly a concern. The upward trend in foreclosure starts in those states in some cases could be an indication of fissures in economic fundamentals driving more distress and in other cases is more likely an indication of long-term delinquencies finally entering the foreclosure pipeline,” Blomquist said.

Bank repossessions increase annually in 36 states

There were a total of 36,582 properties repossessed by lenders (REOs) in October, down 9 percent from the previous month but up 31 percent from a year ago — the eighth consecutive month with a year-over-year increase in REOs. Despite the annual increase, REOs in October are about one-third of their peak of 102,134 in September 2010. Through the first 10 months of 2015 there have been 369,920 completed foreclosures, up 33 percent from 277,815 REOs during the same time period in 2014.

“Bank owned property asset managers are still requesting top dollar, and today’s market demand is responding in their favor. Diamond-in-the-rough distressed properties are ‘the find’ for the cash-heavy buyer that can fulfill a fix-and-flip fantasy and be the chicken dinner buyer to secure the deal for the near future,” said Al Detmer, broker associate at RE/MAX Alliance in Colorado.

Scheduled foreclosure auctions increase annually in 17 states

A total of 46,698 U.S. properties were scheduled for foreclosure auction during the month, up 12 percent from the previous month but down 22 percent from a year ago.

Scheduled foreclosure auctions — which can be foreclosure starts in some states — increased from a year ago in 17 states, including New York (up 47 percent), Massachusetts (up 45 percent), North Carolina (up 24 percent), New Jersey (up 17 percent) and Maryland (up 3 percent).

Maryland, New Jersey, Florida, Nevada, and Illinois post highest state foreclosure rates

A total of 5,126 Maryland properties had a foreclosure filing in October, up 100 percent from the previous month, but still down 14 percent from a year ago. After dropping out of the top five state foreclosure rates in September for the first time in 2015, Maryland’s foreclosure rate jumped to No. 1 in October thanks to the surge in foreclosure starts. One in every 466 Maryland housing units had a foreclosure filing in October, more than 2.5 times the national foreclosure rate.

The state of New Jersey accounted for 7,559 properties receiving a foreclosure filing in October, a foreclosure rate of one in every 471 housing units — second highest among the states after New Jersey’s foreclosure rate ranked No. 1 in September. New Jersey foreclosure activity in October decreased 4 percent from the previous month, but was still up 87 percent from a year ago — the eighth consecutive month with a year-over-year increase in New Jersey foreclosure activity.

One in every 579 Florida housing units received a foreclosure filing in October, the nation’s third highest state foreclosure rate. Florida’s foreclosure rate has ranked in the Top 5 each month in 2015. Florida foreclosure activity increased 8 percent from the previous month but was still down 23 percent from a year ago.

“We continue to see the year-over-year decline of our South Florida distressed real estate market,” Mike Pappas, CEO and president of the Keyes Company, in South Florida, said in the release. “Any new bank-owned inventory is quickly digested, as our under-$300,000 priced inventory is at the lowest level in years.”

New Jersey, Maryland and Florida cities post highest metro foreclosure rates

October marked the fourth consecutive month where the Atlantic City, N.J., metro remained in the No. 1 spot for having the highest foreclosure rate among metropolitan statistical areas with a population of 200,000 or more. One in every 257 Atlantic City housing units had a foreclosure filing in October, more than four times the national average. Atlantic City foreclosure activity in October increased 14 percent from previous month — driven by a 26 percent monthly spike in foreclosure starts — and increased 134 percent increase from a year ago.

Foreclosure activity in October increased 177 percent from a year ago in Columbia, S.C., and the metro area posted the nation’s second highest foreclosure rate: one in every 333 housing units with a foreclosure filing.

Foreclosure activity increased 118 percent from a year ago in Trenton, N.J., and the metro area posted the nation’s third highest metro foreclosure rate: one in every 390 housing units with a foreclosure filing).

0 Comments