Not all that long ago, a combination of risky loans and overzealous speculation by real estate investors and developers hit Florida harder than many other parts of the nation, turning it into one of the poster children for the housing crisis that followed.

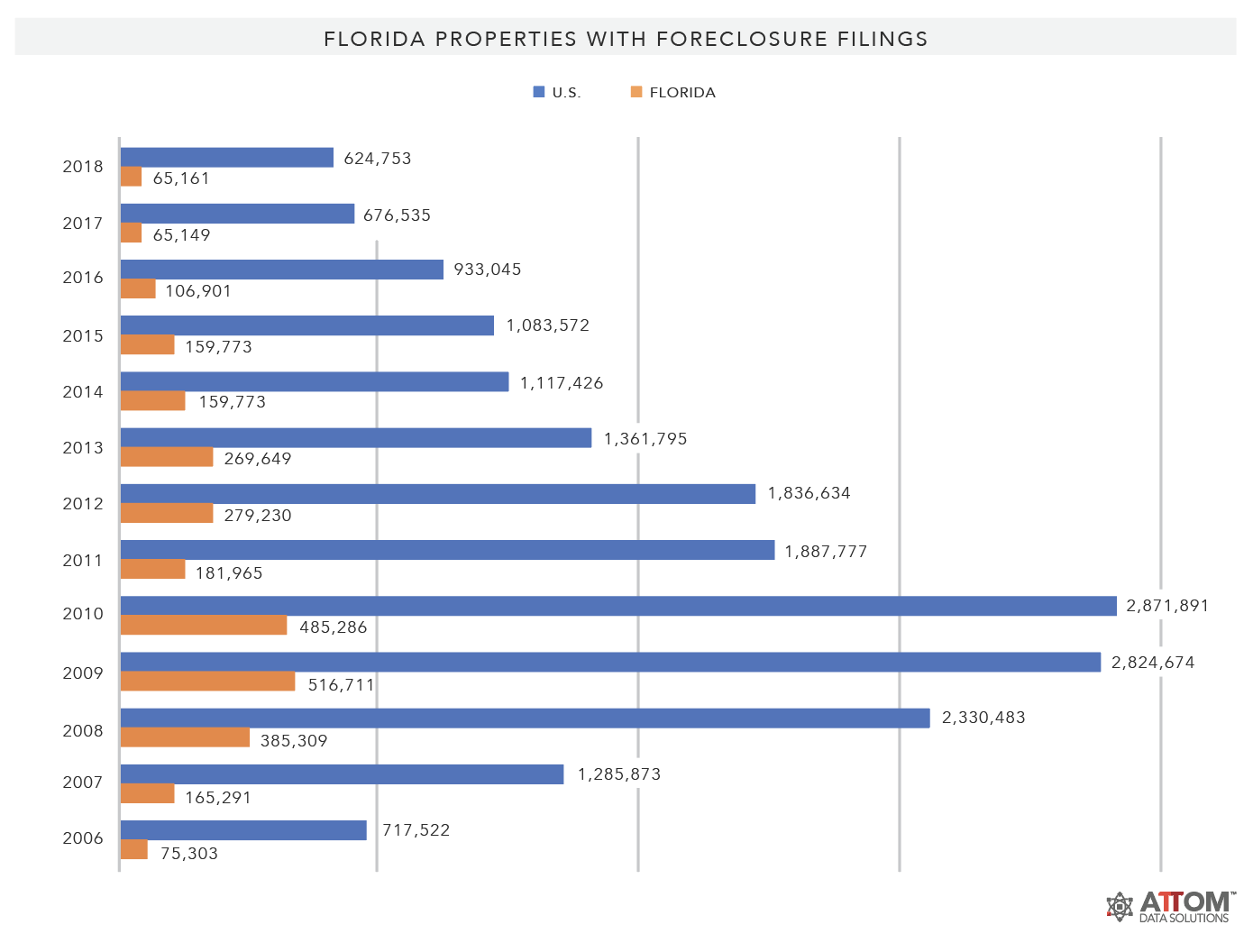

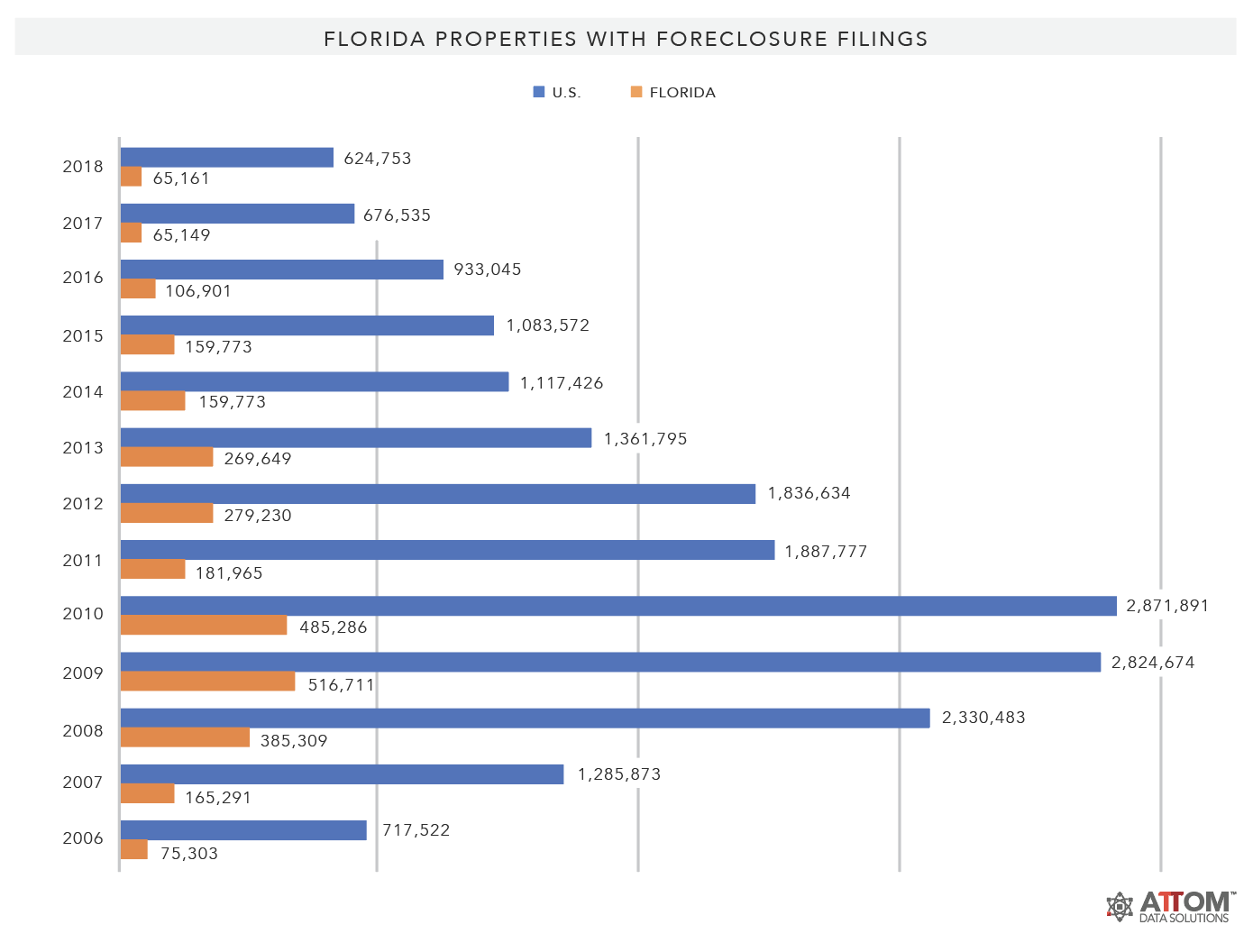

During its darkest hour, the number of properties with foreclosure filings in the state went from more than 75,000 in 2006 to nearly 517,000 in 2009 (an almost 600 percent increase in just three years), according to data provided by ATTOM Data Solutions.

More than a decade later, a lot has changed with the Sunshine State. For one, the annual total number of properties with foreclosure filings has dropped precipitously to just over 65,000 in both 2017 and 2018.

But despite those falling numbers, the state has continuously led the nation in total properties with foreclosure filings since 2013. Additionally, Florida ranked the sixth highest foreclosure rate in the nation at one in every 140 households for all of 2018, ATTOM reported.

Still, both population and job growth are expected to continue while the risk of a recession sometime in 2019 is considered to be low, according to a forecast earlier this year by the Florida Chamber of Commerce.

Unemployment, which rose to as high as 11.2 percent in November 2009, is now hovering near historic lows at 3.5 percent projected for February 2019 by the Bureau of Labor Statistics.

“All the economic indicators are pointing in the right direction. All the major markets are below 4 percent unemployment,” said Jack Winston, principal with Goodkin Real Estate Consulting based in Miami.

“Migration from other parts of the country by both primary residents and active adults (retirees) is still going on. Certain major cities are attempting to get a foothold in other industries to give them some diversification.”

Considering the drive for industrial diversification, the continuous flow of population into the state, and its low unemployment rate, Florida has all the essential economic factors real estate investors look for.

ATTOM reported that for 2018, distressed sales accounted for only 12.8 percent of all home sales in Florida. Of those sales, 5.3 percent were REO sales, 4.6 percent were short sales and 2.5 percent were third party foreclosure auction sales.

Flips accounted for 6.4 percent of all home sales in Florida for 2018, down 9.9 percent from the year before, and down 12 percent from five years ago, but still up 63.5 percent over the last 10 years. The statewide median sales price for 2018 was $218,990, up 8.1 percent from 2017 but down 4 percent from the peak price of $227,500 in 2006.

In all, 41.3 percent of all 2018 home sales in Florida were cash sales while sales to institutional investors accounted for only 2.7 percent.

“From an investor’s standpoint, it’s still a good place to invest your money,” Winston said.

Assuming the Risk: Recession vs. Correction

Assuming the Risk: Recession vs. Correction

In the first quarter of 2012, ATTOM reported that 45.6 percent of all mortgage holders in Florida were seriously underwater. By the end of 2013 only 14.8 of Florida homeowners were equity-rich.

By contrast ,only 8.4 percent of mortgage holders in the state were seriously underwater for the fourth quarter of 2018 while 25.2 percent of homeowners were equity-rich.

“I consider Florida a very safe place,” said author, investor, and hard money lender Bruce Norris, president of The Norris Group based in Riverside, Calif. “If we’re there, we don’t think it’s risky. There’s a lot of things going for it. It’s number one in the country for migration of wealth.”

As someone who has coached and mentored investors over many years, and now also serves as a hard money lender in Florida, Norris is seeing a number of investors pull their money out of California through 1031 exchanges and move that money into one or more new homes in Florida where they can cash flow those rentals.

With the factors that led to the Great Recession are now in the rearview mirror, the risk of another recession in Florida is low with a market correction more likely.

Risk Is Area-Specific

Risk Is Area-Specific

Risk is at the heart of any investment – real estate, stock market or otherwise. When it comes to betting on the housing market, however, managing the amount of risk is proportionate to both the investor’s business model and specific market area chosen.

“The downside, from a rental standpoint, is Miami is the least affordable rental market in the country,” Winston said. “Renters, on average, are paying way more than the 30 percent of their income they should be paying for rent.”

Back in 2008 when the market collapsed, the condominium market in Miami was overbuilt with most of those units sitting vacant for extended periods of time. As a result, an investor-driven recovery occurred with investor groups and institutional investors buying blocks of foreclosed homes.

“We had the biggest overbuilt condo market in the country in 2010 and were out of it by 2014. People are still coming because we have all the attributes,” explained Winston. “Affordable housing is probably the biggest problem now.”

Gabriel Garcia started wholesaling properties in south Florida on his own not long after the crash in 2013. In 2015, he joined with a friend who was also wholesaling on his own, merging their companies to form Florida Cash Home Buyers, LLC.

“Most of our business is wholesaling. Probably 90 to 95 percent now. We’ve done some flips as well. About a year and a half ago, we started acquiring a rental portfolio. We buy in the tri-county area.”

For 2019, Garcia said he is looking to add nine more doors to the company’s rental portfolio with no specific preference for either Dade, Broward or Palm Beach counties, so long as the numbers pencil out.

While business is generally good overall, Garcia expressed some concern about the risk that still exists, particularly in Miami where condominium projects are overbuilt once again, many that have been on the market for years.

The risk factor in all this depends on the investment strategy, Garcia explained.

“It depends on a lot of factors. One of the factors is what you are trying to accomplish. If you want to buy and get massive appreciation from your real estate, then it’s a risky time to buy,” he said. “From the standpoint of holding long-term it’s still a great time to buy.”

Garcia sees south Florida as one of the riskiest markets in the country to flip properties.

“If you bought five years ago, the market would work in your favor. But not today. It’s a combination of buyers not being able to get financing and inventory staying around longer,” he noted. “Most of the investors we see in single-family, other than the big hedge funds, are mom and pops buying turnkey stuff and you don’t see much of that in south Florida.”

While flipping properties may not be the right strategy in the southern part of the state, in central Florida, Billy Ross is busy flipping and wholesaling properties in the greater Orlando metro area.

“There are lots of fix-and-flips, lots of rehabs in the five-county area including Lake, Seminole, Osceola, Volusia, and Orange counties,” said Ross, president of Sell That Florida House. “We like to be in and out. A quick rehab and appeal to the broadest buyers possible. We like to have it under contract in 14 days after completion at pretty close to list price.”

At the moment, Ross and his firm are doing 10-12 deals a month. So his construction crews are always working, going to the next project right after completing their current rehab.

At the moment, Ross and his firm are doing 10-12 deals a month. So his construction crews are always working, going to the next project right after completing their current rehab.

“If you coordinate the contractors tight on a good schedule, there’s no reason to have a cookie cutter rehab go more than 40-45 days. Sixty days is pushing it. Our average rehab is $30,000-$35,000,” Ross said.

Ross buys below market and prefers to stay below the area’s median price point which ATTOM reported at $225,000 in 2018. Staying in that price range, he does not see any risk to his business model.

If Ross sees any risk at all in his market, it’s in owning rentals. He does not believe now is the time to be buying a lot of rental properties in his market.

“The market is correcting, not really crashing,” he said.

Compared to other parts of the state, Obadiah Dorsey sees his market in the north – specifically Jacksonville – to be much more of a blue collar part of the state.

“It’s a different animal in that respect. Much more affordable and not quite the same product,” said Dorsey, co-founder and CEO of Freedom Home Buyers. “We’re getting a fair amount of investors coming in and buying. It’s a uniform product that cash flows without breaking the bank.”

Doing roughly 20 deals a year, Dorsey describes his business model as a wholesaler who cherry picks about 10 percent of his properties to fix and flip and another 10 percent to buy and hold as rentals.

“We spend a lot of time and energy going into the weeds to find the off-market deals. That’s the best way to capture some equity,” he explained. “We’re still able to find deals in Jacksonville proper.”

Dorsey estimates that his average time to rehab a property is 30-45 days. If priced right, the time on market to sell the rehab is less than 45 days making for a total 90-160 days to go all the way through the fix-and-flip cycle.

While it is hard to find deals that make sense in the current economic climate, he is finding it very easy to sell his properties. With properties not appreciating the way they were over the past three-to-four years, Dorsey believes the market in Jacksonville has stabilized and he sees very little risk.

“My philosophy is that risk is all relative to what you’re comparing it against. We’re dealing with real estate, so we’re dealing with something people still need. There is population growth, so as long as we are prudent and aren’t over leveraging and over paying, and conscious of what’s happening in the market, it’s as reasonable a risk as anything else in any other line of business,” he noted.

Assuming the Risk: Recession vs. Correction

Assuming the Risk: Recession vs. Correction Risk Is Area-Specific

Risk Is Area-Specific

0 Comments