With more auction volume to (finally) choose from, why are some buyers tapping the brakes?

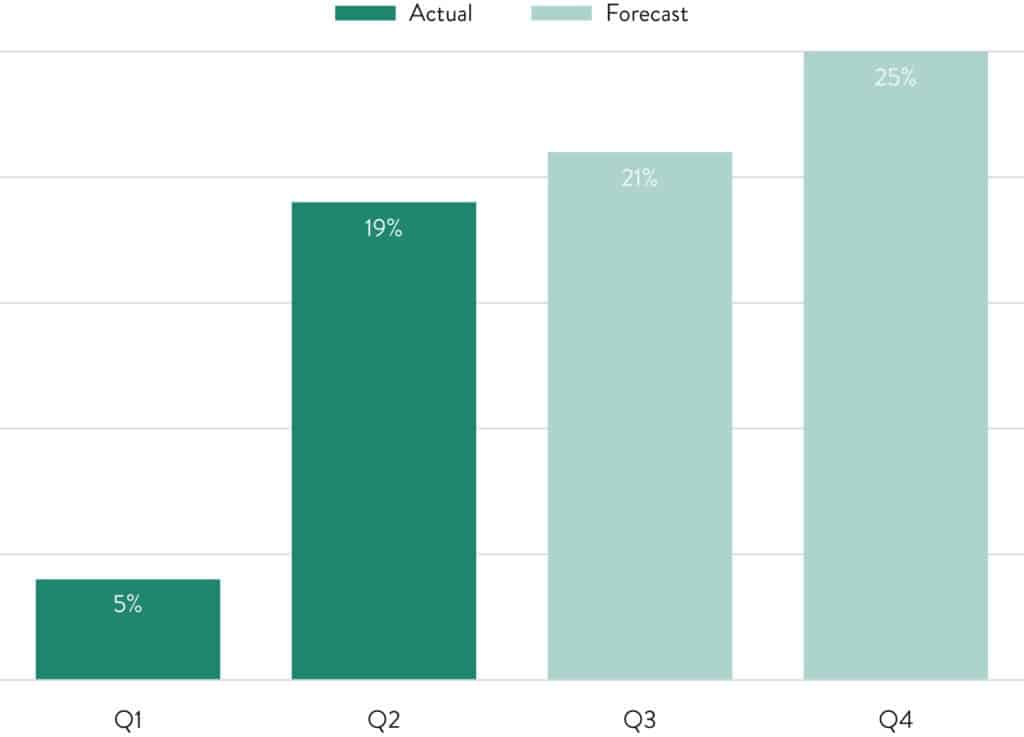

Scheduled foreclosure auction volume for the third and fourth quarters of 2025 points to more opportunities for investors and other buyers to pick up distressed properties at auction in the second half of the year, continuing a trend from the first half of the year (see Fig. 1).

This trend also points to more financing opportunities for private lenders and others who offer business purpose lending to the local community developers buying and renovating distressed properties, either to resell or to hold as rentals.

More Auction Acquisitions Expected

“There is definitely more inventory,” wrote a Florida-based Auction.com buyer in response to a buyer survey in early July. “(The) market had settled. I was hoping it would go down more, but apparently, it’s not.”

This buyer, who also purchases properties in Oklahoma, said she is planning to buy more distressed properties at auction in the next three months than she did in the previous three months. That aligned with 37% of survey respondents, up from 33% of survey respondents in an April survey.

Volume Building for H2

Proprietary scheduled foreclosure auction data from Auction.com, which accounts for close to 50% of all foreclosure auctions nationwide, shows volume building in the second half of 2025 compared to the same time in 2024.

As of the beginning of June 2025, more than 22,000 properties were already scheduled for foreclosure auction for the third quarter of 2025. That was up 21% from third quarter 2024 as of the beginning of June 2024.

Although the data is still thin, scheduled auction data for October indicates annual increases in foreclosure auction volume could continue to accelerate in the fourth quarter. As of the beginning of June 2025, the number of properties scheduled for auction in October 2025 is up 25% from the same scenario a year ago.

A Two-Year High in Q2

The projected foreclosure auction volume increases for the second half of 2025 would continue a trend already seen in the first half of the year. Completed foreclosure auction volume in second quarter 2025 increased 8% from the previous quarter and was up 19% from a year ago to a two-year high, according to the latest Auction Market Dispatch from Auction.com.

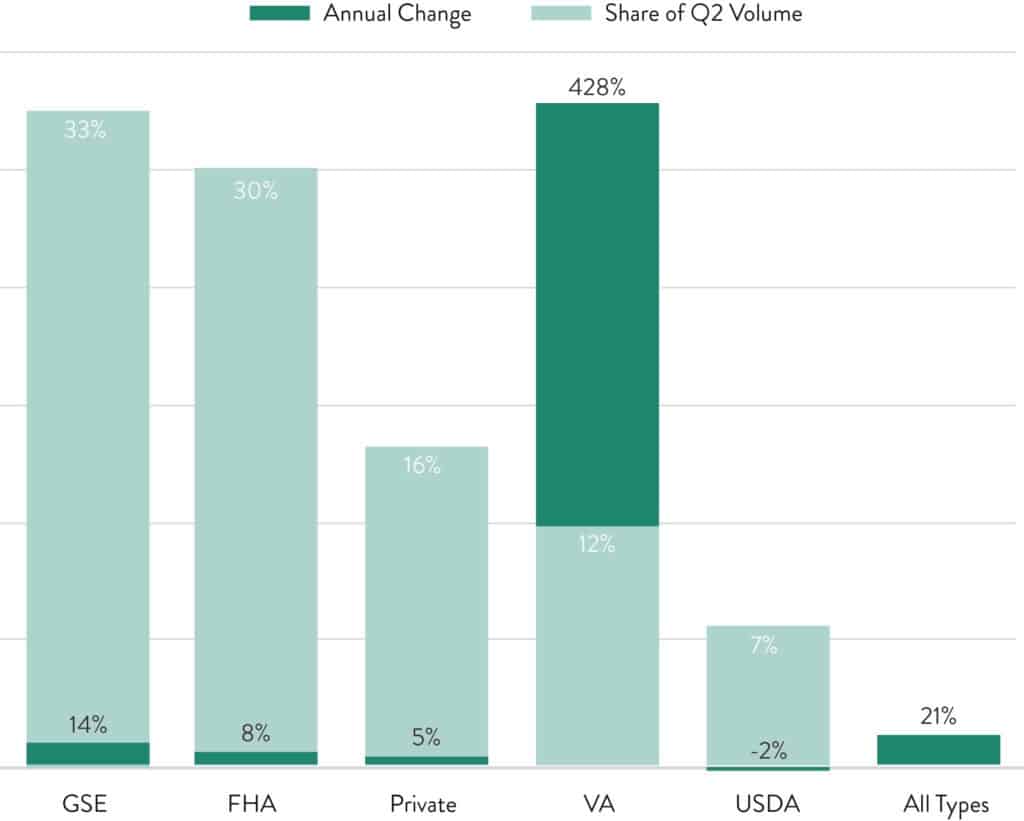

The biggest increase in second quarter 2025 foreclosure auction volume was for properties securing mortgages insured by the Veterans Affairs (VA), which were up an eye-popping 122% from the previous quarter and 428% from a year ago. Those stratospheric increases were somewhat expected given a nationwide foreclosure moratorium on VA-insured mortgages that ended in December 2024. That moratorium created a backlog of deferred distress that is now making its way through to foreclosure auction. The VA numbers should normalize in future quarters as that backlog is worked through. Additionally, a new partial claim loss mitigation option for VA borrowers is now available thanks to a bill passed by Congress and signed into law by President Donald Trump July 30.

Aside from that VA outlier, foreclosure auction volume in the second quarter was still up broadly from a year ago across all other loan types except for loans insured by the U.S. Department of Agriculture (USDA) (see Fig. 2). Completed foreclosure auctions on those USDA-guaranteed loans dipped by 2% from a year ago, while completed foreclosure auctions increased 14% for loans backed by the Government Sponsored Enterprises (GSEs) Fannie Mae and Freddie Mac and increased 8% for loans insured by the Federal Housing Administration (FHA). Completed foreclosure auctions on privately held loans increased 5%.

Foreclosure Auction Trends by State

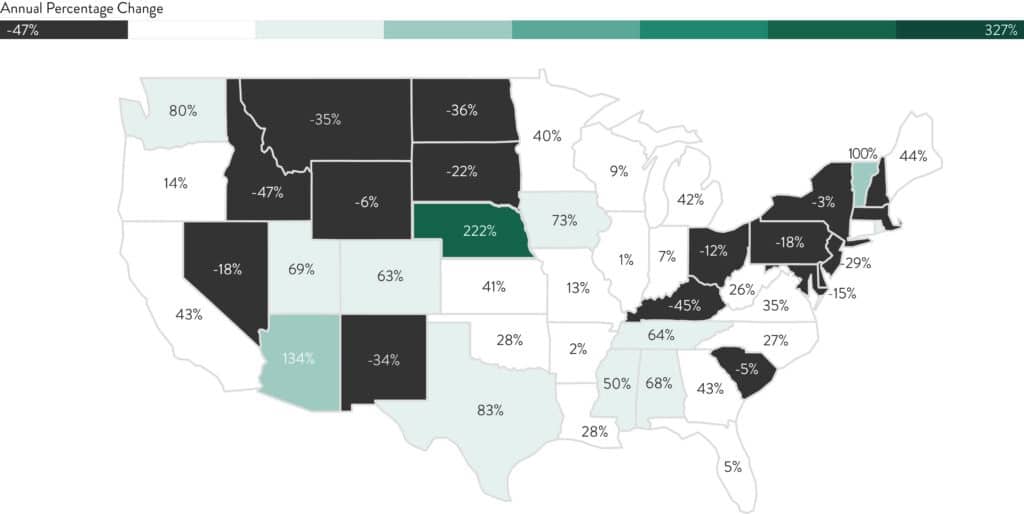

Completed foreclosure auction volume in second quarter 2025 increased from a year ago in 32 states and the District of Columbia (see Fig. 3). States with the largest increases were Nebraska (up 222%), Arizona (up 134%), Vermont (up 100%), Texas (up 83%), and Hawaii (up 81%).

The rapid rise in distressed auction inventory in some markets is causing some buyers to be more cautious in their acquisition strategy. In the July survey, 38% of Auction.com buyers surveyed said the current market environment is making them less willing to buy at auction, up slightly from the previous quarter and up from 34% a year ago.

“Tariffs are keeping interest rates high, keeping material cost high, and contractors are still busy,” wrote a Vermont-based survey respondent. “I’m anticipating these will negatively impact the economy. I’m also anticipating a slowdown in Q3 … and don’t want to have too many irons in the fire. … I’m still keeping reserves as I don’t want to pass up a good deal.”

Despite the impressive percentage increases in many states, completed foreclosure auction volume in second quarter 2025 remained below pre-pandemic (Q1 2020) levels in all but eight states and the District of Columbia. Those states were Connecticut, Colorado, Louisiana, Iowa, Minnesota, Oklahoma, Kansas, and Hawaii.

Foreclosure Auction Trends by Metro

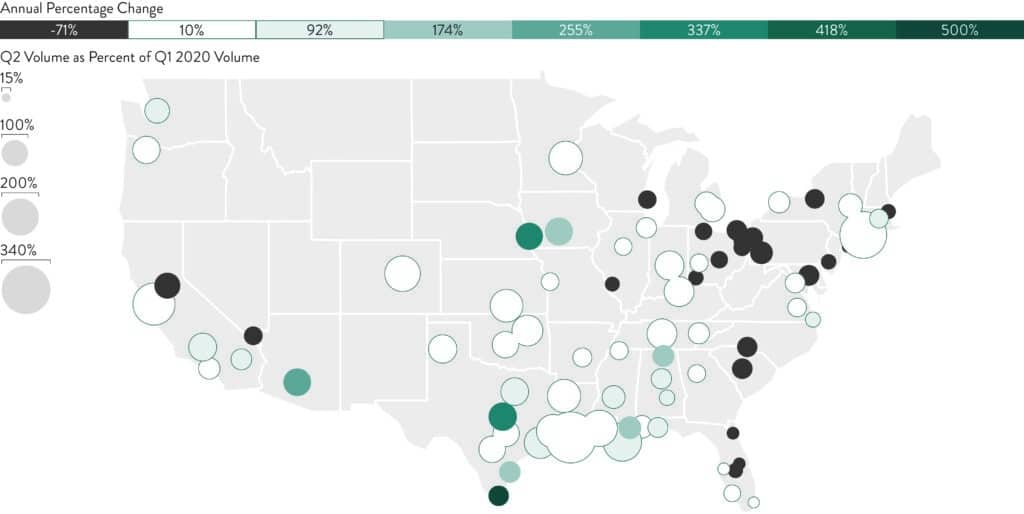

As shown in Figure 4, at the metro level, foreclosure auction volume in second quarter 2025 remained below pre-pandemic levels in 62 of 80 major markets (78%). Exceptions where second quarter foreclosure auction volume matched or exceeded pre-pandemic levels included Houston, Minneapolis-St. Paul, New Orleans, Baton Rouge, Indianapolis, and Denver.

Foreclosure auction volume in second quarter 2025 increased from a year ago in 57 of the 80 major markets (71%), including Houston (up 140%), Dallas (up 100%), Detroit (up 46%), Atlanta (up 58%), and Phoenix (up 215%).

Lifting the Bank-Owned Boat

The rising tide of foreclosure auctions also helped lift the volume of bank-owned (REO) auctions in the second quarter of 2025. Properties revert to the foreclosing bank or lender as REO if they do not sell to third-party buyers at the foreclosure auction.

REO auctions in the second quarter of 2025 increased 10% from the previous quarter and were up 20% from a year ago to a more than two-year high.

REO auctions on vacant properties increased at an even faster pace, up 31% from a year ago to a five-year high (see Fig. 5).

Vacant REO auctions are often more appealing to a broader spectrum of distressed property buyers, including those using private lending or other financing to purchase. Because the property is vacant, there is a better chance of getting an interior inspection, or at the very least an interior appraisal from the bank selling the property, to help more accurately assess the true “as-is” value.

“Especially interested in vacant properties instead of occupied,” wrote a Missouri-based Auction.com buyer in response to the July survey. That respondent said market conditions have not impacted his willingness to buy at auction and that he’s eager to see more inventory available at auction. “Not enough properties to bid on.”

That buyer may get his wish if rising foreclosure volume trends from the first half of 2025 continue in the second half of the year, as the data indicate will happen.

0 Comments