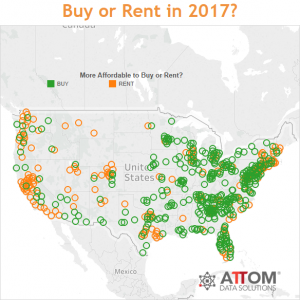

Buying a home is more affordable than renting in 66 percent of U.S. housing markets analyzed in the 2017 Rental Affordability Report issued by ATTOM Data Solutions, parent company of RealtyTrac. The analysis incorporated recently released fair market rent data for 2017 from the U.S. Department of Housing and Urban Development, wage data from the Bureau of Labor Statistics and public record sales deed data from RealtyTrac in 540 counties with at least 900 home sales in 2016.

“While buying continues to be more affordable than renting in the majority of U.S. markets, that equation could change quickly if mortgage rates keep rising in 2017,” said Daren Blomquist, senior vice president with ATTOM Data Solutions. “In that scenario, renters who have not yet made the leap to homeownership will find it even more difficult to make that leap this year. Additionally, renting may end up being the lesser of two housing affordability evils in a growing number of high-priced markets.”

Markets More Affordable to Buy versus Rent

The report found making monthly house payments on a median-priced home — including mortgage, property taxes and insurance — is more affordable than the fair market rent on a three-bedroom property in 354 of the 500 counties analyzed in the report (66 percent).

Among the nation’s most populous counties, those where it is more affordable to buy than to rent are Cook County (Chicago), Illinois; Maricopa County (Phoenix), Arizona; Miami-Dade County, Florida; San Bernardino County, California in inland Southern California; Clark County (Las Vegas), Nevada; Tarrant County (Fort Worth) Texas; Wayne County, (Detroit), Michigan; Broward County, Florida in the Miami metro area; Bexar County (San Antonio), Texas; and Philadelphia County, Pennsylvania.

Markets More Affordable to Rent versus Buy

Counter to the overall trend, renting is more affordable than buying a home in 186 of the 540 counties analyzed for the report (34 percent). This includes Los Angeles County, California; Harris County (Houston), Texas; San Diego County, California; Orange County, California; Kings County (Brooklyn), New York; Dallas County, Texas; Queens County, New York; Riverside County, California in the inland area of Southern California; King County (Seattle), Washington; and Santa Clara County (San Jose), California.

Least Affordable Rental Markets

On average across the 540 counties analyzed, monthly fair market rent on a three-bedroom property in 2017 will require 38.6 percent of average wages, while a monthly house payment on a median-priced home (including mortgage, property taxes and insurance) requires 36.6 percent of average wages across the 540 counties on average.

The least affordable rental markets requiring the highest percentage of average wages to pay fair market rent in 2017 are Marin County, California in the San Francisco metro area (77.3 percent); Spotsylvania County, Virginia in the Washington, D.C. metro area (73.7 percent); Monroe County (Key West), Florida (72.2 percent); Honolulu County, Hawaii (70.7 percent); and Maui County, Hawaii (70.6 percent).

There were 55 counties where the average fair market rent on a three-bedroom property in 2017 will require more than 50 percent of average wages, including Kings, Queens, Suffolk, Bronx and Nassau counties in the New York City metro area; Contra Costa and Alameda counties in the San Francisco metro area; and Orange and San Diego counties in Southern California.

Most Affordable Rental Markets

The most affordable rental markets requiring the lowest percentage of average wages to pay fair market rent in 2017 are Madison County (Huntsville), Alabama (23.9 percent); Allegheny County (Pittsburgh), Pennsylvania (24.4 percent); Fulton County (Atlanta), Georgia (24.8 percent); Anderson County, (Knoxville), Tennessee (25.1 percent); and Rock Island County, Illinois (25.3 percent).

There were 75 counties where the average fair market rent on a three-bedroom property in 2017 will require less than 30 percent of average wages, including Cuyahoga County (Cleveland), Ohio; Harris County (Houston), Texas; Oakland and Wayne counties in the Detroit metro area; Franklin County (Columbus), Ohio; New York County (Manhattan), New York; and Dallas County, Texas.

Rents Rising Faster than Home Prices

Median home prices are rising faster than fair market rents in 340 of the 540 counties analyzed (63 percent), including Los Angeles County, California; Cook County (Chicago), Illinois; Harris County (Houston), Texas; Maricopa County (Phoenix), Arizona; and Miami-Dade County, Florida.

Counter to the national trend, fair market rents are rising faster than median home prices in 200 of the 540 counties analyzed (37 percent), including San Diego County, California; Orange County, California; Dallas County, Texas; Santa Clara County (San Jose), California; and Alameda County, California, in the San Francisco metro area.

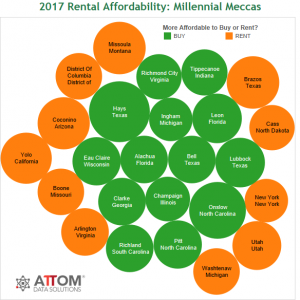

Best and Worst Rental Markets for Millennials

Out of 25 counties where the share of the Millennial home buying population (born between 1979 and 1993) represented at least 30 percent of the total population in 2014, the most affordable rental markets were Ingham County (Lansing), Michigan (28.3 percent of wages to rent a three-bedroom property); New York County (Manhattan), New York, (28.4 percent); Champaign County (Champaign), Illinois (30.0 percent); Cass County (Fargo), North Dakota (30.9 percent); and Richmond City, Virginia, (30.9 percent).

About ATTOM Data Solutions

ATTOM Data Solutions is the curator of the ATTOM Data Warehouse, a multi-sourced national property database that blends property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, health hazards, neighborhood characteristics and other property characteristic data for more than 150 million U.S. residential and commercial properties. The ATTOM Data Warehouse delivers actionable data to businesses, consumers, government agencies, universities, policymakers and the media in multiple ways, including bulk file licenses, APIs and customized reports.

ATTOM Data and its associated brands are cited by thousands of media outlets each month, including frequent mentions on CBS Evening News, The Today Show, CNBC, CNN, FOX News, PBS NewsHour and in The New York Times, Wall Street Journal, Washington Post, and USA TODAY.

0 Comments